Remuneration of Executive Board members

The system for remunerating Executive Board members takes account of the Company’s size, complexity and economic situation, as well as its prospects. It is also aligned with the Company strategy thereby creating an incentive for successful and sustainable governance. At the same time, it takes into account the responsibilities and performance of the Executive Board as a whole and of the individual members, as well as the Company’s current position. For this reason, the remuneration system is based on transparent, performance-related parameters relevant to Company performance and sustainability.

The Supervisory Board is responsible for the structure of the remuneration system for Executive Board members and for defining the individual benefits. The Steering Committee assists the Supervisory Board, monitors the appropriateness of the remuneration system and prepares the Supervisory Board’s resolutions. In the event of material changes to the remuneration system, but at least every four years, the remuneration system is presented at the Annual General Meeting for approval.

Overview of the remuneration system

The following table provides an overview of the components of the remuneration system for Executive Board members for 2023,

the structure of the individual remuneration components and the targets on which these are based.

| T184 | Executive Board remuneration system 2023 | |||

|---|---|---|---|---|

| Component | Objective | Structure | ||

| Performance-unrelated remuneration | ||||

| Basic salary | Shall reflect the role and responsibilities in the Executive Board. Should ensure a reasonable basic income and prevent unreasonable risk-taking | • Annual basic salary • Paid in twelve monthly instalments - Chairman of the Executive Board and CEO: EUR 1,634,000 - Outstanding Executive Board member: EUR 1,118,000 - Ordinary Executive Board members: EUR 860,000 |

||

| Ancillary benefits | Company car with driver, industry-standard concessionary flights for private travel, insurance premiums | |||

| Retirement benefits | Shall ensure adequate retirement benefits | Annual allocation of a fixed amount within the scope of a defined-contribution system - Chairman of the Executive Board and CEO: EUR 990,000 - Outstanding Executive Board member: EUR 585,000 - Ordinary Executive Board members: EUR 450,000 |

||

| Performance-related remuneration | ||||

| One-year variable remuneration (Annual bonus) |

Intended to support profitable growth while taking into consideration liquidity management as well as the collective responsibility of the Executive Board and the individual performance of its members | • Adjusted EBIT versus target (40%) • Adjusted free cash flow versus target (40%) • Collective and individual business and sustainability targets (20%) • Individual performance factor (coefficient of 0.8 – 1.2) • Cap: 200% of target amount • Payable in cash or shares |

||

| Long-term variable remuneration (LTI) |

Intended to promote a sustainable increase in enterprise value, while aligning the interests of the Executive Board members with those of shareholders | • Allocation of virtual Lufthansa shares with a four-year duration • Final number of virtual shares dependent on: - Adjusted ROCE during the performance period versus annual target (50%) - Relative TSR of Lufthansa share versus sector index NYSE Arca Global Airlines Index (30%) - Strategic and sustainability targets (20%) • Performance depending on absolute trend for Lufthansa share (incl. dividends) during the programme • Cap: 200% of target amount • Payable in cash or shares |

||

| End-of-service benefits | ||||

| Mutually agreed termination Not used in the 2023 financial year. |

Shall avoid unreasonably high severance payments | Severance payment limited to remainder of service contract or two times annual remuneration (cap) | ||

| Post-contractual non-compete clause Not used in the 2023 financial year. |

Protects the Company’s interests | • One-year non-compete clause after leaving the Executive Board, with payment of compensation of 50% of basic salary • Company may waive non-compete clause (with six months’ notice) |

||

| Change of control Not used in the 2023 financial year. |

Shall ensure independence in takeover situations | • Severance payment corresponding to the remuneration owed for the remainder of the service contract, up to 100% of the cap on severance pay | ||

| Other compensation rules | ||||

| Share Ownership Guidelines | Intended to strengthen the equity culture and align interests of Executive Board members and shareholders | • Obligation to invest in Lufthansa shares over a period of four years - Chairman of the Executive Board and CEO: 200% of basic salary - Ordinary Executive Board members: 100% of basic salary • Holding obligation for the duration of work on the Executive Board: graduated annual reduction of 25% of shareholding after leaving the Executive Board |

||

| Compliance and performance clawback Not used in the 2023 financial year. |

Shall ensure sustainable Company development | Supervisory Board has the right to withhold annual bonus and LTI or recover remuneration already paid | ||

| Maximum remuneration in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG |

Shall prevent uncontrolled high payments | Reduction in variable remuneration if maximum for a financial year is exceeded: - Chairman of the Executive Board and CEO: EUR 11.0m - Outstanding Executive Board member: EUR 6.5m - Ordinary Executive Board members: EUR 5.0m |

||

Review of the appropriateness of Executive Board remuneration

In the 2023 financial year the Supervisory Board once again considered in detail the appropriateness of the Executive Board’s remuneration and reviewed its amount and structure, coming to the conclusion that it is appropriate.

When reviewing the appropriateness of Executive Board remuneration, the Supervisory Board also considers whether it is market-standard by examining the amount and structure of Executive Board remuneration at comparable companies and the relation between remuneration for the Executive Board and for senior managers and the workforce as a whole, also over time. (see T199, p. 295ff.).

| T185 | Target remuneration and relative proportion in 2023 and 2022 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CEO | Outstanding Executive Board member responsible for “Finance” | Ordinary Executive Board members | |||||||||||

| 2023 | 2023 | 2022 | 2022 | 2023 | 2023 | 2022 | 2022 | 2023 | 2023 | 2022 | 2022 | ||

| in € thousands | Stake | in € thousands | Stake | in € thousands | Stake | in € thousands | Stake | in € thousands | Stake | in € thousands | Stake | ||

| Fixed remuneration | |||||||||||||

| Basic salary | 1,892 | 33.6% | 1,634 | 33.6% | 1,118 | 33.6% | 860 | 33.6% | 860 | 33.6% | 860 | 33.6% | |

| Variable remuneration | |||||||||||||

| One-year variable remuneration | 1,320 | 23.4% | 1,140 | 23.4% | 780 | 23.4% | 600 | 23.4% | 600 | 23.4% | 600 | 23.4% | |

| Long-term variable remuneration LTI 2023 (LTI 2022) |

2,420 | 43.0% | 2,090 | 43.0% | 1,430 | 43.0% | 1,100 | 43.0% | 1,100 | 43.0% | 1,100 | 43.0% | |

| Target direct remuneration | 5,632 | 100% | 4,864 | 100% | 3,328 | 100% | 2,560 | 100% | 2,560 | 100% | 2,560 | 100% | |

To determine whether it is appropriate and market-standard, the target and maximum remuneration are assessed on the basis of Deutsche Lufthansa AG’s position in a comparable market, as defined by reference to revenue, employees and market capitalisation. The comparable market consists of companies listed on the DAX and MDAX, since they are of a similar size as of the assessment date.

For the vertical appropriateness review, the Supervisory Board looks at the remuneration of both senior executives and the workforce as a whole, with regard to the German Group companies in the Lufthansa collective bargaining group.

Target remuneration

The following table shows the remuneration granted to the members of the Executive Board for the 2023 and 2022 financial years, with a breakdown for the Chairman of the Executive Board, the Executive Board member for the finance function, determined by the Supervisory Board to be of particular importance, and the other members of the Executive Board.

Maximum remuneration

In addition to the caps on the one-year and long-term variable remuneration, in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG the Supervisory Board has capped the total amount of remuneration received by each Executive Board member in a given financial year. Since 2023, this maximum remuneration has been EUR 11m for the Chairman of the Executive Board, EUR 6.5m for the Executive Board member for the finance function and EUR 5m for the other ordinary Executive Board members and relates to actual expenses or the actual payment of remuneration agreed for the financial year (including retirement benefit commitments). If remuneration for a financial year exceeds this cap, the variable remuneration is reduced accordingly.

Compliance with the maximum remuneration limit for the 2023 financial year

Since the amount paid out for the long-term variable remuneration in 2023 will only be known on 31 December 2026 due to the four-year performance period, definitive information about compliance with the remuneration cap for the remuneration granted in the 2023 financial year can only be provided in the remuneration report for the 2026 financial year.

Compliance with the maximum remuneration limit for the 2020 financial year

For the 2020 financial year, the Supervisory Board specified a maximum amount for the overall remuneration granted to the Executive Board members for the financial year. Following the end of the performance period for the long-term variable remuneration 2020 (LTI 2020) on 31 December 2023, it is clear that none of the Executive Board members active in the 2020 financial year exceeded this maximum amount. The following table provides a detailed overview of the amounts of remuneration granted for the individual Executive Board members for the 2020 financial year, including the respective maximum amounts.

| T186 | MAXIMUM REMUNERATION FOR 2020 FINANCIAL YEAR | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carsten Spohr, Chairman of the Executive Board Chairman since 1 May 2014; Executive Board member since 1.1.2011; |

Christina Foerster Executive Board member since 1 Jan 2020 |

Harry Hohmeister Executive Board member since 1 Jan 2013 |

Detlef Kayser Executive Board member since 1 Jan 2019 |

Michael Niggemann Executive Board member since 1 Jan 2020 |

Thorsten Dirks Executive Board member until 30 Jun 20203) |

Ulrik Svensson Executive Board member until 30 Apr 2020 |

|||||||||

| in € thousands | 2020 | 2020 (max.) |

2020 | 2020 (max.) |

2020 | 2020 (max.) |

2020 | 2020 (max.) |

2020 | 2020 (max.) |

2020 | 2020 (max.) |

2020 | 2020 (max.) |

|

| Fixed remuneration | |||||||||||||||

| Basic salary1) | 1,471 | 1,634 | 774 | 860 | 774 | 860 | 774 | 860 | 774 | 860 | 387 | 430 | 272 | 287 | |

| Ancillary benefits | 19 | 19 | 1 | 1 | 15 | 15 | 6 | 6 | 1 | 1 | 11 | 11 | 5 | 5 | |

| Total | 1,490 | 1,653 | 775 | 861 | 789 | 875 | 780 | 866 | 775 | 861 | 398 | 441 | 277 | 292 | |

| Variable remuneration | |||||||||||||||

| One-year variable remuneration 20202) | – | 2,280 | – | 1,200 | – | 1,200 | – | 1,200 | – | 1,200 | – | – | 51 | 400 | |

| Long-term variable remuneration (LTI 2020) | 321 | 4,180 | 169 | 2,200 | 169 | 2,200 | 169 | 2,200 | 169 | 2,200 | – | – | 56 | 733 | |

| Total | 321 | 6,460 | 169 | 3,400 | 169 | 3,400 | 169 | 3,400 | 169 | 3,400 | 0 | 0 | 107 | 1,133 | |

| Service cost | 925 | 925 | 450 | 450 | 483 | 483 | 460 | 460 | 450 | 450 | 251 | 251 | 160 | 160 | |

| Total remuneration | 2,736 | 9,038 | 1,394 | 4,711 | 1,441 | 4,758 | 1,409 | 4,726 | 1,394 | 4,711 | 649 | 692 | 544 | 1,585 | |

| Maximum remuneration in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG | 9,500 | 5,000 | 5,000 | 5,000 | 5,000 | 2,500 | 1,667 | ||||||||

| 1) Including voluntary waiver of 20% of basic salary for the period from April to September 2020 due to the coronavirus crisis. 2) Including the waiver of claims to the one-year variable remuneration in 2020 due to the coronavirus crisis. 3) In accordance with his severance agreement, Mr Dirks is not entitled to variable remuneration for the 2020 financial year. |

|||||||||||||||

Variable remuneration in the 2023 financial year

The performance criteria for one-year and long-term variable remuneration are derived from the Company’s strategic goals and operational management. They aim to boost profitability, set incentives for growth at the same time and take the importance of liquidity management (including investing activities) and the optimal use of capital into account. For this reason, Adjusted EBIT, Adjusted Free Cash Flow and Adjusted ROCE are the relevant performance indicators for the Lufthansa Group and the main performance criteria for variable remuneration. Taking the interests of shareholders and other stakeholders into account, this is intended to ensure the sustainability of the business and reflect the Lufthansa Group’s social and ecological responsibilities.

On the basis of the remuneration system, the Supervisory Board determined the targets and minimum and maximum amounts for the financial performance indicators and selected focus topics for the sustainability targets for the variable remuneration for the 2023 financial year. The Supervisory Board ensured that the targets were demanding and ambitious.

For both the annual bonus and the long-term variable remuneration, the possible range of performance against both the individual financial and sustainability targets is between 0% and 200%.

One-year variable remuneration (annual bonus 2023)

80% of the one-year variable remuneration for the 2023 financial year is based on financial targets and 20% on overall and individual business and sustainability targets.

In the spirit of value-based management, the Group’s key performance indicators for its financial targets, Adjusted EBIT and Adjusted Free Cash Flow, each account for 40% of the target achievement. For the 2023 financial year, as in prior years, the Supervisory Board defined “Customers” and “Employees” as focal points for the business and sustainability targets in the one-year variable remuneration and thus took the key stakeholders’ interests into consideration.

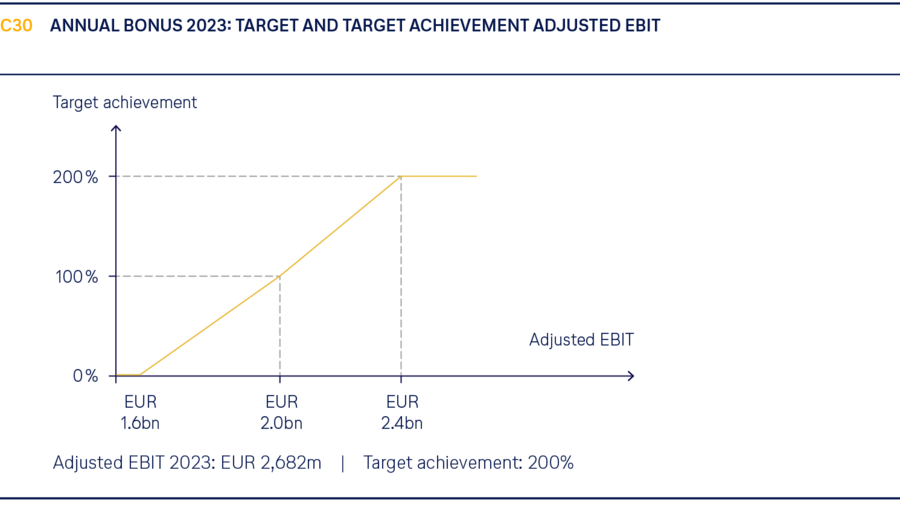

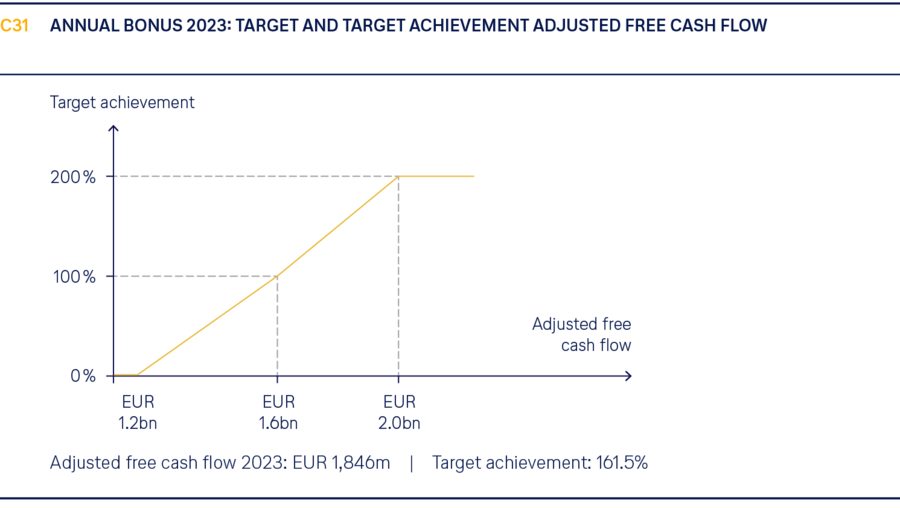

The financial targets are set by the Supervisory Board on the basis of the medium-term Group budget for the upcoming financial year. The target for Adjusted EBIT in the 2023 financial year was EUR 2.0bn. For the Adjusted Free Cash Flow parameter the target was EUR 1.6bn. Interim figures are interpolated on a straight-line basis. The targets and performance against the financial targets are shown in the diagrams.

Overall, the level of target achievement for the financial targets for the one-year variable remuneration for the 2023 financial year is 180.75%.

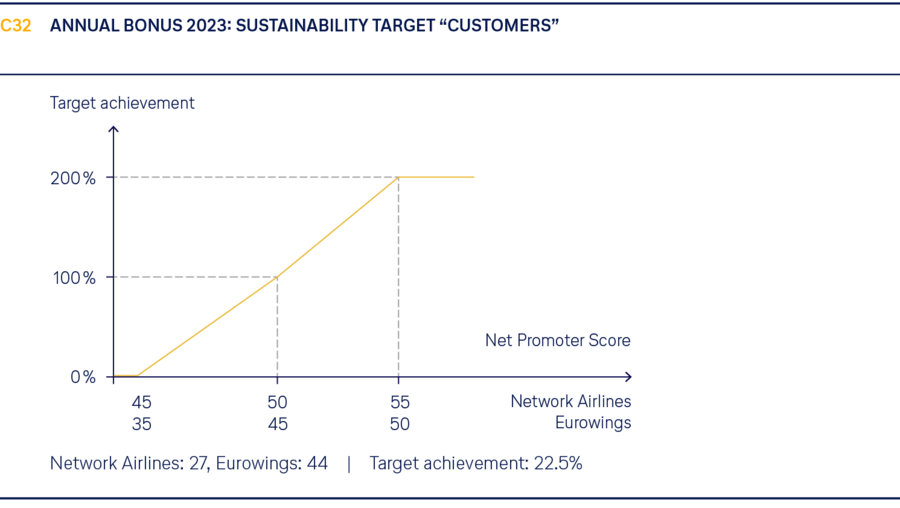

For the sustainability parameter “Customers”, the Net Promoter Score1)

(↗ Combined non-financial declaration), i.e. the proportion of customers recommending the Company, is used. The corresponding results are taken from the Network Airlines (Lufthansa German Airlines, SWISS, Austrian Airlines and Brussels Airlines) and from Eurowings, with three quarters weighted for the Network Airlines and one quarter for Eurowings. Interim figures are interpolated on a straight-line basis.

1) The Net Promoter Score is a registered service mark of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

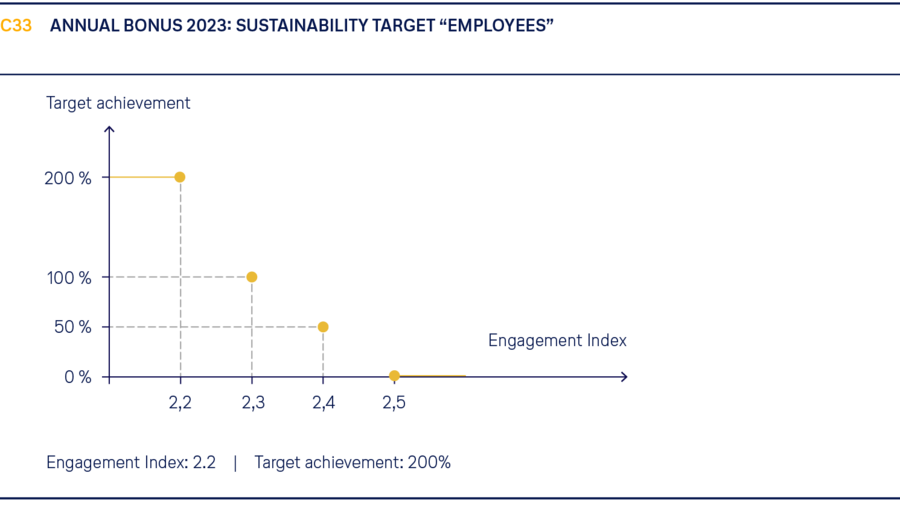

The Engagement Index is used for the parameter “Employees”

(↗ Non-financial declaration). It measures the extent to which employees identify with the Company, as well as their commitment and willingness to recommend the Company to others. Each index score corresponds to a performance level. The 100% target is based on the average external benchmark.

The “Customers” and “Employees” targets each account for 10% of the 2023 annual bonus. The following table shows performance against the business and sustainability targets for the 2023 financial year.

| T187 | ANNUAL BONUS 2023: TARGET ACHIEVEMENT BUSINESS AND SUSTAINABILITY TARGETS | ||||

|---|---|---|---|---|---|

| Weighting in % |

100% Target |

Actual value | Target achievement in % |

||

| Customer (NPS) | 10 | 22.50 | |||

| Network Airlines (3/4) | 50 | 27 | 0.00 | ||

| Eurowings (1/4) | 45 | 44 | 90.00 | ||

| Employee (Engagement Index) | 10 | 2.3 | 2.2 | 200.00 | |

| Total | 20 | 111.25 | |||

Overall, the level of target achievement for the 2023 annual bonus based on the weighted target achievement of the financial and sustainability targets is thus 166.85%.

In addition, the Supervisory Board can apply an individual performance factor (bonus/malus factor) of 0.8 to 1.2 when assessing the performance of each individual Executive Board member for the annual bonus. This is based on the individual performance targets set annually by the Supervisory Board and the individual Executive Board members. In addition to the targets for the individual Executive Board members, these comprise over-arching targets for the entire Executive Board to reflect the collective responsibility of its members as a decision-making body. At the end of the financial year, these are reviewed by the Steering Committee and the Supervisory Board.

The Steering Committee and Supervisory Board assessed performance against the individual targets at the end of the 2023 financial year. The following table provides an overview of the predefined individual and collective targets for the financial year 2023 and their assessment for the definition of the individual performance factor for the annual bonus 2023.

| T188 | Annual bonus 2023: individual performance factor | |

|---|---|---|

| 2023 targets | Evaluation | |

| Ensuring operational stability | Significant stabilisation of flight operations compared to previous year, particularly in terms of punctuality and regularity | |

| Greater focus on premium positioning | Implementation of organisational measures and definition of a clear "roadmap to premium" | |

| Strengthening of the leadership and corporate culture | Group-wide cultural programme implemented | |

| Internationalisation: further development in relation to relevant sales and labour markets as well as consolidation and partnership options | Initiation & implementation of various M&A transactions, e.g. LSG group, Lufthansa AirPlus Servicekarten GmbH, ITA Airways | |

Implementation of the Company's strategy, particularly in the following areas:

|

Expansion of digital self services; continued fleet modernisation and expansion of market position for sustainable aviation fuels; strengthening of balance sheet (incl. reduction in net indebtedness); Engagement Index result matching top level in pre-crisis period and improvement of ranking in terms of attractiveness as employer | |

Including the collective performance and the individual contributions of the Executive Board members, the Supervisory Board defined an individual performance factor of 1.05 for all Executive Board members for the 2023 financial year. For each Executive Board member, the performance factor was then multiplied by the overall target achievement from the financial, business and sustainability targets.

The following table shows the overall level of target achievement and the resulting amount paid for the annual bonus 2023 for each individual member of the Executive Board.

| T189 | OVERALL TARGET ACHIEVEMENT AND PAYMENT AMOUNTS ANNUAL BONUS 2023 in € thousands | ||||

|---|---|---|---|---|---|

| Board member | Target amount | Overall target achievement in % | Individual performance factor | Payment amount | |

| Carsten Spohr | 1,320 | 166.85 | 1.05 | 2,313 | |

| Christina Foerster | 600 | 166.85 | 1.05 | 1,051 | |

| Harry Hohmeister | 600 | 166.85 | 1.05 | 1,051 | |

| Detlef Kayser | 600 | 166.85 | 1.05 | 1,051 | |

| Michael Niggemann | 600 | 166.85 | 1.05 | 1,051 | |

| Remco Steenbergen | 780 | 166.85 | 1.05 | 1,367 | |

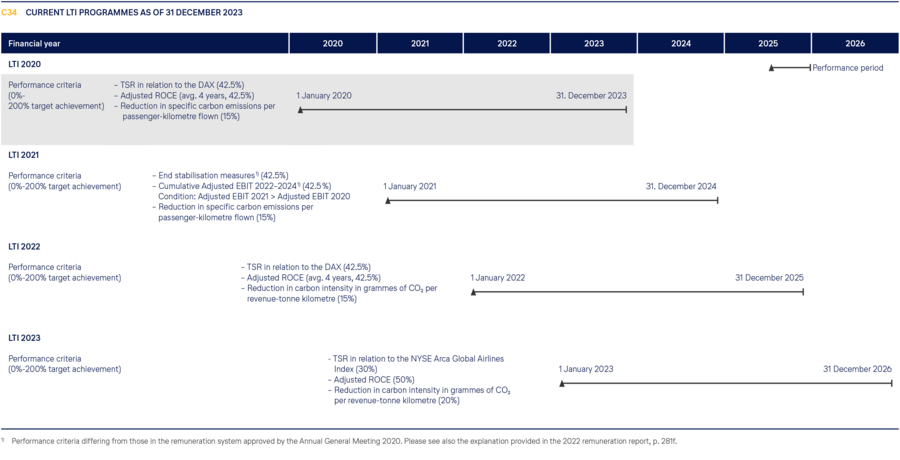

Long-term variable remuneration (LTI)

To promote the long-term, sustainable development of the Company, the long-term variable remuneration, and therefore the majority of variable remuneration, depends on the achievement of long-term targets. Taking the absolute and relative share performance into account aligns the interests of Executive Board members closely with those of shareholders.

Long-term variable remuneration commitment 2023 (LTI 2023)

Since financial year 2020, the long-term variable remuneration commitment for Executive Board members has been share-based. At the beginning of the performance period, the Executive Board members receive a number of virtual shares corresponding to the value of the contractually granted target amount. The number of virtual shares is determined by reference to the average price of the Lufthansa share in the first 60 trading days after the four-year performance period begins. The average price for the LTI 2023 is EUR 9.55. The following table shows the number of virtual shares allotted on a contingent basis to the individual Executive Board members as LTI 2023 in the reporting year.

| T190 | CONDITIONALLY COMMITTED SHARES LTI 2023 - ALLOCATION PRICE: EUR 9.55 | ||

|---|---|---|---|

| Board member | Target amount in € thousands | Number of conditionally committed shares | |

| Carsten Spohr | 2,420 | 253,403 | |

| Christina Foerster | 1,100 | 115,183 | |

| Harry Hohmeister | 1,100 | 115,183 | |

| Detlef Kayser | 1,100 | 115,183 | |

| Michael Niggemann | 1,100 | 115,183 | |

| Remco Steenbergen1) | - | - | |

| 1) In accordance with the severance agreement reached with Remco Steenbergen in February 2024 on his departure from the Executive Board, Steenbergen is no longer entitled to the LTI 2023. | |||

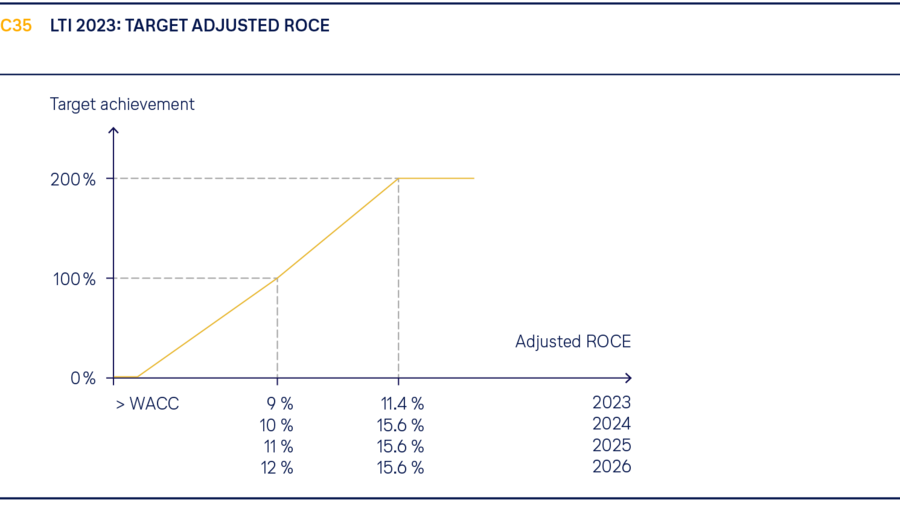

The final number of virtual shares at the end of the four-year performance period depends on the achievement of the financial performance targets Adjusted ROCE (50%) and relative total shareholder return (30%), as well as the strategic and sustainability targets (20%).

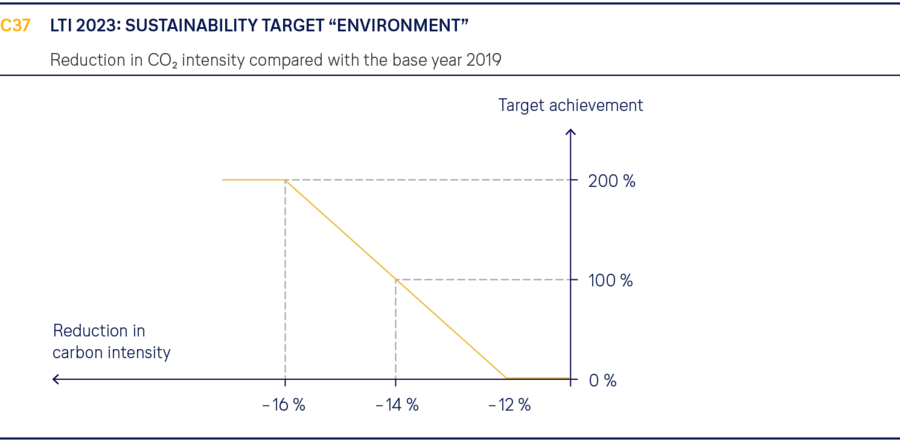

The Supervisory Board has specified the “Environment” parameter as a core area of focus for the strategic and sustainability targets in the LTI 2023. This provides a long-term incentive for the environmental goal of reducing carbon emissions.

Performance against the target of Adjusted ROCE is measured by comparing the average Adjusted ROCE over the four-year performance period with a target set by the Supervisory Board at the beginning of the performance period for each year of the programme. The Supervisory Board refers to the Group’s four-year operational planning for the purpose of this measurement. The lower limit should not be below what is required to cover the weighted average cost of capital (WACC). This is in line with the strategic objective of earning a return on capital employed that is higher than the cost of capital.

The Supervisory Board determines the target performance for each year based on the actual figures and the defined performance curve. Interim figures are interpolated on a straight-line basis. Overall target achievement is measured at the end of the four-year performance period as the average of the target achievements for the individual years. The following chart shows the targets for the LTI 2023.

The actual average Adjusted ROCE reached in the financial years making up the four-year performance period and the resulting level of target achievement are published in the remuneration report for the financial year at the end of the respective performance period.

TSR performance for the LTI 2023 is calculated at the end of the four-year performance period, by comparing the share return for Deutsche Lufthansa AG with the share return for the NYSE Arca Global Airlines Index. To calculate the TSR performance, the average price for the Deutsche Lufthansa AG share for the last 60 exchange trading days before the start of the performance period is compared with the average share price for the last 60 exchange trading days before the end of the performance period. Consideration is taken of fictitiously reinvested dividends. TSR performance is measured in the same way for the NYSE Arca Global Airlines Index. The relative TSR is then measured as the difference between the TSR performance of Deutsche Lufthansa AG and the TSR performance of the NYSE Arca Global Airlines Index in percentage points (outperformance).

The target achievement is then calculated on this basis at the end of the four-year performance period using the defined performance curve. The design of the performance curve includes the market-standard elements of share-based remuneration components in the European market. Target achievement is 100% if the TSR of Deutsche Lufthansa AG corresponds to the TSR for the peer group index. If the relative TSR is 20 percentage points or less, the target achievement is zero. If the relative TSR is 30 percentage points or more, the target achievement is 200%. Interim figures are interpolated on a straight-line basis.

The “Environment” sustainability target is based on the Lufthansa Group’s long-term strategy. Since 2022 the Lufthansa Group’s carbon reduction targets have been based on the industry-wide and internationally acknowledged Science-based Targets (SBT), which are in line with the targets set by the Paris Climate Agreement. The Lufthansa Group thus undertakes to achieve a scientifically based intensity target relating to its specific carbon emissions, measured in terms of grammes per revenue tonne-kilometre. The reduction target for the LTI 2023 is based on the long-term target of a 30.6% reduction in specific carbon emissions by 2030 compared with the 2019 base year (↗ Combined non-financial declaration). The target for the LTI 2023 is a 14 percentage point reduction in carbon intensity by the end of the performance period on 31 December 2026. The end points of the range are defined by a deviation of +/– 2 percentage points from the target. Interim figures are interpolated on a straight-line basis.

To calculate performance, the level of target achievement in terms of the reduction of specific carbon emissions is determined at the end of the four-year performance period. This is then counted towards the overall level of target achievement for the LTI 2023 at the end of the performance period with a weighting of 20%.

At the end of the performance period, the number of virtual shares granted conditionally is multiplied by the total target achievement, which is made up of the weighted financial and sustainability performance targets, in order to obtain the final number of virtual shares. To calculate the payment amount, the final number of virtual shares is multiplied by the average price of the Lufthansa share over the last 60 trading days of the performance period, plus dividends paid during the performance period. Payment is generally in cash.

Long-term variable remuneration 2020 (LTI 2020)

The long-term variable remuneration commitment for the financial year 2020 (LTI 2020) is also share-based. At the beginning of the performance period, the Executive Board members received a number of virtual shares corresponding to the contractually agreed target amount. As with the LTI 2023, the number of virtual shares is determined by reference to the average price of the Lufthansa share in the first 60 trading days after the four-year performance period begins. The average price for the LTI 2020 is EUR 9.48, after adjustment for the effects of the capital increase in 2021.

The final number of virtual shares in the LTI 2020 depends on the achievement of the financial performance targets Adjusted ROCE (42.5%) and the relative total shareholder return compared with the companies in the DAX (42.5%), as well as the strategic and sustainability targets (15%). Please see the detailed comments in the remuneration report 2020 (↗ Annual Report 2020).

Performance against the target of Adjusted ROCE is measured by comparing the average Adjusted ROCE over the four-year performance period with a strategic target set by the Supervisory Board at the beginning of the performance period. This was derived from the Group’s operational planning and amounted to 7% for the LTI 2020. The end points of the range were defined by a deviation of +/– 3 percentage points from the target. Interim figures are interpolated on a straight-line basis.

To calculate the TSR performance, the average share price for the last 60 exchange trading days before the start of the performance period is compared with the average share price for the last 60 exchange trading days before the end of the performance period. Dividends are taken into account as notionally reinvested. The companies in the DAX are used as the peer group for the relative TSR in the LTI 2020; both those in the index at the beginning and at the end of the performance period. The TSR performance of all companies is ranked and the relative performance of Deutsche Lufthansa AG determined by its percentile position. Target achievement is 100% if the TSR of Deutsche Lufthansa AG corresponds to the median (50th percentile) for the peer group. A performance on or below the 25th percentile corresponds to a target achievement of 0%. The maximum of 200% is achieved for a TSR on or above the 75th percentile. Interim figures are interpolated on a straight-line basis.

The target achievement for the financial targets in the LTI 2020 are presented in the following table.

| T191 | LTI 2020: FINANCIAL TARGETS – TARGET AND TARGET ACHIEVEMENT | |||||

|---|---|---|---|---|---|---|

| Objective | Target achievement | |||||

| 0% | 100% | 200% | in % | |||

| Adjusted ROCE (avg. 2020-2023) |

4% | 7% | 10% | -0.92% | 0 % | |

| Relative TSR compared with the DAX |

25th percentile | 50th percentile | 75th percentile | 8. percentile | 0 % | |

| Total | – | 0 % | ||||

The Supervisory Board specified the “Environment” parameter as a core sustainability target for the LTI 2020. The IATA targets for fuel efficiency were used, i.e. the average kerosene consumption to carry a passenger 100 kilometres (↗ Combined non-financial declaration), which provide for an improvement of 1.5% p.a. in specific fuel consumption and thus an improvement in specific carbon emissions. A target of 100% was therefore defined as an annual improvement of 1.5% in specific fuel consumption. The end points of the range are defined by a deviation of +/– 1.5 percentage points from the annual target. Interim figures are interpolated on a straight-line basis. The LTI 2020 includes emissions from Lufthansa’s own fleet as well as those from wet-lease flights.

To calculate performance, the achievement of the environmental target is determined by the Supervisory Board annually over the four-year performance period. These annual target achievement figures then account for one quarter of the total performance against the sustainability target at the end of the performance period.

The levels of target achievement for the “Environment” parameter for the LTI 2020 are presented in the following table. On this basis, the overall level of target achievement for the “Environment” parameter is 127.67%.

| T192 | TARGET ACHIEVEMENT FOR SUSTAINABILITY TARGET IN LTI 2020 Annual reduction in CO2 emissions |

||||

|---|---|---|---|---|---|

| Year of performance period | Reduction in CO₂ emissions compared with previous year |

Target achievement | Weighting | ||

| 2020 | +13.76% | 0.00% | 1/4 | ||

| 2021 | -3.14% | 200.00% | 1/4 | ||

| 2022 | -11.41% | 200.00% | 1/4 | ||

| 2023 | -1.66% | 110.67% | 1/4 | ||

| Total | 127.67% | ||||

Overall, the level of target achievement for the long-term variable remuneration for the 2020 financial year is thus 19.15%.

To calculate the payment amount from the LTI 2020 at the end of the performance period, the number of virtual shares granted conditionally is first multiplied by the total target achievement, which is made up of the weighted financial and sustainability performance targets, in order to obtain the final number of virtual shares. The final number of virtual shares is then multiplied by the average price of the Lufthansa share over the last 60 trading days of the performance period. For the LTI 2020 this is EUR 7.61. The following table shows the calculation of the individual payments for eligible Executive Board members.

| T193 | Payment amounts under LTI 2020 - overall level of target achievement 19.15% | ||||

|---|---|---|---|---|---|

| Executive Board | Target remuneration in € thousands |

Number of conditionally awarded shares (start price: €9.481)) |

Final number of virtual shares |

Payment amount in € thousands (end price: € 7.61) |

|

| Carsten Spohr | 2,090 | 220,464 | 42,219 | 321 | |

| Christina Foerster | 1,100 | 116,034 | 22,220 | 169 | |

| Harry Hohmeister | 1,100 | 116,034 | 22,220 | 169 | |

| Detlef Kayser | 1,100 | 116,034 | 22,220 | 169 | |

| Michael Niggemann | 1,100 | 116,034 | 22,220 | 169 | |

| Ulrik Svensson (until 30 Apr 2020) |

367 | 38,678 | 7,407 | 56 | |

1) After adjustment for the effects of the capital increase in the 2021 financial year.

Malus and clawback rule

In the event of an intentional or grossly negligent breach of statutory obligations or internal policies (compliance penalty or clawback), or if variable remuneration components dependent on achieving certain targets are paid on the basis of false data (performance clawback), the Supervisory Board has the right to withhold or demand repayment of the one-year and long-term variable remuneration. Enforcement of the withholding or repayment claim is at the professional discretion of the Supervisory Board.

The Supervisory Board did not make use of the right to withhold or demand repayment of variable remuneration components in 2023.

Share Ownership Guidelines

The Share Ownership Guidelines (SOG) have been an integral part of the remuneration system for the Executive Board since 2019. They oblige the Chairman of the Executive Board to acquire Lufthansa shares worth twice his basic salary and ordinary Executive Board members to acquire shares worth one year’s gross basic salary and to hold them for their term of office and beyond. Executive Board members must demonstrate annually that they meet this obligation.

The minimum number of Lufthansa shares to be purchased by the current Executive Board members was determined at the beginning of the term of office based on the average share price over the 125 trading days before the service contract begins. Shares are to be acquired over a four-year period. Existing shareholdings can be included in the calculation.

In connection with the restrictions on Executive Board remuneration for the duration of the ESF stabilisation measures, the Supervisory Board has decided to suspend the four-year acquisition period for as long as the stabilisation measures are in place, starting on 21 June 2020. After the stabilisation measures were fully brought to a close on 13 September 2022, this period has now resumed and will be extended accordingly for the current Executive Board members.

| T194 | SHAREHOLDINGS OF CURRENT EXECUTIVE BOARD MEMBERS | ||

|---|---|---|---|

| Number of Lufthansa shares which must be held according to SOG |

Shareholdings as of 31 Dec 2023 | ||

| Carsten Spohr | 180,5961 | 321,950 | |

| Christina Foerster | 56,126 | 38,408 | |

| Harry Hohmeister | 41,044 | 152,096 | |

| Detlef Kayser | 41,044 | 44,640 | |

| Michael Niggemann | 56,126 | 100,000 | |

| Remco Steenbergen | 128,8471 | 130,000 | |

| 1) In each case, taking into consideration the adjustment in the amount of basic pay as of 1 January 2023 | |||

The shares acquired in accordance with the SOG are to be held until the end of the service contract with the Executive Board member. After they leave, Executive Board members may sell 25% of their SOG shares per year.

Retirement benefits

The members of the Executive Board receive retirement benefit commitments based on a defined contribution plan. For the duration of their employment, every Executive Board member receives a fixed annual amount credited to their personal pension account. As of 1 January 2023, this amounts to EUR 990k for Mr Spohr, the Chairman of the Executive Board, to EUR 585k for Mr Steenbergen, the Chief Financial Officer, and to EUR 450k for an ordinary Executive Board member.

The investment guidelines are based on the investment concept for the Lufthansa Pension Trust, which also applies to staff members of Deutsche Lufthansa AG.

Retirement benefits are paid when the beneficiary reaches the retirement age of 60 years (if they are no longer an Executive Board member) or in the event of disability or death. If employment ends before retirement age is reached, the beneficiaries or their surviving dependants acquire a retirement benefit credit as defined in the investment concept. Deutsche Lufthansa AG guarantees the amounts paid into the retirement benefit account.

A supplementary risk capital sum will be added to the pension credit in the event of a claim for a disability pension or a pension for surviving dependants. This sum consists of the average contributions paid into the pension account over the past three years multiplied by the number of full years by which the claimant is short of the age of 60 from the time a pension entitlement arises.

The pension credit is paid out in ten instalments. On application by the Executive Board member or their surviving dependants, a payment as a lump sum or in fewer than ten instalments may also be made, subject to approval by the Company. The pension credits received until 31 December 2018 by Carsten Spohr and Harry Hohmeister may also be paid as an annuity, on application and with the approval of the Company.

Under his contract as a pilot, which is currently not active, Carsten Spohr is entitled to a transitional pension in accordance with the wage agreement “Transitional pensions for cockpit staff”. If Carsten Spohr leaves the Executive Board before he reaches the age of 60 and resumes his employment as a pilot, he is entitled to draw a “Transitional pension for cockpit staff at Lufthansa” once he becomes 60 or on request once he turns 55, in accordance with the provisions of the wage agreement. This additional benefit is paid if certain conditions of eligibility are met and provides for a monthly pension of up to 60% of the last modified salary until the beneficiary reaches the age of 63.

Pension entitlements in financial year 2023

The total amount of pension entitlements earned by active Executive Board members in the 2023 financial year was EUR 3.3m (previous year: EUR 3.0m) according to HGB and EUR 3.4m (previous year: EUR 3.2m) according to IFRS and was recognised in staff costs (current service cost). The individual service cost and present values of pension entitlements are as follows:

| T195 | PENSION ENTITLEMENTS ACCORDING TO HGB AND IFRS | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| HGB | HGB | IFRS | IFRS | ||||||

| Current service costs | Settlement amount of pension obligations | Current service costs | Defined-benefit obligations (DBO) | ||||||

| in € thousands | 2023 | 2022 | 31 Dec 2023 | 31 Dec 2022 | 2023 | 2022 | 31 Dec 2023 | 31 Dec 2022 | |

| Carsten Spohr | 958 | 810 | 10,493 | 8,730 | 996 | 865 | 10,490 | 8,728 | |

| Christina Foerster | 426 | 427 | 2,060 | 1,411 | 457 | 459 | 2,053 | 1,398 | |

| Harry Hohmeister | 442 | 435 | 4,887 | 4,018 | 450 | 451 | 4,887 | 4,017 | |

| Detlef Kayser | 436 | 431 | 2,680 | 1,983 | 451 | 453 | 2,680 | 1,982 | |

| Michael Niggemann | 430 | 433 | 2,111 | 1,457 | 461 | 464 | 2,100 | 1,438 | |

| Remco Steenbergen | 589 | 450 | 1,635 | 909 | 601 | 482 | 1,634 | 907 | |

| Total | 3,281 | 2,986 | 23,866 | 18,508 | 3,416 | 3,174 | 23,844 | 18,470 | |

Remuneration awarded and due in financial year 2023 pursuant to Section 162 AktG

Pursuant to Section 162 AktG, the remuneration report must disclose the remuneration awarded and due to each current or former member of the Executive Board or the Supervisory Board in the past financial year.

Remuneration will be considered to have been awarded if it has fallen due in the reporting period and the individual Executive Board member has actually received it (“payment-based perspective”). According to the prevailing legal opinion regarding the interpretation of the term “award” in Section 162 AktG, remuneration components may, as an alternative, already be presented in the remuneration report for the reporting year in which the one-year or long-term activity constituting the basis for this remuneration has been performed in full (“accumulation-based perspective”). This perspective enables transparent reporting that is easy to understand, with the level of performance in the respective reporting year matching the level of remuneration. As in the previous year, the accumulation-based perspective is therefore used in the present report for the term “award” within the meaning of Section 162 AktG.

Accordingly, the amounts paid out for the annual bonus are already shown in the following tables for the reporting year, even though they will only be paid out after the end of the reporting year in question. Analogously, the amounts paid out for the long-term variable remuneration components are indicated in the reporting year in which the performance period ends, even though here too the payment will only be made in the following year.

The following section shows the remuneration awarded and due to each individual active and former Executive Board member in 2023, in accordance with Section 162 Paragraph 1 Sentence 1 AktG.

As well as the annual bonus for the 2023 financial year, the variable remuneration components awarded in this sense in the financial year include the payment under the LTI 2020.

Executive Board members active in the financial year

Table T196 shows the remuneration awarded and due to Executive Board members active in 2023 as defined in Section 162 Paragraph 1 Sentence 1 AktG, as well as the relative proportions of individual fixed and variable remuneration components. Although the expenses for retirement benefit commitments are not classified as awarded or owed remuneration within the meaning of Section 162 Paragraph 1 Sentence 1 AktG, they are also shown in the following tables for the sake of transparency and correspond to the service cost for pensions and other contractually agreed retirement benefits in accordance with IAS 19.

| T196 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG – EXECUTIVE BOARD MEMBERS ACTIVE IN 2023 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carsten Spohr, Chairman of the Executive Board Chairman since 1 May 2014; Member of the Executive Board since 1 Jan 2011 |

Christina Foerster Member of the Executive Board since 1 Jan 2020 |

Harry Hohmeister Member of the Executive Board since 1 Jan 2013 |

|||||||||||

| in € thousands | 2023 | 20231) | 2022 | 20221) | 2023 | 20231) | 2022 | 20221) | 2023 | 20231) | 2022 | 20221) | |

| Fixed remuneration | |||||||||||||

| Fixed remuneration | 1,892 | 41.3% | 1,634 | 38.5% | 860 | 40.6% | 860 | 44.6% | 860 | 40.4% | 860 | 38.1% | |

| Ancillary benefits | 51 | 1.1% | 38 | 0.9% | 39 | 1.8% | 27 | 1.4% | 47 | 2.2% | 34 | 1.5% | |

| Total | 1,943 | 42.5% | 1,672 | 39.4% | 899 | 42.4% | 887 | 46.0% | 907 | 42.6% | 894 | 39.6% | |

| Variable remuneration | |||||||||||||

| One-year variable remuneration | 2,313 | 50.5% | 2,280 | 53.8% | 1,051 | 49.6% | 1,042 | 54.0% | 1,051 | 49.4% | 1,200 | 53.1% | |

| Long-term variable remuneration | – | – | – | – | – | – | |||||||

| LTI 2020 (2019) | 321 | 7.0% | 199 | 4.7% | 169 | 8.0% | – | 169 | 7.9% | 104 | 4.6% | ||

| Option programme LH Performance 2018 | – | 90 | 2.1% | – | – | – | 60 | 2.7% | |||||

| Total | 2,634 | 57.5% | 2,569 | 60.6% | 1,220 | 57.6% | 1,042 | 54.0% | 1,220 | 57.4% | 1,364 | 60.4% | |

| Total remuneration as defined in Section 162 AktG | 4,577 | 100.0% | 4,241 | 100.0% | 2,119 | 100.0% | 1,929 | 100.0% | 2,127 | 100.0% | 2,258 | 100.0% | |

| Service cost | 996 | – | 865 | – | 457 | – | 459 | – | 450 | – | 451 | – | |

| Total remuneration | 5,573 | – | 5,106 | – | 2,576 | – | 2,388 | – | 2,577 | – | 2,709 | – | |

| 1) The relative proportions indicated here relate to the total remuneration shown in the table as defined in Section 162 AktG excluding retirement benefit expenses. | |||||||||||||

| T196 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG – EXECUTIVE BOARD MEMBERS ACTIVE IN 2023 (cont’d) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Detlef Kayser Member of the Executive Board since 1 Jan 2019 |

Michael Niggemann Member of the Executive Board since 1 Jan 2020 |

Remco Steenbergen Member of the Executive Board since 1 Jan 2021 |

|||||||||||

| in € thousands | 2023 | 20231) | 2022 | 20221) | 2023 | 20231) | 2022 | 20221) | 2023 | 20231) | 2022 | 20221) | |

| Fixed remuneration | |||||||||||||

| Fixed remuneration | 860 | 40.6% | 860 | 42.3% | 860 | 40.6% | 860 | 42.2% | 1,118 | 31.7% | 860 | 27.8% | |

| Ancillary benefits | 37 | 1.7% | 26 | 1.3% | 38 | 1.8% | 32 | 1.6% | 63 | 1.8% | 61 | 2.0% | |

| Total | 897 | 42.4% | 886 | 43.6% | 898 | 42.4% | 892 | 43.7% | 1,181 | 33.5% | 921 | 29.7% | |

| Variable remuneration | |||||||||||||

| One-year variable remuneration | 1,051 | 49.6% | 1,042 | 51.3% | 1,051 | 49.6% | 1,147 | 56.3% | 1,367 | 38.8% | 1,200 | 38.8% | |

| Long-term variable remuneration | – | 0 | – | – | – | – | |||||||

| LTI 2020 (2019) | 169 | 8.0% | 104 | 5.1% | 169 | 8.0% | – | – | – | ||||

| Option programme LH Performance 2018 | – | – | – | – | – | – | |||||||

| Total | 1,220 | 57.6% | 1,146 | 56.4% | 1,220 | 57.6% | 1,147 | 56.3% | 1,367 | 38.8% | 1,200 | 38.8% | |

| Other2) | – | – | – | – | – | – | – | – | 975 | 27.7% | 975 | 31.5% | |

| Total remuneration as defined in Section 162 AktG | 2,117 | 100.0% | 2,032 | 100.0% | 2,118 | 100.0% | 2,039 | 100.0% | 3,523 | 100.0% | 3,096 | 100.0% | |

| Service cost | 451 | – | 453 | – | 461 | – | 464 | – | 601 | – | 482 | – | |

| Total remuneration | 2,568 | – | 2,485 | – | 2,579 | – | 2,503 | – | 4,124 | – | 3,578 | – | |

| 1) The relative proportions indicated here relate to the total remuneration shown in the table as defined in Section 162 AktG excluding retirement benefit expenses. 2) The Supervisory Board agreed to a one-off gross payment of EUR 2,925,000 to Remco Steenbergen in compensation for his loss of benefits from his previous employer. The compensation was paid in three instalments of EUR 975k each in the years 2021, 2022 and 2023, and is not offset against the maximum remuneration for those years as defined in Section 87a Paragraph 1 Sentence 2 No. 1 AktG. |

|||||||||||||

In 2023, the members of the Executive Board received no benefits or promises of benefits from third parties relating to their work on the Executive Board.

Former Executive Board members

Table T197 shows the remuneration awarded and due to former Executive Board members in 2023 in accordance with Section 162 Paragraph 1 sentence 1 AktG. In accordance with Section 162 Paragraph 5 AktG, no personal data was disclosed for former Executive Board members who left the Executive Board before 31 December 2013.

| T197 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG - FORMER EXECUTIVE BOARD MEMBERS | |||||

|---|---|---|---|---|---|---|

| Fixed and variable remuneration | Pensions | |||||

| in € thousands | Ancillary benefits |

LTI 2020 | Annuity | Capital payment |

Total | |

| Thorsten Dirks Member of the Executive Board until 30 Jun 2020 |

– | – | – | 1,663 | 1,663 | |

| Ulrik Svensson Member of the Executive Board until 30 Apr 2020 |

1 | 56 | – | – | 57 | |

| Bettina Volkens Member of the Executive Board until 31 Dec 2019 |

2 | – | 3,491 | 3,493 | ||

| Karl Ulrich Garnadt Member of the Executive Board until 30 Apr 2017 |

2 | – | – | 116 | 118 | |

Total current payments and other benefits to former Executive Board members (including the individual payments shown in Table T197) and their surviving dependants came to EUR 9.2m in the reporting year (previous year: EUR 5.7m). This also includes non-cash benefits and concessionary travel. Pension obligations toward former Executive Board members and their surviving dependants amount to EUR 49.7m (previous year: EUR 51.3m).