Net assets

Impact of the sale of divisions on the financial position

In line with IFRS 5, the assets and liabilities attributable to AirPlus have been presented separately in the statement of financial position as of 31 December 2023 as “Assets held for sale” and “Liabilities in connection with assets held for sale”. The disposal of the LSG group reduced the Group’s assets and liabilities significantly year-on-year. The figures for the previous year have not been adjusted.

To enable better comparability with the previous year, significant effects are quantified in the following comments.

Total assets up by EUR 2.0bn

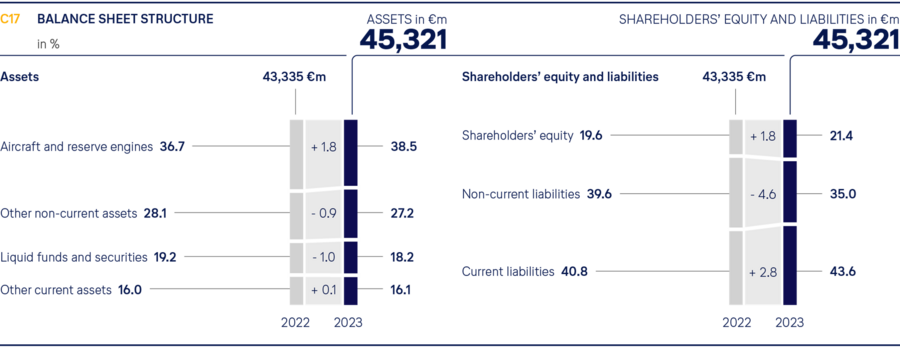

Total Group assets as of 31 December 2023 increased by EUR 1,986m over year-end 2022 to EUR 45,321m (31 December 2022: EUR 43,335m).

Non-current assets were up by EUR 1,692m at EUR 29,772m (31 December 2022: EUR 28,080m). This accounts for 66% of total assets (31 December 2022: 65%). Current assets rose by EUR 294m to EUR 15,549m (31 December 2022: EUR 15,255m). Their share of total assets was thus 34% (31 December 2022: 35%).

Shareholders’ equity was up by EUR 1,235m to EUR 9,709m (31 December 2022: EUR 8,474m). Altogether, non-current funding accounted for 56% of total assets (31 December 2022: 59%).

Non-current financing covered 86% of non-current assets (31 December 2022: 91%). Current funding came to 44% of total assets (31 December 2022: 41%).

Assets

Non-current asset up by EUR 1.7bn

At year-end 2023, non-current assets of EUR 29,772m were EUR 1,692m higher than at year-end 2022 (31 December 2022: EUR 28,080m).

Aircraft and reserve engines went up by EUR 1,574m and repairable spare parts for aircraft by EUR 414m. Lending and other non-current assets (EUR +436m) rose in particular due to higher measurement-driven surpluses of pension plan assets and higher stocks of purchased emissions certificates that do not have to be submitted for the 2024 financial year. This was offset by measurement effects in derivative financial instruments (EUR -461m) and a decline in other property, plant and equipment (EUR -418m) following the disposal of the Catering segment.

The value of aircraft and reserve engines came to EUR 17,464m as of year-end 2023 (31 December 2022: EUR 15,890m). Depreciation and disposals were exceeded by the additions of new owned aircraft and rights-of-use to leased aircraft (three Boeing 787s, one Boeing 777F, two Airbus A321Fs, eleven Airbus A320s and seven Airbus A321s), major maintenance events and down payments on existing orders.

This includes five Airbus A350s that were not yet ready for service at year-end 2023. Twelve aircraft from the Airbus A320 family (of which eight were bought in the financial year) and advance payments for a Boeing 777F were sold to external lessors and leased back for periods of either six or twelve years in the course of sale-and-lease-back transactions. As of 31 December 2023, the Lufthansa Group fleet consisted of 721 aircraft (31 December 2022: 710 aircraft). ↗ Fleet

Current assets up by EUR 294m

Current assets as of 31 December 2023 rose by EUR 294m to EUR 15,549m (31 December 2022: EUR 15,255m). Non-current assets in the Catering segment sold in the financial year came to EUR 381m in the previous year. Inventories rose by a total of EUR 149m, essentially in the MRO segment. Before the reclassification of businesses held for sale, trade and other receivables increased by EUR 761m, whereas derivative financial instruments decreased by EUR 424m, particularly due to the lower US dollar exchange rate.

The increase in assets held for sale (EUR +790m year-on-year) is attributable to the assets of AirPlus (EUR 1,109m), of which a total of EUR 81m related to previously non-current assets. The sale of six Airbus A380s led to a reduction in the previous year’s figure of EUR 315m.

Shareholders’ equity and liabilities

Shareholders’ equity up by EUR 1.2bn, equity ratio rises to 21.4%

Shareholders equity climbed by EUR 1,235m compared with year-end 2022 to EUR 9,709m as of 31 December 2023 (31 December 2022: EUR 8,474m), primarily due to profits for financial year 2023 (EUR +1,673m) and positive currency translation effects recognised directly in equity (EUR +270m.) They were offset by measurement effects in pensions (EUR -355m) and financial instruments (EUR -353m) that were recognised in equity.

The equity ratio therefore increased by 1.8 percentage points compared with year-end 2022 to 21.4% (31 December 2022: 19.6%).

| T025 | DEVELOPMENT OF EARNINGS, EQUITY, EQUITY RATIO AND RETURN ON EQUITY |

|||||||

|---|---|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||

| Profit/loss after income taxes1) |

€m | 1,689 | 804 | -2,193 | -6,766 | 1,245 | ||

| Equity1) | €m | 9,709 | 8,474 | 4,490 | 1,387 | 10,256 | ||

| Equity ratio1) | % | 21.4 | 19.6 | 10.6 | 3.5 | 24.0 | ||

| Return on equity1) | % | 17.4 | 9.5 | -48.8 | -487.8 | 12.1 | ||

| 1) Including non-controlling interests. | ||||||||

Non-current liabilities and provisions decrease by EUR 1.3bn year-on-year

Non-current provisions and liabilities were down by EUR 1,291m to EUR 15,862m (31 December 2022: EUR 17,153m).

Non-current borrowing of EUR 11,055m was EUR 2,215m lower than at year-end 2022 (31 December 2022: EUR 13,270m). This decline is mainly based on maturity reclassifications and reclassifications for the AirPlus business held for sale and disposals from the sale of the LSG group, partly offset by new financing measures.

Net pension obligations, i.e. pension provisions less asset surpluses at some pension plans, which are presented separately in non-current assets, increased by EUR 683m to EUR 2,676m (31 December 2022: EUR 1,993m). Pension provisions were up by EUR 826m to EUR 2,895m (31 December 2022: EUR 2,069m). The interest rate used to discount pension obligations in Germany and Austria decreased significantly by 0.6 percentage points to 3.6%, and in Switzerland by 1.0 percentage point to 1.4%.

The negative effect that this had on the obligations was partly offset by the positive measurement effect in plan assets.

Current liabilities and provisions up by EUR 2.0bn

Current provisions and liabilities went up by EUR 2,042m to EUR 19,750m as of 31 December 2023 (31 December 2022: EUR 17,708m).

Non-current liabilities and provisions in the Catering segment sold in the financial year came to EUR 436m in the previous year. The overall rise was mitigated primarily by the increase in current financial debt (EUR +1,007m) due to maturity reclassifications and the increase in liabilities in connection with assets held for sale (EUR +670m), partly offset by the decline in derivative financial instruments (EUR -226m). Adjusted for the reclassification of businesses held for sale, trade and other liabilities increased by EUR 585m.

Liabilities of EUR 670m in connection with AirPlus assets held for sale mainly consisted of current financial debt and liabilities from the settlement of the credit card business.

Net indebtedness down by EUR 1.2bn on the previous year

At year-end 2023, positive free cash flow brought net indebtedness down to EUR 5,682m, a reduction of EUR 1,189m on year-end 2022 (31 December 2021: EUR 6,871m).

The sum of net indebtedness and net pension obligations in relation to shareholders’ equity, was 46:54 as of 31 December 2023 (31 December 2022: 51:49).

Adjusted net debt, the sum of net indebtedness and net pension obligations less 50% of the hybrid bond issued in 2015, was down by EUR 506m compared with year-end 2022 to EUR 8,111m (31 December 2022: EUR 8,617m).

The ratio of Adjusted net debt/Adjusted EBITDA was thus 1.7 (previous year: 2.3).

| T026 | CALCULATION OF NET INDEBTEDNESS | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Bonds | -6,224 | -6,659 | 7 | |

| Borrower’s note loans | -1,143 | -1,242 | 8 | |

| Credit lines | -21 | – | ||

| Aircraft financing | -3,802 | -4,407 | 14 | |

| Leasing liabilities | -2,568 | -2,443 | -5 | |

| Other financial debt | -185 | -400 | 54 | |

| Financial liabilities | -13,943 | -15,151 | 8 | |

| Other bank borrowing | -4 | -21 | 81 | |

| Group indebtedness | -13,947 | -15,172 | 8 | |

| Bank balances, cash-in-hand and fixed-term deposits (4-12 months) |

1,865 | 1,790 | 4 | |

| Securities | 6,400 | 6,511 | -2 | |

| Net indebtedness | -5,682 | -6,871 | 17 | |

| Pension provisions | -2,895 | -2,069 | -40 | |

| Pension surpluses | 219 | 76 | 188 | |

| Net pension obligation | -2,676 | -1,993 | -34 | |

| Net indebtedness and net pension obligations |

-8,358 | -8,864 | 6 | |