Lufthansa share

| T006 | THE LUFTHANSA SHARE: KEY FIGURES | ||||||

|---|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | 2019 | |||

| Year-end share price 1) | € | 8.05 | 7.77 | 6.18 | 7.72 | 11.71 | |

| Highest share price 1) | € | 10.95 | 8.23 | 9.12 | 11.90 | 16.78 | |

| Lowest share price 1) | € | 6.57 | 5.51 | 5.36 | 5.03 | 9.17 | |

| Number of shares | millions | 1,196.6 | 1,195.5 | 1,195.5 | 579.7 | 478.2 | |

| Market capitalisation (at year-end) | €bn | 9.6 | 9.3 | 7.4 | 6.5 | 7.8 | |

| Earnings per share | € | 1.40 | 0.66 | -2.99 | -12.51 | 2.55 | |

| Dividend per share | € | 0.30 | – | – | – | – | |

| Dividend yield (gross) | % | 3.7 | – | – | – | – | |

| Dividend | €m | 359.0 | – | – | – | – | |

| Total shareholder return | % | 7.5 | 25.7 | -20.0 | -34.1 | -12.6 | |

| 1) Share prices 2019 and 2020 adjusted for the effects of the issuance of new shares in connection with the capital increase in September 2021. | |||||||

Lufthansa share up by 4% over the course of the year

The Lufthansa share had a very volatile performance in the 2023 financial year.

Starting from a price of EUR 7.77 at year-end 2022, the share rose very significantly within a short time at the beginning of the year. The share price reached EUR 10.95 in early March. The Lufthansa share profited from the fact that an increasing number of financial analysts and investors were expecting strong demand in the summer season.

Concerns about weaker demand had weighed on share prices in the industry in the previous months.

From April onwards the share price started to fall, however. This reflected financial market fears that the challenging macroeconomic environment, especially the high inflation, and the geopolitical situation could have an adverse impact on the development of the airline industry in the medium term. Closely related to this were increasing uncertainties about the course of the kerosene price, particularly due to the conflict in the Middle East. In early November, the share price then fell to its low for the year at EUR 6.57.

Supported by the publication of results for the third quarter on 2 November 2023, the share price recovered quickly to EUR 8.59 in early December. This positive market perception partly came about because the Company was again able to present strong quarterly figures, achieve the targets previously communicated and confirm the positive demand outlook. The decline in the oil price also had a positive effect.

As of year-end, the Lufthansa share traded at EUR 8.05. This represented an increase of 4% for 2023 as a whole.

The Lufthansa share thus performed less well in 2023 than the shares of main competitors IAG and Air France-KLM, which increased by 25% and 10% respectively. The share prices of European low-cost carriers also outperformed the Lufthansa share. The MDAX index was up by 8% in 2023.

Over a period of two years, the Lufthansa share significantly outperformed its competitors, however, with an increase of 20%. Only Ryanair shares performed better in this period.

| T007 | Share price performance of Lufthansa and competitors | ||||

|---|---|---|---|---|---|

| in % | 1 year | 2 years | 4 years | 10 years | |

| Lufthansa | 4 | 20 | -32 | -26 | |

| MDAX | 8 | -23 | -4 | 64 | |

| Air France-KLM | 10 | -31 | -73 | -65 | |

| IAG | 25 | 9 | -63 | -42 | |

| easyJet | 57 | -8 | -64 | -67 | |

| Ryanair | 78 | 30 | 52 | 191 | |

| WIZZair | 16 | -47 | -43 | 77 | |

Executive Board and Supervisory Board propose dividend of EUR 0.30 per share

At the Annual General Meeting, the Executive Board and Supervisory Board of Deutsche Lufthansa AG will propose the distribution of a dividend of EUR 0.30 per share for the financial year 2023, in line with the dividend policy.

This represents a dividend ratio of 21% of Group net profits and a dividend yield of 3.7% based on the Lufthansa share’s closing price for the year. ↗ Financial strategy and value-based management, ↗ Earnings position.

Better analyst assessments than the previous year

At year-end 2023, of the 21 equity analysts tracking the Company (previous year: 18), eleven (previous year: five) recommended buying the share, seven (previous year: ten) recommended holding it, and three (previous year: three) selling it. Whereas the analysts viewed the ongoing recovery in the passenger business positively, the continued strength of Lufthansa Technik and the further strengthening of the balance sheet, there were concerns about the state of future demand and the outlook for the airfreight business. The macroeconomic and geopolitical situation is also seen as a risk factor. The average target price at year-end 2023 was EUR 10.21 with a range of EUR 6.70 to EUR 15.00.

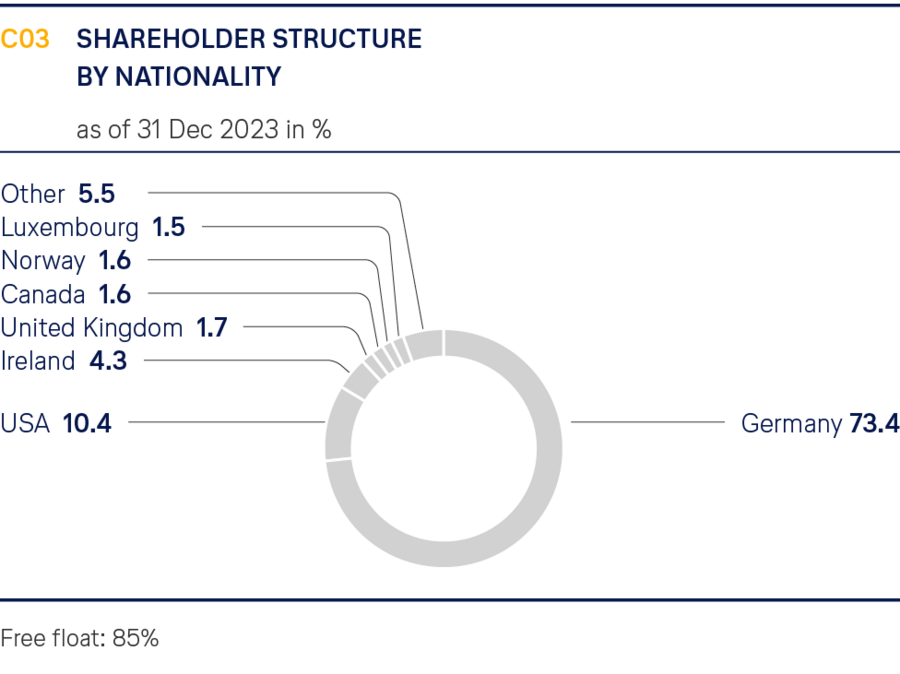

Share of German investors in the Company remains high

In order to protect international air traffic rights and its operating licence, the German Aviation Compliance Documentation Act (Luftverkehrsnachweissicherungsgesetz – LuftNaSiG) requires Lufthansa to provide evidence that a majority of its shares are held by German shareholders. For this reason, all Lufthansa shares are registered shares with transfer restrictions.

At the end of 2023, the shareholders’ register showed that German investors held 73.4% of the shares (previous year: 74.8%). The second largest group, with 10.4%, was shareholders from the USA. Investors from Ireland accounted for 4.3% of the share capital. They were followed by the United Kingdom with 1.7%, Norway and Canada, each with 1.6% and Luxembourg with 1.5%. This ensured that the conditions of the German Aviation Compliance Documentation Act (LuftNaSiG) were met.

On the basis of the voting rights notification received, Kühne Aviation GmbH was the biggest shareholder at year-end 2023 with 15.01%, followed by BlackRock, Inc. with 3.14%.

According to the definition of Deutsche Börse, 85% of Lufthansa shares were in free float. As of the reporting date, 54% (previous year: 49%) of the shares were held by institutional investors and 46% by private individuals (previous year: 51%). The number of shareholders declined year-on-year to 604,000 (previous year: 635,000), but remained high by historical standards. The shareholder structure is updated quarterly and published on the website investor-relations.lufthansagroup.com/en/investor-relations.html. The notifications on voting rights received by the Company from shareholders and published during 2023 are also available there.

Lufthansa share is included in the MDAX and other important indices

The Lufthansa share is part of the MDAX. At year-end, the share had an index weighting of 5.6%. With market capitalisation of EUR 8.2bn, adjusted for the free float, the Lufthansa Group came in at number 36 (previous year: 38) in the ranking of DAX companies (including the DAX 40) published by Deutsche Börse at year-end. The average daily XETRA trading volume of the share in 2023 was 4,587,438 shares (previous year: 7,564,664).

| T008 | THE LUFTHANSA SHARE: DATA | |

|---|---|---|

| ISIN International Security Identification Number | DE0008232125 | |

| Security identification number | 823212 | |

| German stock exchange code | LHA | |

| Stock market listing | Frankfurt | |

| Prime sector | Transport & Logistics | |

| Industry | Airlines | |

| Indices (selection) | MDAX, EURO STOXX, STOXX Global, EURO STOXX Travel & Leisure, Bloomberg EMEA Airlines Index, DAX 50 ESG, MSCI EMU ESG, Vanguard ESG INTL STOCK ETF, STOXX Sustainabilty, EURO STOXX Sustainability, FTSE4Good Europe |

|

The Lufthansa share is also included in many classic international share indices. It is also represented in several sustainability indices, such as the MSCI EMU ESG, the EURO STOXX Sustainability Index and the FTSE4Good Europe Index.

American Depositary Receipts (ADRs) offer an alternative to equity investment

In addition to its stock market listing in Germany, investors who are only allowed to invest in securities denominated in US dollars can also gain exposure to the Lufthansa Group via the Sponsored American Depositary Receipt Program (ADR). The programme is managed by Deutsche Bank Trust Company Americas. Lufthansa ADRs are also registered on the standardised trading and information platform OTCQX. At year-end 2023, 10,969,245 ADRs were in circulation (31 December 2022: 12,593,861) Based on the 1:1 ratio to the share, this corresponds to around 1% of the issued capital.

Lufthansa Group pursues intensive dialogue with investors

As in prior years, the Lufthansa Group again provided its shareholders with timely, comprehensive information in the 2023 financial year. In addition to the quarterly conferences, the Executive Board and Investor Relations team held many roadshows and investor conferences to discuss with institutional investors the current developments at the Group and its operating environment in 2023. In addition, the Supervisory Board Chair met investors in the context of a roadshow in early 2023, mainly to discuss corporate governance topics and the Company’s steps to reduce its emissions. In-depth discussions were also held with investors in debt instruments.

In May 2023, the Group met with more than 3,000 shareholders who attended the Annual General Meeting, which was held exclusively online. This was again significantly more than the number of visitors to the in-person Annual General Meetings in the years before the coronavirus pandemic. Questions that shareholders had submitted in advance were answered in writing by shareholder services on the Company website before the Annual General Meeting took place. Any follow-up questions and questions about new matters were answered via video by the Supervisory Board and Executive Board during the event.

All the publications, financial reports, presentations, the quarterly shareholder information letter and the latest news are available at investor-relations.lufthansagroup.com/en/investor-relations.html. The site also contains the financial calendar and the dates of all the conferences and shareholder events that the Lufthansa Group will be attending.