MRO business segment

| T041 | KEY FIGURES MRO | ||||

|---|---|---|---|---|---|

| 2023 | 2022 | Change in % | |||

| Revenue | €m | 6,547 | 5,550 | 18 | |

| of which with companies of the Lufthansa Group |

€m | 2,158 | 1,546 | 40 | |

| Operating income | €m | 7,028 | 5,951 | 18 | |

| Operating expenses | €m | 6,383 | 5,383 | 19 | |

| Adjusted EBITDA1) | €m | 785 | 732 | 7 | |

| Adjusted EBIT1) | €m | 628 | 554 | 13 | |

| EBIT1) | €m | 628 | 498 | 26 | |

| Adjusted EBIT margin1) | % | 9.6 | 10.0 | -0.4 pts | |

| Adjusted ROCE1) | % | 12.0 | 11.4 | 0.6 pts | |

| Segment capital expenditure | €m | 137 | 99 | 38 | |

| Employees as of 31 Dec | number | 22,870 | 20,411 | 12 | |

| Average number of employees | number | 21,925 | 20,116 | 9 | |

| Fully consolidated companies | number | 25 | 25 | – | |

| 1) The results of equity investments of the associated company “Ameco” are reported under Additional Businesses and Group Functions due to the change in responsibility in Group management; the previous year's figures have been adjusted accordingly. | |||||

Business activities

Lufthansa Technik is the world’s leading MRO provider

Lufthansa Technik is the world’s leading manufacturer-independent provider of maintenance, repair and overhaul services (MRO) for civilian commercial aircraft. The Lufthansa Technik group comprises 30 plants offering technical aviation services worldwide. The company also holds direct and indirect stakes in 64 companies. Lufthansa Technik AG serves more than 800 customers worldwide, including OEMs, aircraft leasing companies, operators of VIP jets, governments and armed forces, as well as airlines. Around one third of its business comes from entities in the Lufthansa Group and two thirds from clients outside the Lufthansa Group.

Course of business and operating performance

New record result thanks to high demand for MRO services and improved competitiveness

Lufthansa Technik again reported an exceptionally positive performance in the reporting year. Strong demand for flights led to rising demand for maintenance and repair services, as well as other products from Lufthansa Technik, which in turn had a positive impact on revenue and earnings. Lufthansa Technik set a new earnings record for the year despite tight supply chains, increasing material and staff costs and the slight decline in the US dollar. The measures taken during the coronavirus pandemic to improve competitiveness paid off. The RISE programme was largely responsible for the changes, which included a wide-ranging reorganisation of the company, and came to an end after three years. RISE aimed to ensure that Lufthansa Technik becomes more customer-focused, transparent, leaner and faster.

Lufthansa Technik launches Ambition 2030 growth programme

The Executive Board of the Lufthansa Group decided in late November 2023 not to pursue its plans for the sale of a non-controlling stake in Lufthansa Technik.

Instead, Lufthansa Technik launched an ambitious programme of growth called Ambition 2030, to build on its leading global position in the technical servicing of aircraft fleets even without taking another shareholder on board. The company is expecting demand for MRO services to remain high, especially for engines. In addition to the rising number of older engines in flight operations worldwide, this is due to the greater maintenance intensity of the new engine developments.

The Ambition 2030 programme entails wide-ranging capital expenditure to expand the core business, additional bases and a greater international presence, potentially also by means of acquisitions, as well as the expansion of digital business models.

Focus on recruiting new professionals

High demand for qualified professionals continued in the reporting year in both operating and administrative areas. Lufthansa Technik is responding to this need with various national and international recruiting activities. The company is also trying new approaches. The Senior Experts programme started in the reporting year and explicitly addresses people of retirement age who have previously worked at Lufthansa Technik or other companies, and would like to continue contributing their expertise after their regular career comes to an end.

To meet the high demand for qualified staff, Lufthansa Technik is also training people with a technical background or from manual trades, and has invested in a training centre in Hamburg for this purpose. The Women@LHT programme is intended to strengthen diversity in the working environment and attract more women to Lufthansa Technik. Many apprentices are also given permanent employment contracts when they finish their training. More than 220 junior staff started work at the German sites alone in the reporting year.

AeroSHARK surface technology reduces carbonemissions

Lufthansa Technik wants to use technology to make flying more sustainable in future. The AeroSHARK technology developed jointly with BASF imitates the characteristics of sharkskin, which is particularly hydrodynamic, thereby optimising the aerodynamics of relevant areas of the aircraft, meaning it uses less fuel. The roll-out of the sharkskin technology at the launch customers Lufthansa Cargo and SWISS began in the reporting year. Since then, 15 Boeing 777 and B777F aircraft have been fitted with AeroSHARK.

Research into sustainable drive systems continues

The Hydrogen Aviation Lab, Hamburg’s new functional laboratory for the testing of maintenance and ground processes for future hydrogen-powered aircraft, started to take shape. A former Lufthansa Airlines Airbus A320 will be converted alongside joint project partners into a field laboratory which will enable early research into the safe use of a potential energy source for future aviation to be carried out under realistic conditions. The gradual integration and operation of the necessary components began in the fourth quarter of 2023.

Many new contracts secure future business

Lufthansa Technik AG serviced some 4,600 aircraft under long-term component contracts at the end of financial year 2023 (8% more than the previous year). In the course of the year, 27 new customers were acquired and 1,000 new contracts with a volume of EUR 8.0bn signed, of which EUR 3.1bn was with companies in the Lufthansa Group.

They included new long-term contracts for strategic component supplies with several airlines. Hawaiian Airlines signed its first component supply agreement with Lufthansa Technik for its Airbus A330ceo and A321neo fleets. Altogether, the agreement covers the supply of spare parts for up to 52 aircraft in the next seven years. With this new agreement, Lufthansa Technik has expanded its market share in MRO services for Airbus aircraft in the USA.

Lufthansa Technik also extended its partnership with Emirates for the Airbus A380, of which the Dubai-based carrier is by far the largest operator. Under the contract, Lufthansa will overhaul the main undercarriages of the Emirates A380 aircraft. Other contracts are for aircraft overhaul services. A further 23 Emirates A380s will be overhauled at Lufthansa Technik Philippines in Manila until October 2026.

Lufthansa Technik demonstrated its leading role in engine maintenance with its first overhaul of a LEAP-1B engine that powers the Boeing 737 MAX. As the first independent MRO provider worldwide, Lufthansa Technik signed a service agreement for the two engines LEAP-1A (Airbus A320neo) and LEAP-1B (Boeing 737 MAX), thereby securing its access to the fleets of the future.

Digitalisation is progressing

Lufthansa Technik is playing a key role in the digital transformation of technical aircraft operations with its Digital Tech Ops ecosystem. It consists of AVIATAR as a platform for data-based analytics solutions, flydocs as a digital records and asset solution, and the maintenance and engineering/MRO software AMOS from global leader Swiss Aviation Software AG. At the end of the reporting year, the data from around 3,300 aircraft (23% more than the previous year) were already connected to the AVIATAR platform.

Digitalisation is also advancing in the company with the Digitize the Core initiative. The aim is to use digital technologies to make business processes and workflows more efficient.

Lufthansa Industry Solutions, an IT advisory and system integration business, part of Lufthansa Technik, reported record revenue in the reporting year. The company develops innovative solutions for more than 300 customers from the aviation, industry, logistics and transport sectors. It particularly expanded its services for AI, process mining and sustainability management in financial year 2023. This included developing the ESG tool EPACTO for measuring and analysing carbon emissions.

Defence business expanded

Alongside traditional MRO services and digital services for civil and commercial aircraft operators, Lufthansa Technik is driving the expansion of its new defence business. The company will be contributing its competences to servicing the new F-35 fighter jets at Deutsche Luftwaffe, the German Air Force. Lufthansa Technik is one of the companies responsible here for servicing and maintenance.

In addition, Lufthansa Technik is a key partner for project Pegasus, the German Air Force’s reconnaissance aircraft. A contract was signed in 2023 opening the way to servicing the new maritime reconnaissance and patrol aircraft. The company is also a partner in Boeing’s industry team for servicing the new Chinook heavy transport helicopter operated by the German Air Force. Lufthansa Technik has serviced the aircraft of the German Special Air Mission Wing for more than 60 years. In the reporting year, Lufthansa Technik delivered the Theodor Heuss, the third new government Airbus A350 aircraft.

Financial performance

Revenue up on previous year by 18%

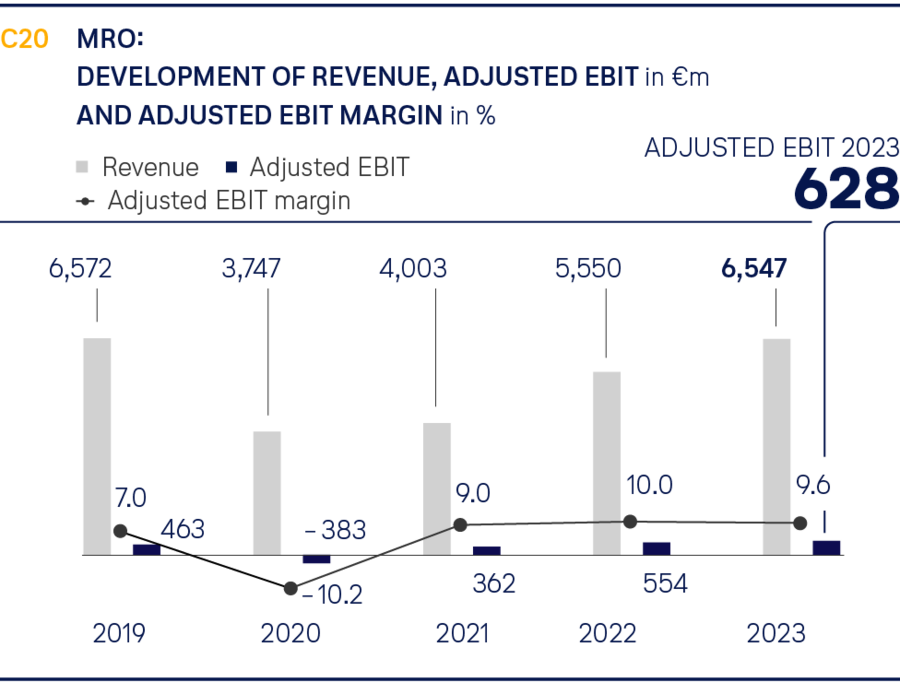

Revenue in the MRO segment climbed by 18% in financial year 2023 to EUR 6,547m (previous year: EUR 5,550m). Lufthansa Technik benefited from increased demand for maintenance and repair services due to the rising number of flights.

Both external revenue and revenue from within the Group increased year-on-year. Performance was driven by the MRO units Engine Services and Aircraft Component Services in particular. Operating income increased by 18% to EUR 7,028m (previous year: EUR 5,951m).

Expenses up on previous year by 19%

Operating expenses increased in the reporting year by 19% to EUR 6,383m (previous year: EUR 5,383m).

The cost of materials and services rose by 25% to EUR 3,844m due to higher volumes and prices (previous year: EUR 3,066m). This was the result of the positive commercial performance, which led to an increase in material consumption and higher external services.

Staff costs of EUR 1,559m were 13% higher than in the previous year (previous year: EUR 1,379m), primarily due to the higher average number of employees, as well as to payscale and salary increases.

Depreciation and amortisation went down by 12% to EUR 157m (previous year: EUR 178m).

| T042 | OPERATING EXPENSES MRO | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Cost of materials and services | 3,844 | 3,066 | 25 | |

| of which other raw materials, consumables and supplies |

2,188 | 1,806 | 21 | |

| of which external services |

1,656 | 1,260 | 31 | |

| Staff costs1) | 1,559 | 1,379 | 13 | |

| Depreciation and amortisation2) | 157 | 178 | -12 | |

| Other operating expenses3) | 823 | 760 | 8 | |

| Total operating expenses |

6,383 | 5,383 | 19 | |

| 1) Without past service expenses/plan settlement 2) Without impairment loss 3) Without book losses. |

||||

Adjusted EBIT reached a new record of EUR 628m.

Adjusted EBIT improved in the reporting year by 13% to EUR 628m (previous year: EUR 554m), which was a new record. The Adjusted EBIT margin decreased by 0.4 percentage points to 9.6% (previous year: 10.0%).

EBIT also came to EUR 628m (previous year: EUR 498m). The previous year’s figure was reduced by impairment losses following the closure of the business in Russia.

Segment capital expenditure up by 38%

Segment capital expenditure in the MRO segment went up by 38% to EUR 137m (previous year: EUR 99m). Investments were mainly made in intangible assets and property, plant and equipment.

Number of employees up by 12%

The number of employees at the end of the year compared with the previous year went up by 12% to 22,870 (previous year: 20,411). The increase is due to recruitment as a result of higher business volumes.