About this combined non-financial declaration

The combined non-financial declaration illustrates material aspects and corporate responsibility issues

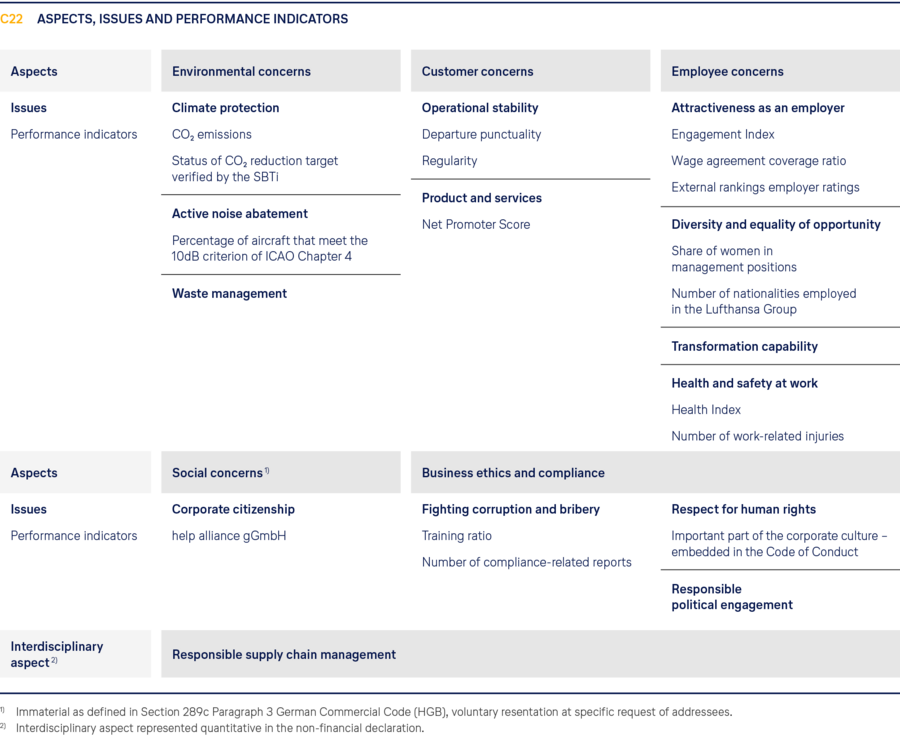

For the 2023 financial year, Deutsche Lufthansa AG has published a combined non-financial declaration in accordance with Sections 315b and 315c of the German Commercial Code (HGB) in conjunction with Sections 289b to 289e HGB. Deutsche Lufthansa AG publishes a non-financial declaration at Company level and a non-financial Group declaration together as a combined non-financial declaration. This combines material aspects and reporting on the following key issues: environmental concerns, customer concerns, employee concerns, social concerns, business ethics and compliance, including anti-corruption and bribery as well as respect for human rights and sustainability in the supply chain.

In addition, measures and initiatives taken by the Lufthansa Group that demonstrate the Company’s wide-ranging commitment to corporate responsibility are described in the combined management report. References to these passages are made in this declaration. The Company’s impact on non-financial aspects is taken into account in the Group risk management system of the Lufthansa Group. Taking into account the measures and concepts described and using the net method, there are currently no indications of risks that would have a severe negative impact on these material aspects and that are highly likely to occur. ↗ Opportunities and risk report

Unless otherwise stated, the disclosures made here relate to the group of consolidated companies referred to in the consolidated financial statements. The disclosures reflect the perspective of both the Group and Deutsche Lufthansa AG, unless otherwise indicated.

This combined non-financial declaration was subject to a voluntary limited assurance engagement in accordance with ISAE 3000 (revised). The materiality analysis process formed part of this voluntary limited assurance engagement. However, it does not cover the reference to the GRI Standards which exceeds what is required by law. ↗ Independent auditor’s report on a limited assurance engagement regarding the combined non-financial declaration.

References to disclosures outside the combined management report are additional information and do not form part of the combined non-financial declaration.

The Lufthansa Group reports in accordance with the compulsory EU Taxonomy Regulation and voluntarily in accordance with TCFD and SASB and with reference to the GRI Standards

In accordance with the EU Taxonomy Regulation (2020/852) and supplementary delegated acts, the Lufthansa Group makes compulsory disclosures on whether and to what extent the activities of the Company are related to economic activities that are classified as taxonomy-eligible and taxonomy-aligned within the meaning of the EU Taxonomy.

↗ Applicability and disclosures required by the EU Taxonomy Regulation (EU) 2020/852

In 2023, the Lufthansa Group also published further information on its website for the 2022 financial year in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) initiated by the Financial Stability Board as well as the Sustainability Accounting Standards Board (SASB). The findings of a qualitative and quantitative climate scenario analysis of the transitory climate risks and opportunities were published in the TFCD report for the 2022 financial year. In the 2023 reporting year, the Lufthansa Group began to expand its climate scenario analysis to include potential physical risks and opportunities. It is envisaged that the findings will be presented in the TCFD report for the 2023 financial year and published on the Lufthansa Group’s websites in April 2024.

The combined non-financial declaration reports with reference to the GRI Standards. ↗ T200 GRI Index.

Disclosures on the business model

The Lufthansa Group is a global aviation group with a total of 241 fully consolidated subsidiaries. The Lufthansa Group’s business model is described in detail in the combined management report. ↗ Principles of the Group

Values and guidelines

Sustainability is firmly established within the Company

Responsible conduct in compliance with legislation is a key element of the Lufthansa Group’s corporate culture and is firmly embedded in the Group strategy. This is reflected in the vision statement of the Lufthansa Group: “Connecting people, cultures and economies in a sustainable way”. Since 2002, the Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance. In addition, it supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015. In order to contribute towards achieving the SDGs, the Company has identified ten SDGs in line with its material aspects where it can reduce its negative impact and increase its positive effect due to its business model.

An overview of the goals and comments on Lufthansa Group activities to support them can be found in ↗ T201 Sustainable Development Goals.

The Code of Conduct, which has been binding for all bodies, managers and employees of the Lufthansa Group since 2017 and was extensively updated in 2023, is supplemented by a Supplier Code of Conduct. In this Supplier Code of Conduct, the Lufthansa Group lays out its position that it also expects business partners and suppliers to adhere to the principles therein as a fundamental aspect of the business relationship. The standards at its core are not only the basis for responsible conduct and fair competition, but also seek to identify legal and reputational risks at an early stage and to avoid them. The Lufthansa Group has published the Code of Conduct and the Supplier Code of Conduct on its website.

Value-based management is also an integral element of sustainable corporate governance for the Lufthansa Group. Sustainability considerations are increasingly helping to ensure financial resilience. The financial strategy of the Lufthansa Group seeks to increase its Company value in a sustainable manner. It focuses on the three dimensions of increasing value creation, generating free cash flows and maintaining financial stability. The concept and the associated performance indicators are described in detail in the chapter ↗ Financial strategy and value-based management. Variable management remuneration is also linked to non-financial factors such as specific CO₂ emissions. ↗ Remuneration report

Material aspects

Materiality analysis forms basis for determining material aspects

Continuous dialogue with stakeholders plays an important role in refining the sustainability strategy of the Lufthansa Group. The Lufthansa Group implements an annual analysis process in order to identify and validate its key sustainability topics. In the reporting year, the Lufthansa Group conducted a wide-ranging survey aimed at learning more about its stakeholders’ view of the relevance of sustainability topics for the Lufthansa Group. In addition, this survey asked about potential effects of business activities on the human and natural environment as well as risks and opportunities for the Company. Over 10,000 representatives of all the Lufthansa Group’s external stakeholder groups, all employees and managers were invited to take part in the anonymous survey. The findings provided a major contribution to the materiality analysis, which was likewise conducted in 2023.

The topics identified were analysed in line with the materiality method under the German Act Transposing the CSR Directive (CSR-RUG) with regard to their relevance for business and the impact of the Lufthansa Group’s business activities. As a result the topics which are material for the Lufthansa Group have not changed. Environmental concerns, customer concerns and employee concerns especially continue to be of particular importance. Furthermore, the aspects of business ethics and compliance, including the fight against corruption and bribery as well as respect for human rights and responsible supply chain management, are of great relevance to the Lufthansa Group. The Lufthansa Group provides additional, voluntary reporting on its social responsibility.

The results of the materiality analysis were noted and approved by the management in the reporting year. They form the basis for selecting the aspects and circumstances described in this combined non-financial declaration.

Organisational foundations and responsibilities

Corporate responsibility is firmly established in the organisational structure

The highest monitoring body in the area of sustainable management is the Supervisory Board. Effective 1 January 2023, the Supervisory Board established an ESG Committee to advise the Supervisory Board, its committees and the Executive Board on environmental, social and governance issues that are essential to the sustainable economic development of the Company.

The Executive Board member in charge of the Lufthansa Group’s Brand & Sustainability function is responsible for the Company’s environmental, climate and social impact at Executive Board level. The Corporate Responsibility department reports directly to the Executive Board member for Brand & Sustainability and is primarily responsible for ESG strategy, ESG reporting and ratings, customer concerns and ESG communication in cooperation with the respective departments of the Lufthansa Group. In addition, the management of help alliance, the Lufthansa Group’s aid organisation, reports functionally to the Corporate Responsibility department.

The ESG strategy is reviewed annually and discussed with the Executive Board as part of the Strategic Roadmap Discussions. In the reporting year, the focus was on the Lufthansa Group’s carbon transition pathway and supporting measures, such as its Sustainable Aviation Fuel (SAF) strategy and in-flight and ground-based efficiency measures. In addition, the details of the more stringent reporting requirements from the 2024 financial year onwards resulting from the required transposition of the Corporate Sustainability Reporting Directive (CSRD) were presented, together with their significance for the Lufthansa Group.

The Group Executive Board meetings determined the focus and further development of sustainability-related activities within the Lufthansa Group in the reporting year. These meetings are prepared in part by the Group Executive Committee (GEC), which is chaired by the Chairman of the Executive Board. The GEC is a committee at senior management level and consists of the Executive Board of Deutsche Lufthansa AG, the CEOs of the segment parent companies and the main Passenger Airlines and the heads of the Lufthansa Group’s Strategy and Communications departments. The Group Policy Committee (GPC), chaired by the Chairman of the Executive Board, discusses politically significant issues, including those relevant to sustainability, and prepares decisions. Individual managers within the committees are responsible for implementing concrete activities and projects. The Sustainability Circle, led by the Corporate Responsibility department, promotes a Group-wide dialogue on sustainability topics. The members of this circle are the Corporate Responsibility Officers of the Group companies and relevant Group Functions.

External ratings

The Lufthansa Group’s sustainability management is rated positively, above the industry average

The Lufthansa Group’s commitment to climate protection with its focus on CO₂ management was awarded a climate score of “A–” for the reporting year 2022 (previous year: “A-”) by the international non-profit rating organisation CDP in February 2024. This means the Lufthansa Group again received the second-highest score category, confirming its rating from the previous year. The comprehensive, verified and transparent disclosure of Scope 1,2 and 3 CO2 emissions, as well as measures to reduce emissions and low emission products along with the disclosure of risks and opportunities, each received an “A” score. The full report is available on the CDP and the Lufthansa Group website.

The Lufthansa Group has been included in the FTSE4Good Index Series (FTSE4Good Europe Index, FTSE4Good Developed Index) since its launch in 2001. This inclusion was most recently reviewed in June 2023. The FTSE4Good is a sustainability and corporate governance index family created by the London-based provider FTSE Russell. Companies that are particularly committed in the area of corporate social responsibility (CSR) are included in this index. The Lufthansa Group is above the industry average in the “Airlines and Customer Services” category and achieved the highest possible score for “Climate Change” and “Corporate Governance”.

In the MSCI rating, the Lufthansa Group maintained its “AA” classification in the 2023 financial year, thus retaining its leading position in the aviation sector.

The Lufthansa Group received a score of 28.3 from rating agency Sustainalytics in June 2023. As in the previous year, this means that it was classified as “medium risk” due to its high CO₂ relevance. It ranked 24th out of 72 in the “Airlines” sub-category. Sustainalytics rates the management of the Lufthansa Group as strong in terms of the main ESG aspects.

In November 2023, the Lufthansa Group was awarded a score of 47 in the comprehensive S&P Global Corporate Sustainability Assessment 2023, which represents an improvement of 13 points on the previous year. A maximum score of 100 points was achieved in areas such as assurance of sustainability reporting, CEO remuneration – success metrics, management of climate risks, codes of conduct and the Company’s workplace health and safety programme. With this result, the Lufthansa Group has placed above the average score for 30 of the 61 companies rated in its Airlines peer group.

In June 2023, the rating agency VE (Moody’s ESG Solutions) rated the Lufthansa Group’s ESG management above the industry average in all three ESG categories. In terms of its overall rating, the Lufthansa Group has improved on its previous rating (44 points) and has now scored 47 points.

In August 2023, ISS ESG rated the Lufthansa Group as “Prime C+”. The Group (along with two other airlines) thus continues to rank among the industry leaders of the 49 companies rated by ISS ESG in this sector.

The sustainability commitment of the Lufthansa Group regularly undergoes a voluntary external evaluation by the sustainability rating platform EcoVadis. In November 2022, the Lufthansa Group’s commitment was reconfirmed for a further year when it received “Silver Status”, once again rating better than comparable companies. The Lufthansa Group is due to be re-evaluated by June 2024.