Financial position

Impact of the sale of divisions on the financial position

The Lufthansa Group sold the Catering activities of the LSG group as of 31 October 2023. The Company also signed a contract in financial year 2023 for the sale of Lufthansa AirPlus Servicekarten GmbH.

The assets and liabilities of the Catering segment were reclassified as held for sale as of 31 March 2023.

They were derecognised when the sale closed on 31 October 2023.

Due to the importance of these business activities as an operating segment, they are shown separately in the income statement as a discontinued operation.

Following the decision to sell, and under the rules of IFRS 5, all AirPlus assets and liabilities from the respective individual items of the statement of financial position were reclassified to the items “Assets held for sale” and “Liabilities in connection with assets held for sale” from 30 June 2023.

The consolidated cash flow statement includes both continuing and discontinued operations. The Catering activities are therefore included in the consolidated cash flow statement until 31 October 2023 and the AirPlus activities for the entire reporting period.

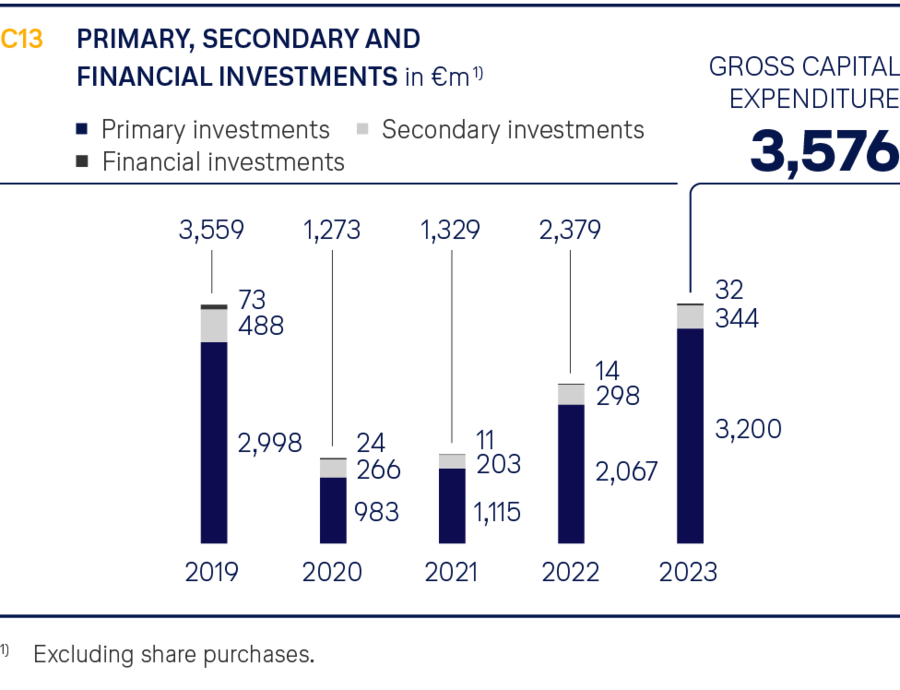

Capital expenditure

Investment volume up on previous year

Compared with the previous year, the Lufthansa Group’s gross capital expenditure (excluding the purchase of shares) in financial year 2023 increased by 50% to EUR 3,576m (previous year: EUR 2,379m).

Primary investment in down payments and final payments for aircraft, aircraft components, and aircraft and engine overhauls were up by 55% to EUR 3,200m (previous year:EUR 2,067m). This accounts for 89% of total capital expenditure. EUR 1,536m was attributable to advance payments for future deliveries, particularly for long-haul aircraft (previous year: EUR 821m).

Capital expenditure for other items of property, plant and equipment and for intangible assets, known collectively as secondary investment, increased by 15% to EUR 344m (previous year: EUR 298m). Property, plant and equipment, such as technical equipment and machinery, and operating and office equipment accounted for EUR 238m of the total (previous year: EUR 217m). EUR 106m (previous year: EUR 81m) was invested in intangible assets such as licences and software.

Financial investments (excluding share purchases) with a total volume of EUR 32m (previous year: EUR 14m) mainly comprised cash outflows from loans to join-ventures.

Passenger Airlines accounted for the bulk of capital expenditure with EUR 3,095m (+52% year-on-year). ↗ Fleet Capital expenditure of EUR 191m (-25% year-on-year) in the Logistics segment consisted mainly of advance payments for cargo aircraft. Capital expenditure of EUR 137m in the MRO business segment (+38%) was mainly for technical operating equipment.

Outflows for additional repairable spare parts increased by 254% to EUR 506m (previous year: EUR 143m) due to the net increase in inventories of materials in the MRO segment for the increased business activity.

Aircraft delivered in financial year 2023 or the previous year and advance payments were sold to external lessors and leased back for periods of either six or

twelve years in financial year 2023 in the course of sale-and-lease-back transactions for twelve passenger aircraft and the transfer of a purchase contract to the lessor of one cargo aircraft. This resulted in inflows of EUR 690m.

Including payments for replacement parts for aircraft, proceeds from the sale of assets (aircraft especially) and dividend and interest income, the Lufthansa Group’s net capital expenditure came to EUR 2,811m (previous year: EUR 2,286m).

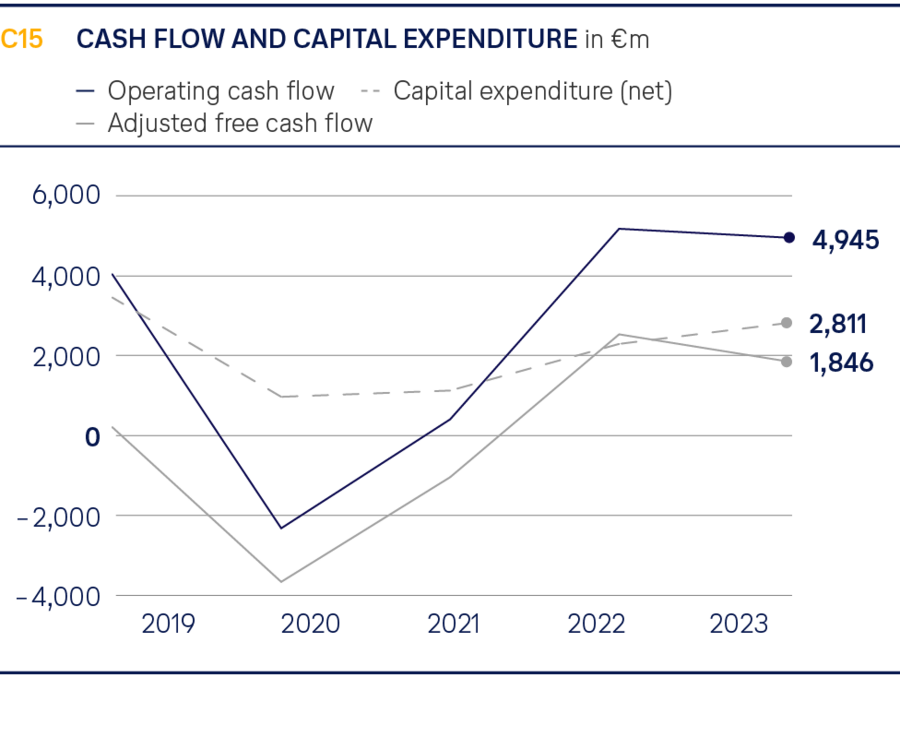

Cash flow

Cash flow from operating activities came to EUR 4,945m.

The cash flow from operating activities at the Lufthansa Group in financial year 2023 was 4% lower than the previousyear at EUR 4,945m (previous year: EUR 5,168m). The decline is largely due to the lower inflow from changes in working capital compared to the previous year (EUR 278m, previous year: EUR 1,694m), which more than offset the increase in EBITDA. In the previous year, the inflow from changes in working capital was exceptionally high due to the strongincrease in business activity and the resulting steep increase in advance payments for fares.

Inflows from the change in working capital were related to higher liabilities from unused flight documents and liabilities under customer loyalty programmes (in particular Miles & More). They increased in the reporting year by EUR 198m (previous year: EUR 1,514m). Whereas receivables and contract assets, mainly in the AirPlus and MRO businesses went up by EUR 258m, liabilities and contract obligations increased by EUR 552m. Inventories, particularly of technical consumables, were up by EUR 200m. All items relate to the changes in balance sheet figures from both continuing operations and the business held for sale.

EUR 662m of the operating cash flow related to payments to former employees on the basis of pension obligations (previous year: EUR 748m). In addition, allocations were made to pension plans in the amount of EUR 472m (previous year: EUR 394m), while investment income from plan assets of EUR 630m (previous year: EUR 970m) was used in connection with pension payments. Cash flowing into or out of the plan assets was also reported in cash flow from operating activities, resulting in a net cash outflow of EUR 505m in connection with pensions (previous year: net outflow of EUR 172m).

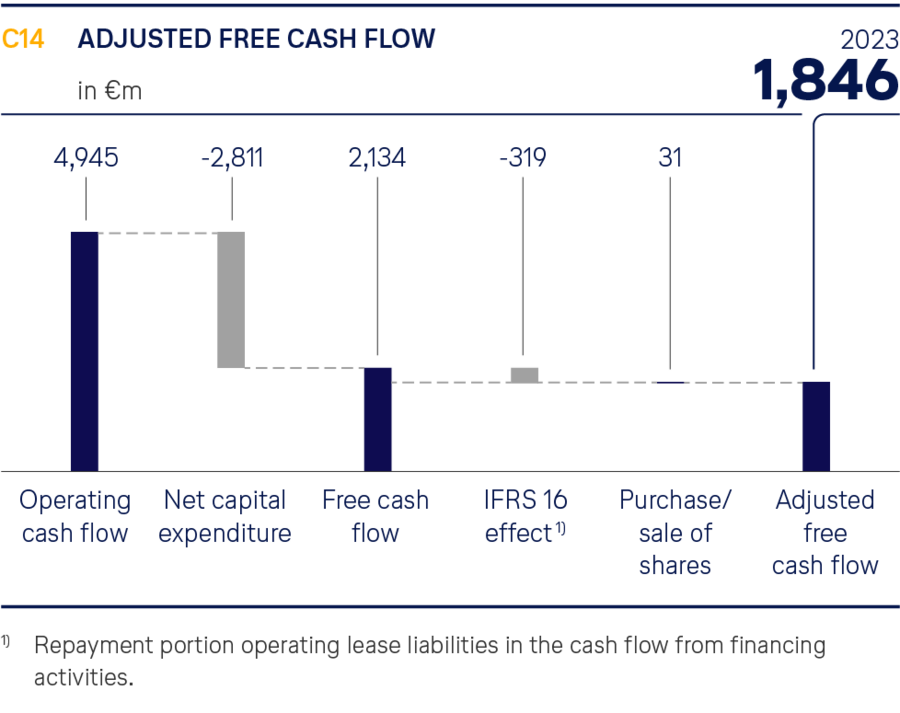

Adjusted free cash flow comes to EUR 1,846m

Gross capital expenditure (without share purchases) by the Lufthansa Group came to EUR 3,576m in the reporting year (previous year: EUR 2,379m) and includes the primary, secondary and financial investments mentioned above. This was offset by the increase in repairable spare parts for aircraft of EUR 506m (previous year: increase of EUR 143m). Expenditures of EUR 33m were made for share purchases (previous year: EUR 46m).

Income from the disposal of non-current assets and assets held for sale of EUR 1,031m (previous year: EUR 175m) mainly related to the sale of a total of 18 aircraft. Interest and dividend income went up by 155% to EUR 273m (previous year: EUR 107m), primarily due to higher interest income as a result of higher interest rates. This brought total net cash used for investing activities to EUR 2,811m, which was 23% above the previous year’s figure (previous year: EUR 2,286m).

After deducting this net cash used for investing activities, free cash flow for the 2023 financial year was positive at EUR 2,134m (previous year: EUR 2,882m).

Adjusted free cash flow decreased by 27% to EUR 1,846m (previous year: EUR 2,526m). It includes cash outflows for leases (repayment portion) as shown in cash flow for financing activities. These came to EUR 319m in the reporting year (previous year: EUR 381m). Not included in this figure are cash flows from the purchase or sale of shares in companies, which amounted to a net figure of EUR -31m in the reporting year (previous year: EUR -25m).

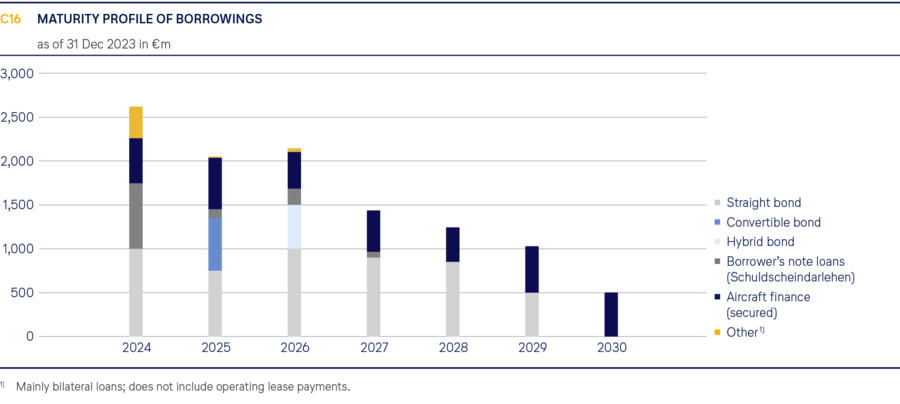

Financing

Financing activities result in cash outflow of EUR 2,072m

Financing activities in financial year 2023 led to a net cash outflow of EUR 2,072m (previous year: outflow of EUR 2,266m).

This resulted from the repayment of financial liabilities amounting to EUR 1,767m. The liabilities settled consisted mainly of aircraft financing and leasing (EUR 970m), a euro bond (EUR 600m) and two borrower’s note loans (EUR 110m).

Interest and dividend payments came to EUR 534m (previous year: EUR 387m).

On the other hand, the cash inflow from new financing measures on the capital market amounted to EUR 230m. This was primarily attributable to asset-backed security (ABS) financing at AirPlus of EUR 153m and aircraft financing of EUR 53m.

Furthermore, the Lufthansa Group has bilateral credit lines with banks.

At the end of the 2023 financial year, the revolving credit line amounting to EUR 2.0bn was available. On 31 December 2023, unused credit lines totalled EUR 2,097m (31 December 2022: EUR 2,119m).

Liquidity

Total available liquidity of EUR 10.4bn

Balance-sheet liquidity (total of cash, current securities and fixed-term deposits) was virtually constant compared with the end of 2022 at EUR 8,265m (31 December 2022: EUR 8,301m). Net repayment of financial debt was offset by positive Adjusted free cash flow of roughly the same amount. EUR 7,709m was available centrally to Deutsche Lufthansa AG at year-end 2023 (31 December 2022: EUR 7,087m).

Including its freely available credit lines at year-end 2023, the Company’s available liquidity thus amounted to EUR 10.4bn (31 December 2022: EUR 10.4bn).

| T024 | ABBREVIATED CASH FLOW STATEMENT OF THE LUFTHANSA GROUP | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Profit/loss before income taxes | 2,055 | 1,050 | 96 | |

| Depreciation and amortisation/reversals | 2,392 | 2,444 | -2 | |

| Net proceeds from disposal of non-current assets | 144 | -30 | ||

| Net interest/result from equity investments | -133 | 420 | -68 | |

| Income tax payments/reimbursements | -92 | -288 | -68 | |

| Significant non-cash-relevant expenses/income | -264 | -524 | – 50 | |

| Change in trade working capital | 278 | 1,694 | -84 | |

| Change in other assets and liabilities | 299 | 402 | -26 | |

| Operating cash flow | 4,945 | 5,168 | -4 | |

| Investments and additions to repairable spare parts and cash outflows for acquisitions of equity investments | -4,115 | -2,568 | -60 | |

| Purchase/disposal of shares/non-current assets | 1,031 | 175 | 489 | |

| Interest income and dividends paid | 273 | 107 | 155 | |

| Net cash from/used in investing activities | -2,811 | -2,286 | -23 | |

| Free cash flow | 2,134 | 2,882 | -26 | |

| Purchase/disposal of securities/fund investments | -170 | -1,155 | 85 | |

| Capital increase | – | – | – | |

| Capital reduction | – | – | – | |

| Transactions through minority interests | -1 | -1 | – | |

| Non-current borrowing and repayment of non-current borrowing | -1,537 | -1,878 | -18 | |

| Dividends | -25 | -8 | -213 | |

| Interest paid | -509 | -379 | -34 | |

| Net cash from/used in financing activities | -2,072 | -2,266 | 9 | |

| Changes due to currency translation differences | -8 | 18 | ||

| Cash and cash equivalents 1 Jan | 1,784 | 2,305 | -23 | |

| Cash and cash equivalents as of 31 Dec | 1,668 | 1,784 | -7 | |