Risks at an individual level

The table below shows the top risks for the Lufthansa Group. It encompasses all quantitative A and B risks, as well as qualitative risks with a rating of at least “substantial” and “high” in the order of their significance. Detailed explanations can be found in the following sections.

| T050 | Top risks Lufthansa Group1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quantitative risks | Significance | Magnitude | Change compared with previous year | |||||||||

| Fuel price movements | critical | extreme | → | |||||||||

| Revenue risks | critical | extreme | → | |||||||||

| Risk of failure to achieve cost savings targets | critical | extreme | → | |||||||||

| Risk from material problems in Pratt & Whitney engines in the Airbus A320neo fleet | Critical | extreme | new | |||||||||

| Cyber and IT risks | critical | high | → | |||||||||

| Crises, wars, political unrest, terrorist attacks or natural disasters | critical | high | → | |||||||||

| Breaches of compliance requirements and data protection regulations | critical | medium | → | |||||||||

| Risks due to irregularities in flight operations (incl. reputation) | substantial | extreme | → | |||||||||

| Exchange rate movements | substantial | extreme | → | |||||||||

| Qualitative risks | ||||||||||||

| Pandemic diseases | critical | medium | ↓ | |||||||||

| Flight operations risks (with information security risks) | critical | low | → | |||||||||

| Regulatory risks resulting from climate change | substantial | extreme | → | |||||||||

| Human resources risks | substantial | extreme | → | |||||||||

| Provider risk2) | substantial | high | → | |||||||||

| Strategic fleet sizing | substantial | high | → | |||||||||

| Increased noise legislation | substantial | high | → | |||||||||

| Risks in the Lufthansa Technik segment3) | critical | extreme | ↑ | |||||||||

| 1) Unlike in 2022, in 2023 the risks “exchange rate losses on pension fund investments”, “counterparty risk” and “digital transformation – entry of new competitors (Lufthansa Technik)” are no longer listed among the top risks, since their significance is no longer rated critical or substantial. 2) The “provider risk" has been reclassified from quantitative to qualitative. 3) Risk measurement at segment level. |

||||||||||||

Macroeconomic risks

Uncertain economic environment

The Lufthansa Group’s forecast for 2024 is based on the expectation that future macroeconomic conditions and sector developments will correspond to the description given in the ↗Forecast. If the global economy performs worse than forecast, this is expected to have a negative effect on the Lufthansa Group’s business.

Risks with potential effects on global economic growth, and thereby for the Lufthansa Group’s sales, primarily arise from the further course of Russia’s war of aggression against Ukraine, the Middle East conflict, a possible global recession, long-term high inflation and the energy transition towards renewable energies with the related government regulation.

Crises, wars, political unrest and natural disasters

The security situation due to Russia’s invasion of Ukraine, the deteriorating, critical security situation in the Middle East and North, West and Sub-Saharan Africa, and the latent risk of terrorist attacks on air traffic and aviation infrastructure in Europe and Germany too, could have concrete effects on business operations and on the safety of the Lufthansa Group’s flight operations, customers and employees.

The Russian war of aggression against Ukraine and the sanctions it has caused, including potential countermeasures, affect the development of the global economy and cause further increases in the prices of important energy sources such as oil and gas, and other resources. A destabilisation of the region and continued tensions between Russia and the member countries of NATO and the EU could also lead to pressures in the medium and long term.

The escalation of the Middle East conflict is a new dimension in the region with effects on the security of the whole world.

Particular challenges include the increase in hate speech and attacks, violent protests and increasing political tension.

Only continuous, proactive risk management by the Lufthansa Group makes it possible to continue ensuring safe flights that reflect the high safety standards of all concerned.

Potential financial losses could result from primary effects, such as not being able to fly to individual destinations, but also from significant secondary effects, including a drop in passenger numbers, higher insurance premiums, additional fuel costs due to airspace closures, higher costs due to a shortage of energy and raw materials or more stringent statutory security requirements.

Any further escalation in the Middle East conflict or Russia’s war of aggression against Ukraine could affect the insurance coverage of airlines worldwide. In particular, there is a risk of insurance coverage being cancelled immediately in the event of direct military action between Russia, USA, China, the United Kingdom and France, and in the event of incidents constituting a casus foederis under Article 5 of the NATO treaty. To address this risk and ensure continuity of flight operations, the Lufthansa Group companies are engaged in discussions with governments and aviation authorities in their respective home markets.

Because of its strong symbolic effect, civil aviation is still a potential target of terrorist attacks. Geopolitical trends also mean there is an increasing risk of sabotage to traffic and other critical infrastructure (KRITIS) by actors commanded or supported by states. Military conflicts between states are a high risk, especially if they take place in the short term and outside clearly defined borders. The threat from air-defence systems, particularly from non-state actors, and increasing military activities mean that flights over crisis areas continue to require comprehensive risk assessment and management. The demands made of the security functions of international companies are rising continuously in view of the political environment and the continuous development of new technology. In this context, particular mention should be given to the greater availability and use of unmanned, and in some cases armed aircraft (drones) and the various challenges they present. Increasing security regulations due to greater threats, as well as a tightening of entry requirements for passengers around the world, could lead to further restrictions in international air traffic and thereby to adverse effects for the air transport industry. In addition to the escalation or acceleration of existing conflicts, there is also growing pressure on internal resources and established conflict resolution mechanisms at the same time.

In order to analyse, track and manage these risks, the Lufthansa Group carries out comprehensive monitoring of the global security situation and current events that may affect the Lufthansa Group. This includes natural events that may make high demands of our employees and the organisation of our flight operations. The Lufthansa Group prepares comprehensive security analyses on an ongoing basis and continuously refines them in order to assess developments in advance so as to draw up preventive scenarios in the event of any disruptions. It can draw on an extensive network of national and international security authorities and specialised security advisers to do so. The necessary security measures depend on the probability and consequences of the event.

To evaluate security-relevant events in the context of the regional environment, the Lufthansa Group uses a quality management system, which helps with the continuous evaluation of local security procedures, both in existing operations and with new destinations. In order to guarantee compliance with national, European and international aviation security legislation and the Lufthansa Group’s own security standards, these sites are inspected regularly in the course of risk audits for aviation security and country risks. If necessary, deficits are compensated for by additional measures that may affect all relevant functional areas. In addition, perceptions of Germany, and of Switzerland, Austria, Belgium or the European Union in certain regions of the world and the profile of the Lufthansa Group compared with other, particularly exposed Western airlines are taken into account when choosing infrastructure and processes abroad.

Pandemic and epidemics

The risk of pandemics and epidemics is rising, partly due to increasing urbanisation, climate change and migration. Epidemics, pandemics or other causes such as bioterrorism could cause high rates of disease in various countries, regions or continents. In the short, medium and long term, this could drastically reduce the number of passengers travelling by air due to a fear of contagion, as was dramatically demonstrated in 2020 by the spread of the coronavirus pandemic. Furthermore, it is possible that staff may not be willing to fly to the countries concerned for fear of infection and that local employees want to leave these countries.

A high prevalence of sickness among employees may put operations at risk. Official travel restrictions to prevent the transmission of pathogens may also result in operational constraints.

The Lufthansa Group permanently reviews information from the World Health Organisation (WHO), the US and European Centres of Disease Control, the Robert Koch Institute in Germany and other institutions in order to identify risks of an epidemic or pandemic as early as possible. Own staff with infectiological and epidemiological training use the different early warning systems for this purpose. Employees receive detailed information, risk groups are given personal protective equipment and preventive vaccination campaigns against influenza are run throughout the Lufthansa Group every year. Passengers receive optimal protection from infection by means of safety measures adapted to the situation and based on the Lufthansa Group’s pandemic planning.

The coronavirus-related health risks to customers and employees of the Lufthansa Group have now declined significantly thanks to increasing immunity within the population. The ongoing evolution of the virus last year did not give any grounds for concern; its evolutionary changes have diminished since the emergence of the omicron variant.

There remains a general risk that new virus variants able to evade our immune system will arise, however. Generally speaking, the greatest risk for future pandemics comes from respiratory diseases caused by the influenza or coronaviruses, for example.

Sector-specific risks

Development of markets and competition

The growth of the aviation sector is highly dependent on the global political situation and correlates with the macroeconomic development. In the past, the airline industry was on a long-term growth path with above-average growth rates, especially in regions such as Asia/Pacific. Ongoing changes in demand in connection with the coronavirus pandemic, the Russian war of aggression against Ukraine and the influence of the climate debate mean that long-term market growth is expected to be lower than in the past. In addition, supply-side bottlenecks such as limited infrastructure and restrictions in supply chains act as further brakes on the development of air traffic. Cost competition, which is already prevalent in many segments of the airline market, will intensify further as a result of the changed market environment.

Revenue risks

The entire Lufthansa Group is exposed to revenue risks, And there is still a high level of uncertainty concerning future market developments. Whereas the risk of another more intense wave of coronavirus infections has declined, the steep rise in inflation, forecast slower economic growth and ongoing geopolitical crises all affect how demand and bookings will develop in future. These trends make it difficult to forecast revenue. In addition to the factors mentioned above, risks can still result from price fluctuations, excess capacities, economic fluctuations, competitive developments, potential changes in customer behaviour for reasons of climate protection, geopolitical influences and unpredictable events with a global impact. They can be addressed in the short term by continuously monitoring bookings and adjusting capacities. Sales, product, and cost-reduction measures can also be taken. In the long term, the intention is to improve unit costs systematically and sustainably by means of continuous efficiency gains.

Risks due to irregularities in flight operations

There are still bottlenecks in the supply of spare parts, engines and aircraft in many areas of the aviation industry. Capacities will remain under pressure in European air traffic, particularly in the summer months when traffic increases, to cope with rising passenger numbers. These bottlenecks represent risks for the airlines and may result in changes to flight timetables, delays and cancellations. This in turn may lead to lost revenue and additional costs for compensating and supporting the passengers affected. Numerous processes are being automated and optimised to minimise these risks and reduce the impact of flight irregularities. In addition, internal capacities are being increased by means of continuous recruitment.

Risks in the MRO segment

Lufthansa Technik is faced with challenging market dynamics in the maintenance, repair and overhaul (MRO) environment. The coronavirus pandemic is increasingly moving into the background and the aviation sector is seeing a significant, steady recovery due to pent-up demand. Demand in the MRO business is back at its pre-crisis level in the Americas and EMEA regions. In some cases, demand exceeds available capacity due to personnel shortages. The Asia-Pacific market is also recovering. Global demand for maintenance and repair services, which is relevant for Lufthansa Technik, is thus increasing significantly in the current phase. However, political crises, wars and high inflation mean that this market trend is not only hard to forecast, but also highly volatile and fragile.

There is an additional risk from maintenance contracts with Lufthansa Technik customers for Pratt & Whitney PW1100G engines. A contaminated metal powder that was used in the manufacture of components with a limited useful life in all the available Pratt & Whitney engine models means that a significant portion of the engines under contract require additional maintenance. For Lufthansa Technik, this could entail the risk that maintenance services contractually agreed with customers cannot be performed in full, and that insufficient compensation for this is obtained from the manufacturer. Lufthansa Technik is working with the customers, the authorities and the manufacturer to improve the situation quickly. Since the Lufthansa Technik group operates the world’s biggest production site for maintaining the PW1100G engine, customers of Lufthansa Technik have the opportunity of being able to use their A320neo fleets in full again soon, despite a global shortage of production capacities.

Company-specific risks

Risk of failure to achieve cost cutting targets

The Lufthansa Group strives to improve its cost base, productivity and efficiency in all business segments. The identified improvement goals are part of the plan for the business segments and are discussed in detail during the planning process. There is a risk that the expected improvements are not achieved in full, or are only achieved later than originally expected. There is also a possibility that insufficient additional potential is identified in the course of the year, resulting in the agreed cost targets not being achieved in full. The steep rise in the inflation rate and the resulting increase in staff and operating costs also creates a risk of countervailing effects that counteract productivity and efficiency gains more than currently expected. Developments in total costs are reviewed regularly with every business entity and by the Executive Board to enable early countermeasures.

Staff

Labour disputes

There is a general risk of labour disputes as a result of pending collective bargaining agreements with various groups of employees within the Lufthansa Group.

A long-term wage agreement was signed in the reporting year with the Vereinigung Cockpit pilots’ union (VC) for the cockpit crew at Deutsche Lufthansa AG and Lufthansa Cargo, covering both pay and working conditions. In view of these wage agreements there is no longer any strike risk. At the flight operations of Eurowings Germany, Lufthansa Cityline and Discover Airlines at least the strike risk is higher, however, since VC’s demands are high and the positions are different. The possibility of these wage disputes spreading to other companies cannot be ruled out either.

The strike risk at SWISS has declined significantly thanks to the wage settlements for the pilots in early 2023 and the new collective agreement for cabin crew in late 2023.

The UFO (Unabhängige Flugbegleiter Organisation e.V.) trade union terminated the collective agreements on wages and part-time work for the flight attendants at Deutsche Lufthansa AG as of year-end 2023. The negotiations that began in December 2023 continued in 2024. However, given the demands on the table, there is a risk of calls for industrial action being made to back up the union demands.

The trade union ver.di (Vereinigte Dienstleistungsgewerkschaft e.V.) terminated the wage agreements of the ground staff covered by collective bargaining agreements of Deutsche Lufthansa AG, Lufthansa Technik and Lufthansa Cargo as of 31 December 2023. The no-strike obligation ceased as of year-end and the strike risk increased significantly. ver.di called two warning strikes of more than 24 hours each in February 2024. The strike risk will remain until a collective agreement is reached.

If the trade unions are successful in their demands, this may result in higher staff costs. Strikes can also lead to reputational damage and tangible economic impacts for the Lufthansa Group.

↗ Employees

Lack of cooperation between works councils and labour unions

Effective, trust-based collaboration with the co-determination partners are a key factor for the Company’s success. Numerous measures will again contribute to this goal in 2024. Market changes made further reorganisation necessary at Deutsche Lufthansa AG and shone a spotlight on the economic performance of the Lufthansa Group and on retaining and recruiting employees in the relevant home markets in 2023, with hiring needs expected to stay high. This means the Group has to be attractive as an employer, which is another focus for 2024. The challenge is to implement organisational changes as quickly as the economic environment and the labour market require, in order to maintain adaptability. A trusting relationship between the Works Council and the Executive Board has a vital influence on decision-making in operating matters, and a lack of trust can result in delayed decisions and more difficult negotiations.

Employee workload

Increased demand for flights in the second half of 2023 brought individual operating areas of the Lufthansa Group to the limits of their capabilities. Short-term secondment of additional administrative staff to operating areas relieved some of the pressure at peak times. Despite this, the strong surge in business put great pressure on staff, which in some cases had an adverse impact on the customer experience that could be provided and on employee satisfaction. In order to boost commitment and become more attractive as an employer, the working conditions for staff were revised in cooperation with the collective bargaining partners. The Lufthansa Group deliberately uses its employer branding and HR marketing activities to support additional hiring, and is making improvements to its recruitment process and certain key elements of its employees’ experience, for example their onboarding. Various apprenticeships, student and trainee programmes are offered to this end, and talents in a variety of groups were supported and systematically networked. Furthermore, an assortment of professional development programmes are offered to enable employees to work on their personal and career development.

Staff structure

Differences between strategic HR requirements, the existing skill sets of employees and how they are distributed across the companies in the Lufthansa Group constitute a structural HR risk. The Lufthansa Group will recruit a large number of new employees in 2024. Both the administration of recruitment activities and the professional integration of new employees pose great challenges for the organisation. There is a risk of frustration at long recruitment processes and inefficient onboarding. The Lufthansa Group addresses this risk across the Group with a recruitment task force, strategic HR planning, the development of a skills model and by strengthening employer branding and recruitment.

Supplier risks

The economic effects of the current geopolitical situation and disruptions in supply chains also affect suppliers to the Lufthansa Group. Factors such as the energy crisis, a lack of raw materials and staff shortages or the insolvency of an important supplier mean there is a risk of disruptions in the supply of goods and services, which in turn jeopardise business continuity. Another risk is that of significant price increases.

Purchasing at the Lufthansa Group regularly identifies providers that are critical for business continuity and assesses the relevant risk. In order to address the risk of interruptions to supplies or a price increase in time or to mitigate it, there is a regular process of dialogue with relevant suppliers. Suitable instruments are also used, such as changing the terms of payment, reviewing contracts regularly and implementing a system to visualise and manage the risks of any supply chain disruption.

Risk from material problems in Pratt & Whitney engines in the Airbus A320neo fleet

The Lufthansa Group is increasingly confronted with risks resulting from problems with the materials in components of Pratt & Whitney PW1000G engines. The effects extend to the Airbus A320neo and Airbus A220 fleets at the Lufthansa Group. This problem entails the risk of operating interruptions, a shortage of spare parts and higher maintenance costs for the airlines in the Lufthansa Group that use these engines. The Lufthansa Group is responding to this challenge by monitoring the affected engines more closely and adjusting the operating and maintenance strategies. This includes regularly assessing the risks related to these engines and close consultations with Pratt & Whitney and other relevant suppliers. The aim is to ensure the availability of spare parts and to minimise potential interruptions to operations. The Lufthansa Group is also negotiating with the manufacturer Pratt & Whitney regarding appropriate compensation for the ensuing costs.

Risks from strategic fleet sizing

The strategic sizing of the Group fleet determines the available capacity and therefore also a large part of the fixed costs and future capital expenditure. Due to the demand, competition and cost risks mentioned above, as well as potential delivery delays for new aircraft, there is a risk that the size of the fleet does not develop as planned, resulting in a decline in earnings.

As part of the annual strategy and planning process, the Lufthansa Group regularly reviews the planned fleet development over the next ten years and takes decisions on the allocation of aircraft to the various airlines in the Group and capacity for the next four years.

Fleet planning is also reviewed and adjusted during the year as needed. The fleet may be reduced through the sale and parking of aircraft. Similarly, aircraft orders may be cancelled or delivery postponed in negotiations with aircraft manufacturers, and lease agreements may be terminated. If deliveries are delayed it is possible to postpone planned retirements and take out additional leases at short notice.

Flight operations risks

The airlines in the Lufthansa Group are exposed to potential flight and technical operating risks. One of these is the risk of not being able to carry out regular flight operations for technical or external reasons. Another risk is the risk of an accident, with the possibility of personal injuries and damage to property. This is divided into environmental factors (for example, weather or bird strike), technical factors (such as engine failure), organisational factors (for instance, contradictory instructions) and the human factor.

The companies in the Lufthansa Group search for these dangers systematically and in a forward-looking manner in order to manage the resulting risk by means of suitable countermeasures and to increase the level of flight safety further. For example, every single flight made by an airline in the Lufthansa Group is routinely analysed using the parameters recorded in the flight recorder (black box) in order to identify any peculiarities at an early stage and to act on them, such as in the context of training courses. Other sources of information, for example, accidents and hazardous situations around the world that come to light, are also analysed and the results integrated into prevention measures, such as training courses, where relevant. The safety management systems are continuously improved and refined.

The sustained implementation of uniform flight safety standards across the entire Lufthansa Group is also supported by further progress on harmonising the IT environment in the course of safety management. Ongoing dialogue between the airlines in the Lufthansa Group provides an opportunity to consolidate information gained in an operational setting and factor it into the development of the corresponding standards. A standardised platform for the analysis of flight data relevant to flight safety is currently being implemented.

Risks in connection with information security in flight operations are also taken into account. This concerns the IT systems on board and on the ground that are relevant to a flight event and the associated data exchange processes; it applies both to the Lufthansa Group’s own systems and processes and to supplier processes and products.

Cyber and IT risks

Cyber risks are all risks to which computer and information networks, ground and in-flight IT infrastructure as well as all IT-enabled commercial and production processes are exposed as a result of sabotage, espionage or other criminal acts. If established security measures fail, the Lufthansa Group may suffer reputational damage and be obliged to make payment on the basis of contractual and statutory claims by customers, contract partners and public authorities. A loss of income is also conceivable if operating systems should fail.

The business processes in the Lufthansa Group are supported by IT components in virtually all areas. The use of IT inevitably entails risks for the stability of business processes and for the availability, confidentiality and integrity of information and data, and such risks ultimately cannot be fully eliminated.

The number of worldwide cyberattacks continues to increase and they are becoming more professional. This is borne out by the Group’s experience of security incidents and by information from other companies and public agencies. At the same time, the digitalisation of business processes in the Lufthansa Group is increasing, meaning that the potential effects of cyberattacks and the corresponding risk potential may also continue to escalate.

The Lufthansa Group monitors the IT security situation across the Group, the industry, and worldwide on an ongoing basis. On this basis, the Lufthansa Group takes various measures to strengthen its IT security. Technological tools are continuously refined to prevent and respond quickly to cyberattacks, processes have been adapted to changing risk scenarios and the new hybrid working practices, and awareness training is carried out regularly. Measures have been implemented in various core areas across the Group as part of the cybersecurity programme adopted by the Executive Board and are being rolled out to strengthen cyber resilience within the Lufthansa Group. This also includes the mitigation of new risks arising from the digitalisation of aircraft. In line with the current risk assessment, measures are defined that also include partners and providers of the Lufthansa Group when they are implemented in the IT systems and processes. The results from the programme are already showing a positive contribution to reducing risks. The Lufthansa Group also monitors its own cybersecurity performance, that of the individual subsidiaries and key providers using an external, neutral cybersecurity rating. This makes it possible to compare the Group’s security level with that of other industry participants and sectors.

IT risk and IT security processes are organised across segments. The status of IT risks and IT security is compiled annually, consolidated at Group level and discussed by the Risk Management Committee of the Lufthansa Group. The Lufthansa Group’s information security management system (ISMS) for core processes (including passenger check-in, frequent flyer programme, Logistics, MRO and IT) is certified in accordance with ISO 27001. The risk and security management systems and selected other measures are also reviewed regularly by the Internal Audit department.

The Lufthansa Group sources most of its IT infrastructure from external service providers. The operational and commercial risks involved in this kind of outsourcing by nature are assessed and managed on a continuous basis.

Risks of breaching data protection regulations

Protecting the privacy of its customers, employees, shareholders and suppliers is an important and self-evident concern for the Lufthansa Group. With a view to meeting the requirements of the General Data Protection Regulation (GDPR), all Group companies within the scope of the GDPR have put in place appropriate governance structures and processes in accordance with the requirements of the Group’s Executive Board, based on recommendations from the Group’s data protection unit to identify and manage potential risks from breaches of the extensive legal requirements. Customers regularly exercise their rights to access and erasure of data. Risks arising from international regulations are also taken into account.

Compliance risks

Compliance refers to the observance of legally binding requirements, and is intended to ensure that the Company, its executive bodies and its employees act in accordance with the law. The effectiveness of the compliance programme is therefore vital to the Lufthansa Group. https://investor-relations.lufthansagroup.com/en/corporate-governance.html

The Lufthansa Group is active in many countries and is therefore subject to various legal norms and jurisdictions with different legal frameworks, including for criminal law on corruption. In addition, all activities not only have to be judged against local criminal law, the laws applicable in the sales area and the local cultural customs and social conventions, but also against extraterritorial regulations such as the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. Any infringements are investigated rigorously; they may result in criminal prosecution for the individuals involved and could expose the companies in the Lufthansa Group to hefty penalties or fines. There would also be significant reputational damage and the Company would be put at a distinct disadvantage when competing for public tenders. The Lufthansa Group has put processes in place that are intended to identify specific compliance risks and, in particular, to prevent corruption.

The Lufthansa Group is also exposed to risks arising from competition and antitrust law. They stem, in particular, from the fact that the Lufthansa Group also operates in highly oligopolistic markets, has a strong position in some markets, cooperates with competitors in alliances, and that legal parameters may change. In some business units in the Lufthansa Group the same individuals are employees of suppliers and competitors as well as customers. The Lufthansa Group’s Competition Compliance function addresses the risks of collusive behaviour and provides executive bodies and employees with extensive training.

The Lufthansa Group, in particular Deutsche Lufthansa AG as a publicly listed company, is also exposed to risks from capital market compliance. The EU Market Abuse Regulation (MAR) and many other national and European regulations have codified bans on insider trading and market manipulation, the obligation to make ad hoc announcements as well as other obligations relating to capital markets. These regulations are directly applicable in Germany. However, in some cases, it is still difficult to predict and to put into practice the interpretation of these new European rules, particularly concerning ad hoc announcements and administrative practices. The Lufthansa Group takes many organisational precautions to comply with the provisions of the MAR. The Group uses special software to compile insider lists, for instance, and to publish any ad hoc announcements, and it has the corresponding policies, information letters and process descriptions at hand. The Corporate Compliance Office also conducts online training courses for those groups of employees specifically affected by the laws applicable to insider trading and market abuse. Matters relating to the law on ad hoc announcements are also discussed with the Ad Hoc Committee in consultation with external experts.

Despite the existence of a compliance management system and its risk-mitigating activities, individual breaches and related investigations by public authorities and penalties cannot be ruled out completely, particularly in the fields of integrity, competition and capital market compliance.

Litigation, administrative proceedings and arbitration

The Lufthansa Group is exposed to risks from legal, administrative and arbitration proceedings in which it is currently involved or which may take place in the future. Due to the adverse effect this may have on the proceedings and in accordance with DRS 20 No. 154, the risks have not been quantified. It cannot be ruled out that the outcome of these proceedings may cause significant damage to the business of the Lufthansa Group or to its net assets, financial and earnings position. Appropriate provisions have been made for any financial losses that may be incurred as a result of legal disputes. More information on provisions for litigation risks and contingent liabilities can be found in ↗ Notes 36 and 46 to the consolidated financial statements.

Furthermore, the Lufthansa Group has taken out liability insurance for an amount that the management considers appropriate and reasonable for the industry in order to defend itself against unjustified private third-party claims and to settle such claims it considers justified. Even in such cases, however, this insurance cover does not protect the Lufthansa Group against possible damage to its reputation. Such legal disputes and proceedings may also give rise to expenses in excess of the insured amount, expenses not covered by the insurance or those which exceed any provisions previously recognised. Finally – and depending on the type and extent of future losses – it cannot be guaranteed that the Lufthansa Group will continue to obtain adequate insurance cover on commercially acceptable terms in the future.

Ryanair has appealed to the European Court of Justice against the decision by the European Commission approving stabilisation measures for companies in the Lufthansa Group. Stabilisation measures of around EUR 7.6bn in total are affected for Deutsche Lufthansa AG, Austrian Airlines AG and Brussels Airlines SA/NV. The lawsuits relating to the state aid for Austrian Airlines AG and Brussels Airlines SA/NV have since been dismissed in the first instance. However, Ryanair has lodged an appeal against this decision with the European Court of Justice in the Austrian Airlines AG case. The appeal period is still running in the Brussels Airlines SA/NV case following the ruling in their favour in October 2023. In May 2023, the European General Court upheld the action for annulment with regard to the stabilisation measure in the amount of EUR 6bn granted to Deutsche Lufthansa AG by the Economic Stabilisation Fund (ESF) of the Federal Republic of Germany and annulled the corresponding state aid decision of the European Commission on the grounds of substantive errors of law. Until a final judgement is made or a new state aid decision is issued, uncertainty remains as to the legal consequences of the annulment of the decision to grant state aid. There is no immediate repayment risk as the stabilisation measures have already been completed and Deutsche Lufthansa AG has already repaid the silent participations from the ESF in full. Potential indirect consequences include the demand for clawback interest for the period between the allocation and the repayment of the stabilisation funds, as well as the imposition of conditions attached to a new state aid decision. Deutsche Lufthansa AG appealed to the European Court of Justice against the ruling of the court of first instance. As of the date of this report, it is not yet clear whether the European Commission and the Federal Republic of Germany will intervene in the appeal. Nor is it known how the further proceedings at the European Commission in its response to the judgement of the European General Court will pan out. Deutsche Lufthansa AG expects the European Commission to initiate a formal examination procedure, as it has done in similar cases.

The Lufthansa Group is subject to tax legislation in many countries. Changes in tax laws and case law, as well as different interpretations as part of tax audits/external wage tax audits can result in risks and opportunities affecting tax expenses, income, claims and liabilities. The Corporate Taxation department identifies, evaluates and monitors tax risks and opportunities systematically and at the earliest stage possible, and initiates steps to mitigate the risks as necessary.

Regulatory risks

Political decisions at national and European level continue to have a strong influence on the international aviation sector. This is particularly the case when countries or supranational organisations unilaterally intervene in the competition within a submarket, for example, by way of regional or national taxes, emissions trading, fees and charges, restrictions or subsidies. The Lufthansa Group campaigns actively to influence these developments in the appropriate boards and forums and in cooperation with other companies and industry associations.

Regulatory risks in connection with climate change

The European Commission published a package of legislation entitled “Fit for 55” in July 2021, which is intended to reduce carbon emissions by 55% compared with 1990. Air transport is particularly affected by the revision of the Emissions Trading System (ETS), the proposal to introduce a quota for blending sustainable aviation fuels (SAF) and the proposal to abolish the mandatory tax exemption and introduce a uniform minimum tax for aviation fuel.

Air traffic within the EU is already part of the EU Emissions Trading System, EU ETS, which has been associated with the Swiss Emissions Trading System since the beginning of 2020. The revision of the ETS will result in higher costs and/or additional conditions, because there are requirements to, for example, reduce the emissions limit, or “cap”, and abolish the existing allocation of free emissions rights. Both will increase the Lufthansa Group’s ETS costs in future financial years. Tightening the ETS severely distorts competition.

The introduction of quotas for blending SAF has also been decided at the European level and in various EU member states. This will not only increase fuel costs for the Lufthansa Group, but result in a further distortion of competition in intercontinental traffic. Airlines from outside Europe with transfer stops near Europe could then continue to use unblended fuel for part of the journey and ignore the quota.

As part of the revision of the Energy Taxation Directive, the European Commission is proposing to abolish the mandatory tax exemption and introduce a minimum tax on aviation fuel, which creates an additional cost risk. Since the proposal is only for a minimum tax, there is also the risk of different tax rates within Europe, which would also create a distortion of competition within Europe.

In future, the regulation will also take into account the “non-CO2 climate impact of aviation”, such as condensation trails and nitrogen emissions. Operational measures may also reduce climate impact. However, research in this area has only just begun. As a result, the focus of regulation will remain on carbon emissions for the time being. In addition to wide-ranging measures to limit carbon emissions, such as the continuous renewal of its fleet, the use of sustainable aircraft fuels and the expansion of voluntary carbon offset options, the Lufthansa Group participates in the public debate – sometimes together with other European airlines, airports and industry associations – and endeavours to prevent any regulations that could distort competition. ↗ Combined non-financial declaration

Increased noise legislation

Stricter noise standards may apply to airlines or airports. They may cause, for example, higher costs for retrofitting aircraft, bans on specific aircraft models, higher charges or higher monitoring expenses. The still outstanding revision of the directive on environmental noise at European level is primarily relevant here. The limits set in the Aircraft Noise Abatement Act were reviewed at the federal level as scheduled in 2017. The Act has not yet been amended. Although the latest results of noise research do not show any significant changes in health risks, the way in which noise is perceived as a nuisance by those affected has changed radically, even when noise levels at airports are stable. Further lobbying is taking place in this area to tighten noise legislation.

In November 2017, the Lufthansa Group, Fraport, Condor, the Board of Airline Representatives in Germany (BARIG) and the government of Hesse came to a voluntary agreement on noise limits at Frankfurt Airport, which have never since been exceeded. The assumption is that as the fleet renewal continues, this limit will not be exceeded in future either, thus allowing for further growth. The agreement does not provide for any interference with operating licences as long as the limits are respected. Introducing a voluntary noise limit in Frankfurt could have an effect on other sites in Germany.

The Lufthansa Group develops coordinated strategies by means of targeted communications in collaboration with trade associations and other industry stakeholders. It is involved in research projects looking at active noise abatement measures and follows research into the effects of noise closely. ↗ Combined non-financial declaration

Financial risks

Financial market developments represent opportunities and risks for the Lufthansa Group. Negative changes in fuel prices, exchange rates and interest rates can result in higher expenses and/or lower income compared with the assumptions used for planning and forecasting.

System of financial risk management for fuel prices, exchange rates and interest rates

Financial and commodity risks are systematically and centrally managed for the entire Group on the basis of internal guidelines. The derivative financial instruments used serve to hedge underlying transactions. Here, the Lufthansa Group works with partners that have at least an investment grade rating equal to Standard & Poor’s “BBB” rating or a similar long-term rating. All hedged items and hedging transactions are tracked in treasury systems so that they can be valued and monitored at any time. The functions of trading, settlement and controlling of financial risk are strictly separated at an organisational level. The executive departments and Financial Risk Controlling ensure compliance with these guidelines. The current hedging policies are also discussed regularly in management bodies across the business areas.

↗ Notes to the consolidated financial statements, Note 46.

Fuel price movements

In the 2023 financial year, the price of crude oil was on average 17% lower than in the previous year. The price difference between crude oil and kerosene, known as the jet crack, remains at a historically high level, even if it has gone down since 2022. Whereas the jet crack was USD 40.41/barrel on average in 2022, it came to USD 29.58/barrel in 2023.

In the reporting year, the Lufthansa Group consumed 8.8 million tonnes of kerosene. At around EUR 7.9bn, fuel expenses constituted a major item of expense for the Lufthansa Group in 2023. Severe fluctuations in fuel prices can have a significant effect on earnings. A change in the year-end fuel price of +10% (-10%) in 2024 would probably increase (reduce) fuel costs for the Lufthansa Group by EUR 547m (EUR -545m) after hedging. This scenario analysis does not assume that ticket prices are altered following changes in fuel prices.

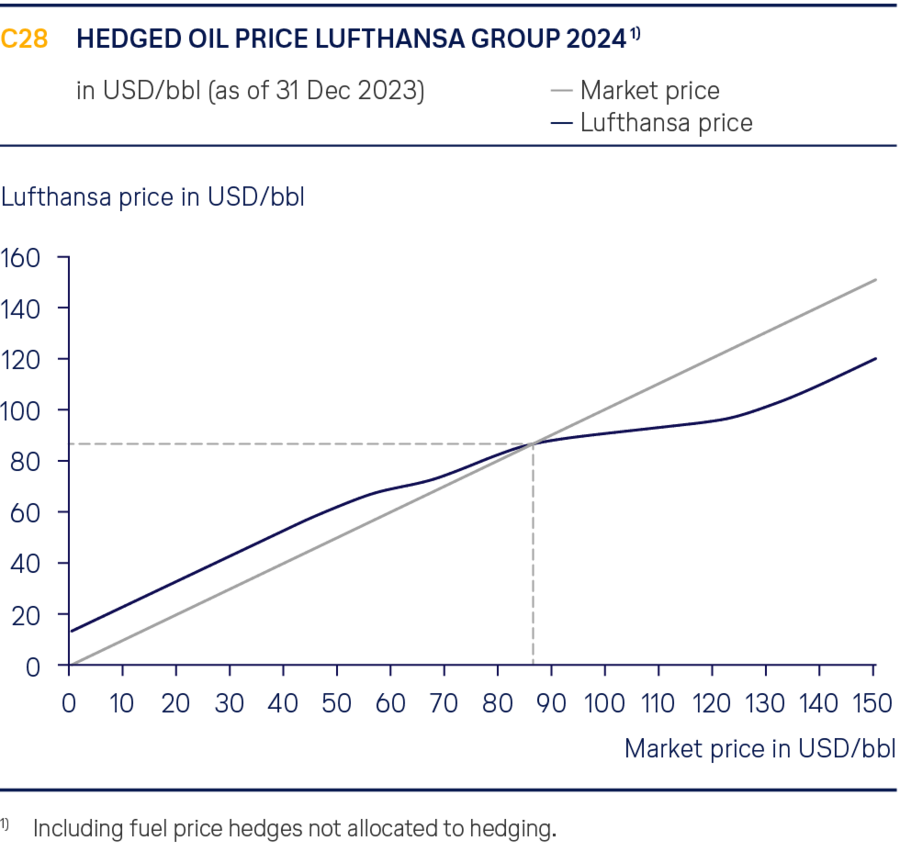

The Lufthansa Group uses rules-based fuel hedging with a time horizon of up to 24 months. The target hedging level for fuel hedging was 85% as of 31 December 2023. The aim is to reduce fluctuations in fuel prices. The Lufthansa Group uses standard financial market instruments in fuel hedging. Hedges are mainly in gas oil, as well as crude oil and with option combinations for reasons of market liquidity. Incomplete protection against higher prices is accepted in exchange for maximising the benefits derived from any fall in prices. The increasing use of gas oil hedges instead of solely crude oil-based hedges addresses the price difference to kerosene to a greater extent than in prior years. At the same time, additional forward hedges were concluded for the price difference between kerosene and crude oil, and between gas oil and crude oil. The instruments used will be settled by payments and will not result in physical deliveries. As of 31 December 2023, there were crude oil, gas oil and kerosene hedges for circa 77% of the forecast Group fuel requirement for 2024 in the form of futures and options. Crack hedges were also taken out for 8% of the fuel requirement, a significantly smaller percentage than in the previous year. Around 28% of the forecast fuel requirement for 2025 was hedged at that time. As fuel is priced in US dollars, fluctuations in the euro/US dollar exchange rate can also have an additional positive or a negative effect on reported fuel prices. US dollar exposure from planned fuel requirements is included in currency hedging.

Exchange rate movements

Foreign exchange risks for the Lufthansa Group arise in particular from international ticket sales and the purchasing of fuel, aircraft and spare parts. All subsidiaries report their planned currency exposure over a timeframe of at least 24 months. At Group level, a net position is aggregated for each currency to take advantage of “natural hedging”. Seventeen foreign currencies are hedged because their exposure is particularly relevant to the Lufthansa Group. The US dollar is the only one of these currencies for which there is a net requirement. 52% of this net requirement for 2024 of USD 5.1bn was hedged as of 31 December 2023. ↗ Notes to the consolidated financial statements, Note 46.