Financial strategy and value-based management

Financial strategy builds on three pillars

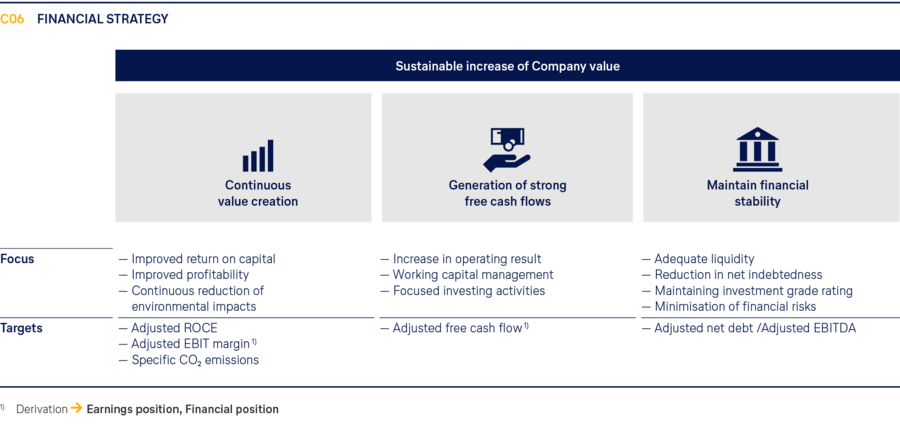

The financial strategy of the Lufthansa Group seeks to increase its Company value in a sustainable manner. Three dimensions form the pillars for this: continuous value creation, generating strong free cash flows and maintaining financial stability. The successful implementation of the financial strategy aims to increase the enterprise value sustainably and further strengthen the Lufthansa Group balance sheet so that the Group can invest in future profitable growth and successfully overcome crises.

Finance Transformation Programme is intended to deliver improvements in the area of finance

The Lufthansa Group initiated a financial transformation programme in 2022 to drive the structural development of the finance function and strengthen it. The aim of the Finance Transformation Programme is to enhance the Company’s commercial performance and competitiveness. The cornerstones of this programme are the review and improvement of financial steering, increased efficiency, the ongoing development of talent and employees as well as the modernisation of the finance IT landscape.

Several measures were implemented successfully in the reporting year. This included driving the necessary preparations for renewing and harmonising the IT systems and establishing attractive training and development courses, especially for financial subjects.

Continuous value creation

Sustainable value creation in the Company

The Lufthansa Group applies a value-based system of management. At its centre is the return on capital. This is measured by the Adjusted Return on Capital Employed (Adjusted ROCE). The capital base is adjusted for the Group’s cash and cash equivalents. If Adjusted ROCE exceeds the weighted average cost of capital (WACC), the Company is creating value. In 2021, the Lufthansa Group set itself the objective of generating an Adjusted ROCE of at least 10% from 2024.

This objective was already reached in the reporting year.

The Company’s profitability is measured by Adjusted EBIT and the Adjusted EBIT margin, i.e. the ratio of Adjusted EBIT to revenue.

The adjustments eliminate non-recurring, non-operating effects and thus improve the presentation of the Company’s operating performance and facilitate comparisons. Matters that justify an adjustment are listed in a catalogue. They comprise write-downs and write-backs, earnings effects from disposals of non-current assets, effects of pension plan changes, restructuring expenses in the form of severance payments, significant costs of legal procedures and company transactions not arising in the normal course of business and other material non-recurring expenses caused directly by extraordinary external factors.

Material matters eliminated for the purpose of Adjusted EBIT measurement in the reporting year were impairment losses on aircraft held for sale, expenses in connection with the purchase and sale of company divisions, expenses from adjustments to pension plans, book losses largely for aircraft and reserve engines, book gains, in particular from sale-and-lease-back transactions and from the disposal of interests in joint ventures. ↗ T021 Reconciliation of results

The Lufthansa Group seeks to achieve a sustainable Adjusted EBIT margin in excess of 8%.

↗ Forecast

Furthermore, the Lufthansa Group incorporates the specific carbon emissions into its management system to lower the associated costs by reducing environmental impacts and to enable sustainable value creation. Progress made in reducing emissions also influences funding terms. Target achievement in this area also forms part of management remuneration.

Information about the long-term goals for reducing carbon emissions can be found in the

↗ Combined non-financial declaration/Climate protection.

The Company’s value creation was significantly positive in the 2023 financial year. In the 2023 financial year, the Adjusted ROCE after tax was 13.1% (previous year: 7.6%), while the WACC was unchanged year on year at 7.2%. Adjusted EBIT came to EUR 2,682m (previous year: EUR 1,520m). The Adjusted EBIT margin was therefore 7.6% (previous year: 4.9%). ↗ Earnings position Specific carbon emissions per passenger-kilometre were 88.4 grammes in 2023, 1.8% lower than in the previous year (previous year: 90.0 grammes).

↗ Combined non-financial declaration/Climate protection

Restructuring programme completed, Efficiency programme initiated for airlines

The Lufthansa Group completed its Group-wide restructuring and transformation programme as planned in financial year 2023. The programme has allowed the Company to align itself with the changes in the market

environment created by the crisis. It included adjustments to cost structures, particularly the reduction of fixed costs. This reflected the lower market volume caused by the coronavirus pandemic and made it possible to return to the earnings level in the period before the pandemic, although available capacity was significantly lower than the pre-crisis level.

Since cost pressure remains high due to high inflation and lower productivity than before the crisis, an efficiency programme is to be launched for the Group airlines in 2024. The intention is to achieve the same level of efficiency as in 2019 by no later than year-end 2025. The focus here is primarily on the efficient use of fleet and crews, which was compromised in the reporting year, partly by bottlenecks at system partners and the significant capacity expansion in response to resurgent demand.

| T009 | CALCULATION OF ADJUSTED ROCE | |||

|---|---|---|---|---|

| in €m | 2023 | 2022 ³ | Change in % | |

| Total revenue | 35,442 | 30,895 | 15 | |

| Changes in inventories, work performed by entity and capitalised and other operating income | 3,140 | 2,534 | 24 | |

| Operating income | 38,582 | 33,429 | 15 | |

| Operating expenses | 36,126 | 32,033 | 13 | |

| Result from equity investments | 213 | 23 | 826 | |

| EBIT | 2,669 | 1,419 | 88 | |

| Adjusted EBIT | 2,682 | 1,520 | 76 | |

| Taxes (fixed rate of assumption 25% of EBIT) | -667 | -355 | -88 | |

| ROCE1) in % | 13.1 | 7.1 | 6.0 pts | |

| Adjusted ROCE2) in % | 13.1 | 7.6 | 5.5 pts | |

| Total assets | 45,321 | 43,335 | 5 | |

| Non-interest bearing liabilities | ||||

| of which liabilities from unused flight documents |

4,981 | 4,898 | 2 | |

| of which trade payables , other current financial liabilities, other current provisions |

6,465 | 6,189 | 4 | |

| of which advance payments, deferred income, other non-financial liabilities |

3,585 | 3,437 | 4 | |

| of which other non-interest bearing liabilities | 5,826 | 5,605 | 4 | |

| of which capital employed for discontinued Catering segment | – | 435 | ||

| of which liquid funds | 8,265 | 8,301 | ||

| Capital employed | 16,199 | 14,470 | 12 | |

| Average capital employed | 15,334 | 14,996 | 2 | |

| WACC in %4) | 7.2 | 7.2 | – | |

| 1) (EBIT – 25% taxes on EBIT) / Average capital employed. 2) (Adjusted EBIT – 25% taxes on Adjusted EBIT) / Average capital employed. 3) Previous year’s figures adjusted due to the disposal of the LSG group. 4) Internal management metric. |

||||

Generation of strong free cash flows

Financial management aims for strong free cash flows

Strong free cash flows must be generated in order to create value for shareholders and further reduce borrowing. In addition to increasing the operating result, the key levers for this are strict working capital management and focused investing activities. The Lufthansa Group strives to generate further significantly positive Adjusted free cash flow in the years ahead. In the 2023 financial year, Adjusted free cash flow benefited in particular from the increased earnings as well as further improvements in working capital management. Adjusted free cash flow of EUR 1,846m (previous year: EUR 2,526m) was achieved as a result although, as expected, there was no repeat of the previous year’s sharp increase in advance bookings, which was connected to the sudden leap in demand after the coronavirus pandemic.

↗ Financial position

Improvements in working capital management support cash flow generation

Working capital management is to be further intensified. This includes targeted measures such as strict receivables management, optimising payment terms with suppliers, improvements to procurement processes and maintenance of inventories, in particular at Lufthansa Technik. Free cash flow also plays a major role for managers’ variable remuneration and in the performance dialogues with the business entities. The organisation is continuously made aware of its influence on Company value and incentives are established to increase the level of free cash flows.

Focused investments to increase return on capital employed

The Lufthansa Group is making extensive investments in the modernisation of its fleet, on-board and ground products as well as in infrastructure in order to ensure profitable long-term growth. In 2024, net capital expenditure should again not exceed the value of the depreciation and amortisation.

Additional aircraft will very largely replace older,

less efficient models. The allocation of new aircraft to the different airlines and bases is constantly optimised according to value-based criteria. Greater use of leasing is intended to increase the level of flexibility for long-term fleet planning and to limit the use of capital. In the medium term, this will take the proportion of leasing above its current level of around 11%. Sale-and-lease-back transactions were completed for this purpose in the reporting year, in which a total of twelve aircraft from the A320neo family were sold to lessors and then leased back.

The Lufthansa Group increased the volume of its investments year-on-year in the reporting period. Compared with the previous year net capital expenditure rose by 23% to EUR 2,811m (previous year: EUR 2,286m). Advance and final payments for aircraft and aircraft components along with aircraft and engine overhauls account for most of this.

↗ G13 Primary, secondary and financial investments

Continuous dividend distribution aimed for

Now that the balance sheet has been successfully strengthened again, shareholders will regularly participate directly in the Company’s success again via an attractive dividend. This is intended to make the Company more attractive on the capital market, including for investors with a long-term investment horizon.

The Lufthansa Group’s dividend policy provides for a distribution to its shareholders of 20% to 40% of net profit,

adjusted for non-recurring gains and losses. One condition for the payment of a dividend is that the net profit for the year as shown in the individual financial statements of Deutsche Lufthansa AG that are drawn up under German commercial law allows for a distribution of the relevant amount.

Executive Board and Supervisory Board propose dividend of EUR 0.30 per share

In line with the dividend policy, the Executive Board and Supervisory Board will table a proposal at the Annual General Meeting on 7 May 2024 to distribute a dividend of EUR 0.30 per share to shareholders for the financial year 2023. This represents a total dividend of EUR 359m or 21% of net profit for 2023.

↗ Earnings position, p. 39.

Maintaining financial stability

Liquidity should be between EUR 8bn and EUR 10bn

The Lufthansa Group has decided to hold liquid funds of between EUR 8bn and EUR 10bn in future to protect against possible crises. For capital efficiency reasons, part of the strategic liquidity reserve is held in the form of a revolving line of credit. This amounted to EUR 2.0bn at year-end 2023, unchanged from the previous year. Including the unused credit line, the liquidity available to the Lufthansa Group totalled EUR 10.4bn at the end of the reporting year, as in the previous year.

↗ Financial position

Lufthansa Group benefits from good capital market access

The Lufthansa Group successfully raised new funds on the capital market again in the 2023 financial year. New borrowing of EUR 230m in total was raised via an asset-backed security (ABS) at AirPlus and through aircraft financing transactions. A large part of the maturing liabilities was repaid by cash flows from operating activities, however. The Group continues to benefit from the extensive refinancing measures implemented at attractive terms, especially in 2021. ↗ Financing

Further reduction of debt as the core goal of the financial strategy

The long-term financial strategy continues to focus on reducing the level of gearing. The generation of strong free cash flows in particular is intended to help reduce the volume of net debt. In addition, the Group has started to change the allocation of pension assets. This is intended to align the sensitivity of plan assets to interest rates more closely with the sensitivity of the pension obligations. In this way, the volatility of pension provisions should be permanently reduced and a repeated significant increase avoided, even if interest rates drop across the market. A corresponding switch initially took place for half the pension assets in 2023; in 2024 the quota is to be increased to the target value of 75%.

At the end of the 2023 financial year, net indebtedness was EUR 5,682m. It was therefore 17% lower than the previous year (previous year: EUR 6,871m) and lower than the pre-crisis level at year-end 2019 (EUR 6,662m). Net pension liabilities rose in the reporting year, due to the lower discount rate used to discount the pension obligations, to EUR 2,676m (previous year: EUR 1,993m). ↗ Assets

Use of diversified finance sources

A mix of different instruments is to be used for future borrowing, above all aircraft financing, bonds and borrower’s note loans. Optimising the funding mix should reduce financing costs, maintain a balanced maturity profile and diversify the Lufthansa Group’s portfolio of creditors. In principle, newly raised funds should be subject to fixed interest rates. The volume of floating-rate liabilities should not exceed the volume of funds invested at a floating interest rate. Net debt is thus subject to a fixed interest rate and market-wide interest-rate changes do not have any material impact on the Group’s interest burden.

↗ G16 Maturity profile of borrowings47.

Retaining the investment grade rating

Deutsche Lufthansa AG is again receiving an investment grade rating from all the leading rating agencies. During the coronavirus pandemic the rating agencies, with the exception of Scope Ratings, downgraded the Company.

The global rating agency Fitch rated the credit risk of Deutsche Lufthansa AG for the first time in November 2023, giving it an investment grade rating of BBB-, outlook stable.

Since December 2023 Standard & Poor’s has also given Deutsche Lufthansa AG an investment grade rating of BBB- again, outlook stable.

The rating agency Moody’s likewise raised its rating for Deutsche Lufthansa AG to Baa3, which is also investment grade, in mid-January 2024, with a stable outlook.

| T010 | DEVELOPMENT OF RATINGS | |||||

|---|---|---|---|---|---|---|

| Rating/outlook | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Standard & Poor’s | BBB-/ stable |

BB/ positive |

BB-/ stable |

BB-/ negative |

BBB/ stable |

|

| Moody’s | Ba1/ stable |

Ba2/ stable |

Ba2/ negative |

Ba2/ negative |

Baa3/ stable |

|

| Scope Ratings | BBB-/ positive |

BBB-/ stable |

BBB-/ negative |

BBB-/ negative |

BBB/ stable |

|

| Fitch Ratings | BBB-/ stable |

|||||

The Group strives to be rated as investment grade on a lasting basis. Investment grade ratings for the Company’s debt ensure good access to the capital markets and low funding costs and thus financial flexibility. Conditions for an investment grade rating are good profitability and low debt, among other things.

The Group’s gearing, measured by the ratio of Adjusted net debt to Adjusted EBITDA, should be limited to a figure of less than 3.5 on a long-term basis; no lower limit has been set. With Adjusted net debt, the ratio takes into account both net indebtedness (including the financial obligations arising from lease agreements, primarily for property and aircraft) and the net pension obligations.

At the end of 2023, the ratio of Adjusted net debt/Adjusted EBITDA was 1.7 (previous year: 2.3).

| T011 | ADJUSTED NET DEBT / ADJUSTED EBITDA | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Net indebtedness 1) | 5,435 | 6,624 | -18 | |

| Net pension obligations | 2,676 | 1,993 | 34 | |

| Adjusted net debt | 8,111 | 8,617 | -6 | |

| Adjusted EBIT | 2,682 | 1,520 | 76 | |

| Depreciation, amortisation and impairment | 2,228 | 2,199 | 1 | |

| Adjusted EBITDA | 4,910 | 3,719 | 32 | |

| Adjusted Net Debt/ Adjusted EBITDA |

1.7x | 2.3x | -28 | |

| 1) In order to calculate net indebtedness, here 50% of the hybrid bond issued in 2015 (EUR 247m) has been discounted. Calculation of net debt ↗ Financial position. |

||||

Structured risk management minimises finance risks

The Group’s financial stability is also ensured by means of integrated risk management. Hedging fuel, exchange rate and interest rate risks minimises the short-term financial risks for the Lufthansa Group. The hedges smooth price fluctuations by means of rule-based processes. Changes in fuel costs can therefore be taken into account in pricing at an early stage. ↗ Opportunities and risk report, Notes to the consolidated financial statements, Note 46