Sector outlook

Passenger traffic expected to exceed pre-crisis level in 2024

The International Air Transport Association (IATA) predicts that global passenger traffic – measured by global revenue passenger-kilometres – will grow year-on-year by 10% in 2024 (previous year: growth of 38%). This would put passenger traffic 5% above its pre-crisis level in 2019.

In its forecast for 2024, IATA expects significant regional differences in growth. The highest growth of 13% is expected for the Asia/Pacific region, followed by Europe at 10%. Growth of 7% is predicted for Africa and Latin America, respectively, and of 6% for North America and the Middle East, respectively.

According to the forecasts, the industry is set to

exceed its pre-crisis level again in 2024 for the first time since the coronavirus pandemic. European short-haul traffic almost returned to its pre-crisis level in the reporting year, and financial analysts specialised in the industry are forecasting that long-haul traffic too will continue to grow in 2024. However, industry-wide constraints, such as a shortage of staff at airports, in air traffic control and at airlines, as well as delays in the delivery of new aircraft, are expected to limit growth and support airlines’ pricing power, according to experts.

In addition to ongoing strong demand for leisure travel, business travel is expected to continue its recovery in the 2024 financial year. A full return to the pre-crisis level is not expected, even in the medium term, however. This is due partly to greater use of digital communications tools and to the sometimes tense macroeconomic conditions to which many companies are exposed. Future growth opportunities vary considerably from

region to region. The biggest impetus for growth, both in business travel and in long-haul traffic, is expected to come from a further opening-up in China. An easing of visa conditions there for many Europeans and pent-up demand are seen here as the main drivers, since the country opened up later after the coronavirus pandemic by global standards.

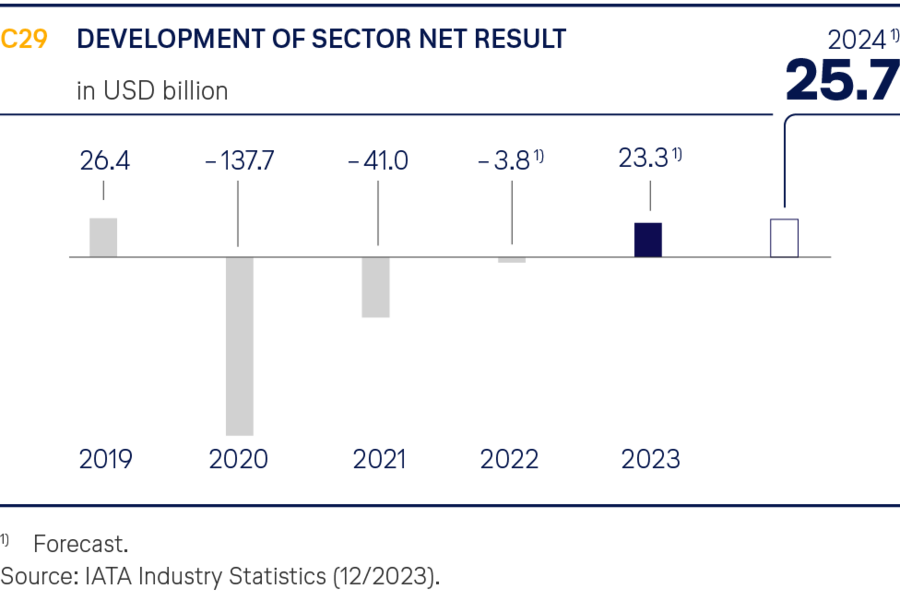

In terms of yields, IATA is expecting a year-on-year increase of 1.8% in 2024 (previous year: 6.2%). The industry is expected to report a net profit of USD 25.7bn (previous year: USD 23.3bn).

Airfreight set to increase again in 2024

Global airfreight traffic reached record highs in 2020 and 2021 due to global supply chain problems and a shortage of maritime transport capacities. Transport volumes declined in 2022 and 2023, but global revenue cargo tonne-kilometres are expected to rise again by 5% in 2024 (previous year: decline of 4%).

Yields in the cargo business are nevertheless forecast to decline by 20.9% in 2024 (previous year: 32.2%). This would still mean that yields are around 12% higher than before the crisis, however.

Further recovery expected in MRO market

The aviation industry is in a period of transition from conventional aircraft models to new, more efficient technologies. However, supply chain problems are preventing the leading aircraft manufacturers from reaching their original plans for production rates.

The new engine technologies (like the Pratt & Whitney PW1100 engine and the LEAP family of engines from CFMI) also have to be retrofitted with upgrades and modifications at the request of the authorities.

The consequence is that new engines have to be integrated into the still emergent repair networks earlier than expected. At the same time, demand remains high for maintenance services for existing engine models, because the airlines are forced to use them for longer.

The consultancy firm ICF predicts average growth for the MRO market of 7% in 2024 compared with the previous year. Growth rates in the individual regions are roughly even, with 8% for the Americas and APAC (Asia/Pacific) and 6% for EMEA (Europe, Middle East and Africa). However, this growth can still be affected massively by external influences such as geopolitical factors, inflation or supply chain instability.