Earnings position

Impact of LSG group sale on earnings position

Due to the sale of the LSG group to AURELIUS, all the income and expenses associated with the discontinued Catering business have been separated from the respective items in the income statement and presented as a combined item under earnings after taxes in the line item “Profit/loss from discontinued operations” immediately above the “Net profit/loss” line item. This item also includes valuation adjustments made in connection with the measurement in accordance with IFRS 5, as well as the results of the disposal. The figures for the previous year have been adjusted accordingly.

Revenue and income

| T020 | REVENUE AND INCOME | |||

|---|---|---|---|---|

| 2023 | 2022 1) | Change | ||

| in €m | in €m | in % | ||

| Traffic revenue | 29,926 | 25,864 | 16 | |

| Other revenue | 5,516 | 5,031 | 10 | |

| Total revenue | 35,442 | 30,895 | 15 | |

| Changes in inventories and other own work capitalised | 727 | 354 | 105 | |

| Other operating income2) | 2,260 | 2,019 | 12 | |

| Total operating income | 38,429 | 33,268 | 16 | |

| 1) Previous year’s figures adjusted due to sale of LSG group. 2) Without fixed asset write-ups and book gains. |

||||

Traffic increased, traffic revenue up by 16%

Driven by the continued recovery in demand for flights, the Lufthansa Group’s operating performance improved significantly over the course of the 2023 financial year.

Traffic in the Passenger Airlines segment of the Lufthansa Group rose significantly over the course of the reporting year. Capacity (available seat-kilometres) was expanded during 2023. In the first quarter, it was 75% of the pre-crisis level in 2019. It then increased to 83% in the second quarter, 88% in the third quarter and 89% of the pre-crisis level in the fourth quarter. Over the reporting year as a whole, capacity was 84% of the pre-crisis level (previous year: 72%).

Capacity was increased by 16% on the previous year, and the number of flights increased by 15%. Sales (revenue seat-kilometres) grew by 20%. The airlines in the Lufthansa Group carried around 123 million passengers in total in the 2023 financial year, 20% more than in the previous year. The passenger load factor was up by 3.1 percentage points to 82.9%. Traffic revenue in the passenger business picked up by 29% to EUR 26,701m (previous year: EUR 20,705m).

The Lufthansa Group’s cargo business declined in the reporting period as the entire sector returned to normal. Capacity (available cargo tonne-kilometres) was 9% higher than the previous year due to the increase in belly capacities resulting from greater demand for passenger flights. Sales (revenue cargo tonne-kilometres) increased by 2%. The cargo load factor declined by 3.9 percentage points to 56.4%. Traffic revenue in the cargo business went down by 37% to EUR 3,225m, mainly as a result of lower average yields (previous year: EUR 5,159m).

Overall traffic revenue for Lufthansa Group airlines increased in the reporting year by 16% to EUR 29,926m year-on-year (previous year: EUR 25,864m).

Further information on the regional breakdown of traffic revenue for the Passenger Airlines and Logistics segments can be found in the chapters.

↗ Business segments.

Other revenue up by 10%

Other revenue improved by 10% year-on-year to EUR 5,516m (previous year: EUR 5,031m). This was mainly due to the increase in external business activities and the associated higher revenues in the MRO and AirPlus business segments.

Revenue up by 15%

Revenue, which consists of traffic revenue plus other revenue, increased by 15% in the 2023 financial year to EUR 35,442m (previous year: EUR 30,895m).

Further information on regional distribution of revenue can be found in the ↗Notes, Notes to the segment reporting.

Changes in inventory and work performed by entity and capitalised went up by 105% to EUR 727m due to the higher volume of major maintenance events relating to engines (previous year: EUR 354m).

Due in particular to higher payments for compensation received for damages, other operating income improved by 12% to EUR 2,260m (previous year: EUR 2,019m).

Total operating income thus increased by 16% in the 2023 financial year to EUR 38,429m (previous year: EUR 33,268m).

Expenses

Cost of materials and services up by 14% due to increased business activities and inflation-related cost increases

The cost of materials and services for the Lufthansa Group in the 2023 financial year was 14% higher than in the previous year at EUR 20,363m (previous year: EUR 17,930m). The increase was driven by additional business activities and cost inflation.

Within the cost of materials and services, fuel expenses increased by 4% to EUR 7,931m (previous year: EUR 7,601m). This change is based on higher consumption, whereas prices for crude oil and jet crack (the price difference between crude oil and kerosene) declined year on year.

The result of price hedging was EUR -172m (previous year: EUR 929m). Currency effects also reduced the amount of expenses.

Expenses for other raw materials, consumables and supplies and purchased goods went up by 27% to EUR 2,713m (previous year: EUR 2,142m), particularly in the MRO business segment, due to increased business activity and inflation effects, as well as higher expenses for emissions certificates.

Fees and charges swelled by 20% to EUR 4,487m in the reporting period (previous year: EUR 3,730m), primarily due to business growth and fee increases at airports.

Expenses for external MRO services also went up by 20% to EUR 2,104m (previous year: EUR 1,756m) in connection with increased maintenance requirements.

As passenger business picked up, there was a 28% increase in expenses for in-flight services to EUR 980m (previous year: EUR 768m).

Operating staff costs up by 15%

Operating staff costs of EUR 8,310m in the reporting year were 15% higher than in the previous year (previous year: EUR 7,223m). The increase stems particularly from payscale salary increases as well as the end of short-time work and special crisis-relief schemes that reduced expenses in the previous year.

The 3% increase in the average number of employees also had an effect. Adjusted for the number of employees in the discontinued Catering segment, the increase came to 6%.

| T021 | EXPENSES | ||||

|---|---|---|---|---|---|

| 2023 | 2022 1) | Change | Share of operating expenses |

||

| in €m | in €m | in % | in % | ||

| Cost of materials and services | 20,363 | 17,930 | 14 | 57 | |

| of which fuel | 7,931 | 7,601 | 4 | 22 | |

| of which fees and charges | 4,487 | 3,730 | 20 | 12 | |

| of which external services MRO | 2,104 | 1,756 | 20 | 6 | |

| of which charter expenses | 878 | 855 | 3 | 2 | |

| Staff costs2) | 8,310 | 7,223 | 15 | 23 | |

| Depreciation3) | 2,228 | 2,199 | 1 | 6 | |

| Other operating expenses4) | 5,059 | 4,419 | 14 | 14 | |

| of which staff-related expenses | 935 | 701 | 33 | 3 | |

| of which rental and maintenance expense | 617 | 510 | 21 | 2 | |

| Total operating expenses | 35,960 | 31,771 | 13 | 100 | |

| 1) Previous year’s figures adjusted due to sale of LSG group. 2) Without past service cost / Plan settlement. -> T023. 3) Without impairment loss. -> T023. 4) Without book losses and write-downs on assets held for sale. -> T023. |

|||||

Depreciation and amortisation at same level as in previous year

Depreciation and amortisation amounted to EUR 2,228m in the reporting year and were thus at roughly the same level as in the previous year (previous year: EUR 2,199m). This mainly related to aircraft and reserve engines (EUR 1,764m, previous year: EUR 1,709m).

Other operating expenses up by 14%

Other operating expenses rose by 14% to EUR 5,059m (previous year: EUR 4,419m) in particular due to increased sales and marketing costs and higher travel expenses for crew following the expansion of flight operations. This was partly offset by the decline in foreign currency losses.

Operating expenses up by 13%

Overall, operating expenses for the Lufthansa Group rose by 13% in financial year 2023 to EUR 35,960m (previous year: EUR 31,771m).

Earnings performance

Adjusted EBIT improves to EUR 2.7bn

The operating result from equity investments went up in the reporting year by 826% to EUR 213m (previous year: EUR 23m). This trend is mainly based on the improved earnings from the SunExpress joint venture, which also benefited from a non-recurring tax effect, and from equity investments in the Additional Businesses and Group Functions business segment.

Overall, Adjusted EBIT for the Lufthansa Group improved by 76% in financial year 2023 to EUR 2,682m (previous year: EUR 1,520m). That makes them the third-best earnings in the history of the Lufthansa Group. The Adjusted EBIT margin, i.e. the ratio of Adjusted EBIT to revenue, improved by 2.7 percentage points to 7.6% (previous year: 4.9%).

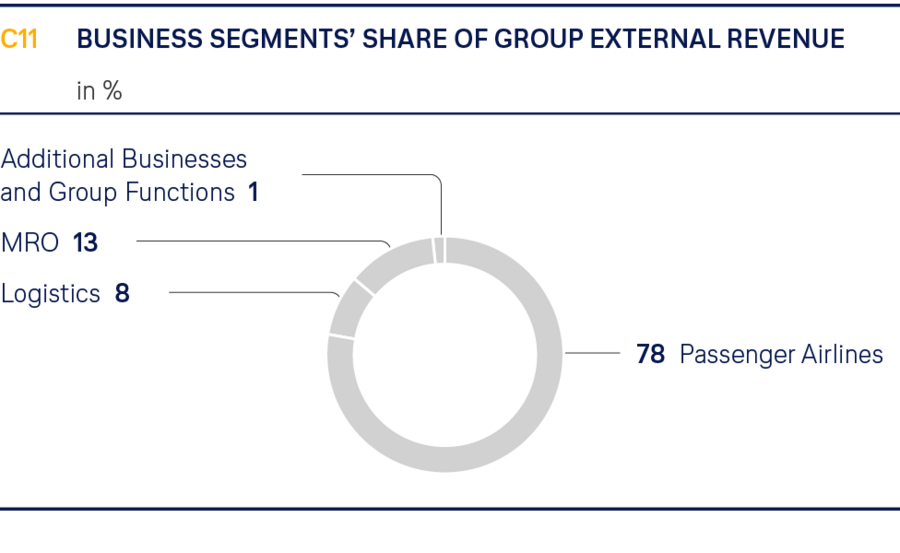

Adjusted EBIT in the Passenger Airlines business segment amounted to EUR 2,033m (previous year: EUR -300m). Adjusted EBIT in the Logistics segment decreased to EUR 219m (previous year: EUR 1,600m). With an Adjusted EBIT of EUR 628m, the MRO segment achieved a record result (previous year: EUR 554m). The other Group companies, which under IFRS 8 do not require separate reporting, and the Group Functions reduced the Group’s Adjusted EBIT by a total of EUR -206m (previous year: EUR -298m).

EBIT of EUR 2.7bn

Based on EBIT, as a key performance indicator Adjusted EBIT is adjusted for clearly defined, non-plannable earnings components for the purpose of better comparability. The adjustments relate to impairment losses and write-backs, earnings effects from the disposal of non-current assets, effects of pension plan changes, restructuring expenses in the form of severance payments, significant costs of legal proceedings and company transactions not arising in the normal course of business and other material non-recurring expenses caused directly by extraordinary external factors.

EBIT amounted to EUR 2,669m in the 2023 financial year (previous year: EUR 1,419m). The difference relative to Adjusted EBIT was therefore EUR -13m (previous year: EUR -101m).

The adjustments mainly consist of impairment losses on aircraft held for sale of EUR 32m, expenses in connection with the purchase and sale of company divisions of EUR 39m and expenses from the adjustment of pension plans of EUR 24m.

Book losses of EUR 33m, mainly on aircraft and reserve engines, were offset by book gains of EUR 134m, in particular from the sale-and-lease-back transactions for twelve Airbus A320/321s and the sale of interests in joint ventures. The adjustments made in the previous year included expenses directly related to the Russian war of aggression against Ukraine, and net income resulting from netting restructuring expenses with the write-back of unused restructuring provisions.

The result from operating activities came to EUR 2,456m in the 2023 financial year (previous year: EUR 1,396m).

Financial result of EUR -139m

The financial result came to EUR -139m in financial year 2023 (previous year: EUR -147m).

The result from equity investments included in this figure was EUR 213m (previous year: EUR 23m).

Net interest also improved to EUR -348m, partly thanks to lower net indebtedness (previous year: EUR -409m). Due to the rise in interest rate levels, higher interest expenses for floating-rate liabilities were more than made up for by higher interest income on short-term investments. The Group’s financing strategy of entering into fixed-rate liabilities in the amount of its net debt thus paid off.

↗ Financial strategy and value-based management

Other financial items came to EUR -4m (previous year: EUR 239m). Positive effects from the measurement of the convertible bond and the strategic liquidity reserve through profit or loss were offset by negative measurement effects of hedging transactions.

In the previous year there were positive effects from the convertible bond measurement and the measurement of strategic interest rate swaps recognised in profit or loss.

Income taxes came to EUR -380m (previous year: EUR -239m). The effective tax rate for continuing operations was 16% (previous year: 23%), primarily due to non-taxable income and tax effects from prior years.

The result from continuing operations therefore came to EUR 1,937m (previous year: EUR 1,010m).

The profit/loss from discontinued operations relates to the sale of the LSG group and amounted to EUR -248m (previous year: EUR -206m). In addition to the segment’s operating earnings after tax (EUR 53m), it included measurement effects (after tax) of EUR -85m and the disposal result of EUR -243m.

This includes currency effects of EUR -178m recognised directly in equity in the past, which were now realised.

After taking minority interests of EUR -16m (previous year: EUR -13m) into account, the net profit for the period attributable to the shareholders of Deutsche Lufthansa AG amounted to EUR 1,673m (previous year: EUR 791m).

Earnings per share came to EUR 1.40 (previous year: EUR 0.66).

↗ Notes to the consolidated financial statements, Note 17

| T022 | PROFIT BREAKDOWN OF THE LUFTHANSA GROUP | |||

|---|---|---|---|---|

| 2023 | 2022 1) | Change | ||

| in €m | in €m | in % | ||

| Operating income | 38,582 | 33,429 | 15 | |

| Development of operating expenses | -36,126 | -32,033 | -13 | |

| Profit/loss from operating activities |

2,456 | 1,396 | 76 | |

| Financial result | -139 | -147 | 5 | |

| Profit/loss before income taxes | 2,317 | 1,249 | 86 | |

| Income taxes | -380 | -239 | 59 | |

| Profit/loss from continuing operations |

1,937 | 1,010 | 92 | |

| Profit/loss from discontinued operations |

-248 | -206 | -20 | |

| Profit/loss after income taxes | 1,689 | 804 | 110 | |

| Profit/loss attributable to minority interests | -16 | -13 | -23 | |

| Net profit/loss attributable to shareholders of Deutsche Lufthansa AG |

1,673 | 791 | 112 | |

| 1) Previous year’s figures adjusted due to sale of LSG group. | ||||

Executive Board and Supervisory Board propose dividend of EUR 0.30 per share

In principle, the Lufthansa Group’s dividend policy is to distribute to its shareholders 20% to 40% of net profit, adjusted for non-recurring gains and losses. One condition for the payment of a dividend is that the net profit for the year as shown in the individual financial statements of Deutsche Lufthansa AG that are drawn up under German commercial law allows for a distribution of the relevant amount. ↗ Financial strategy and value-based management and Forecast

Deutsche Lufthansa AG reported net profit for the year of EUR 6,765m for the 2023 financial year. Following the transfer of EUR 3,382m to retained earnings, distributable profit comes to EUR 3,383m.

In line with the dividend policy, the Executive Board and Supervisory Board of Deutsche Lufthansa AG will table a proposal at the Annual General Meeting on 7 May 2024 to distribute a dividend of EUR 0.30 per share to shareholders for financial year 2023. This represents a total dividend of EUR 359m or 21% of net profit for 2023. The remaining amount of EUR 3,024m is to be transferred to other retained earnings.

| T023 | RECONCILIATION OF RESULTS | ||||

|---|---|---|---|---|---|

| 2023 | 20221) | ||||

| in €m | Income statement | Reconciliation Adjusted EBIT | Income statement | Reconciliation Adjusted EBIT | |

| Total revenue | 35,442 | 30,895 | |||

| Changes in inventories and other own work capitalised | 727 | 354 | |||

| Other operating income | 2,413 | 2,180 | |||

| of which book gains et al. | - 134 | - 59 | |||

| of which write-ups on capital assets | -4 | - 2 | |||

| of which reversal of provisions for restructuring/M&A projects and material legal disputes | - 12 | -98 | |||

| of which extraordinary other operating income | -3 | – | |||

| Total operating income | 38,582 | -153 | 33,429 | -159 | |

| Cost of materials and services | -20,378 | -17,973 | |||

| of which extraordinary cost of materials and services | 16 | 42 | |||

| Staff costs | -8,344 | -7,277 | |||

| of which past service costs/settlement | 24 | 20 | |||

| of which restructuring costs | 10 | 34 | |||

| Depreciation, amortisation and impairment | -2,242 | -2,245 | |||

| of which impairment losses | 14 | 45 | |||

| Other operating expenses | -5,162 | -4,538 | |||

| of which impairment losses on assets held for sale | 32 | 14 | |||

| of which expenses incurred from book losses | 33 | 26 | |||

| of which expenses for material legal disputes | – | 6 | |||

| of which expenses for M&A projects | 39 | 37 | |||

| of which extraordinary other operating expenses | - 2 | 36 | |||

| Total operating expenses | -36,126 | 166 | -32,033 | 260 | |

| Profit/loss from operating activities | 2,456 | 1,396 | |||

| Result from equity investments | 213 | 23 | |||

| EBIT | 2,669 | 1,419 | |||

| Total amount of reconciliation Adjusted EBIT | 13 | 101 | |||

| Adjusted EBIT | 2,682 | 1,520 | |||

| Depreciation and amortisation | 2,228 | 2,199 | |||

| Adjusted EBITDA | 4,910 | 3,719 | |||

| 1) Previous year’s figures adjusted due to sale of LSG group. | |||||