Passenger Airlines business segment

| T027 | KEY FIGURES PASSENGER AIRLINES | ||||

|---|---|---|---|---|---|

| 2023 | 2022 | Change in % | |||

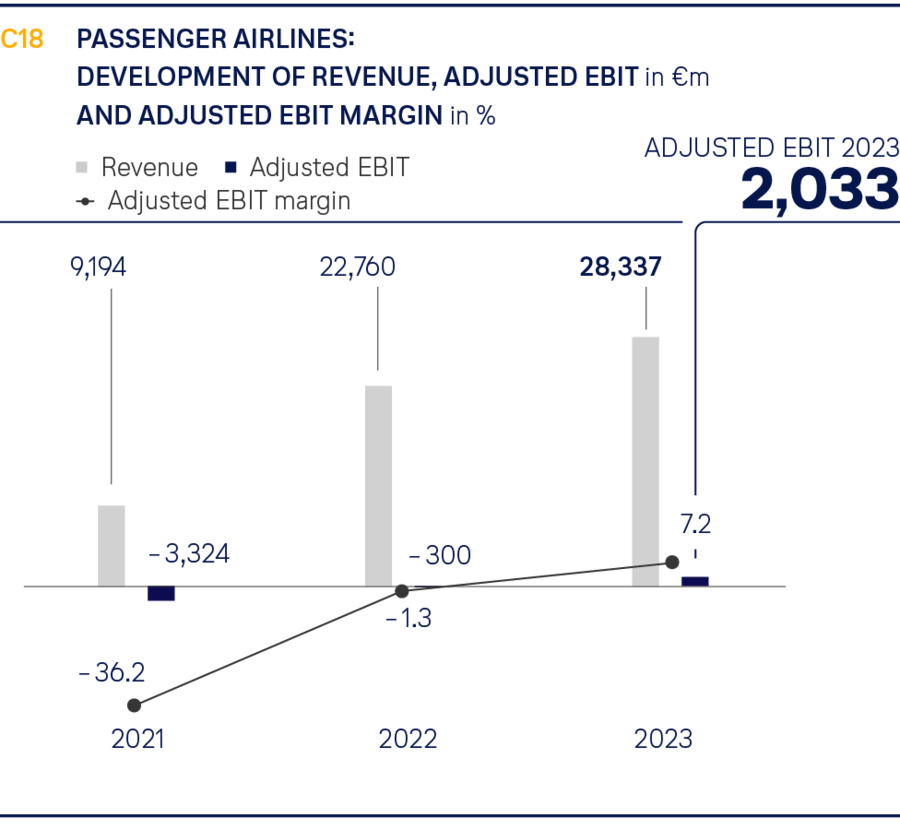

| Revenue | €m | 28,337 | 22,760 | 25 | |

| of which traffic revenue | €m | 26,701 | 20,705 | 29 | |

| Operating income | €m | 29,643 | 23,785 | 25 | |

| Operating expenses | €m | 27,730 | 24,100 | 15 | |

| Adjusted EBITDA | €m | 3,758 | 1,466 | 156 | |

| Adjusted EBIT | €m | 2,033 | -300 | ||

| EBIT | €m | 2,064 | -279 | ||

| Adjusted EBIT margin | % | 7.2 | -1.3 | 8.5 pts | |

| Adjusted ROCE | % | 19.4 | -2.8 | 22.2 pts | |

| Segment capital expenditure | €m | 3,095 | 2,032 | 52 | |

| Employees as of 31 Dec | Number | 60,924 | 56,762 | 7 | |

| Average number of employees | Number | 59,331 | 56,054 | 6 | |

Business activities

Passenger Airlines offers their customers a differentiated and high-quality product

The Passenger Airlines segment includes Lufthansa Airlines, SWISS, Austrian Airlines, Brussels Airlines and Eurowings, whose results are also reported individually.

The network carriers Lufthansa Airlines, SWISS, Austrian Airlines and Brussels Airlines offer their customers a premium experience, with high-quality products and services. The multi-hub strategy offers passengers a comprehensive route network along with the greatest possible flexibility for their journey.

Eurowings is positioned as a value carrier with an exclusive focus on point-to-point traffic on European short- and medium-haul routes.

The Passenger Airlines segment also includes the regional airlines Lufthansa CityLine, Lufthansa City Airlines, Air Dolomiti, Edelweiss Air, Discover Airlines and the equity investment in SunExpress, the joint venture with Turkish Airlines.

Moreover, commercial joint ventures with leading international airlines extend the Passenger Airlines route network. Commercial joint ventures exist with United Airlines and Air Canada on routes between Europe and North America, and with All Nippon Airways (ANA), Singapore Airlines and Air China on routes between Europe and Japan as well as Singapore and China respectively. In addition, numerous code-share agreements are in place.

Course of business

Fleet modernisation continues

The Passenger Airlines are driving forward with modernising and unifying their fleets. Older aircraft models are being retired and new, efficient aircraft with lower fuel needs and less carbon emissions are joining the fleet. The capital expenditure in modern and particularly fuel-efficient aircraft and engine technologies is currently the most important lever for reducing carbon emissions in flight operations.

↗ Combined non-financial declaration/Environmental concerns/Climate protection

The Lufthansa Group decided in March 2023 to order ten new Airbus A350-1000, five A350-900 and seven Boeing 787-9 Dreamliner long-haul aircraft. They are due to be delivered from the middle of the decade onwards. At list prices, the overall order volume is around USD 7.5bn and is in line with the Group's medium-term financial planning. The Lufthansa Group ordered another four A350-900s in May 2023.

The Lufthansa Group entered into an agreement for the sale and lease-back of twelve short- and medium-haul aircraft in December 2023. The aircraft are currently operated by Lufthansa Airlines, Lufthansa CityLine and Eurowings.

In addition, the Lufthansa Group ordered 80 cutting-edge short- and medium-haul aircraft in December 2023. These were 40 Airbus A220-300s and 40 Boeing 737-8 MAXs. The aircraft are expected to be delivered between 2026 and 2032. The confirmed order for 80 aircraft is worth around EUR 9bn at list prices. The aircraft will enter service in various flight operations at the Lufthansa Group. Purchase options were also agreed for another 20 A320-300s, 60 B737-8 MAXs and 40 aircraft from the A320 family.

At the end of the 2023 financial year, the Passenger Airlines fleet had a total of 700 aircraft (previous year: 692 aircraft). ↗ Fleet

Further expansion of product and services

Lufthansa Group Passenger Airlines are continuing to expand their product range in line with customer expectations. Customers will thus be offered a wider choice of relevant individually selectable product components as well as an improved travel experience on board and on the ground, in the premium segment in particular. This includes fitting Lufthansa Airlines and SWISS aircraft with Allegris and SWISS Senses product generation seating which will offer a new travel experience in every class on long-haul routes. Austrian Airlines is also to get a new long-haul cabinwhen the Boeing 787 Dreamliner is introduced.

Customers with Lufthansa Group Travel ID or a Miles & More account will also have better internet availability on board, and so be able to use short messaging services free of charge on an unlimited basis. All customers will continue to have access to new service options in the expanded in-flight entertainment programme and to all the services of the Lufthansa Group apps during the flight.

The culinary range will also be upgraded in the spirit of a premium service. There is also a focus on improvements to customer service, e.g. the enhanced accessibility of call centres, and expanded digital service channels.

Sustainability activities intensified

The Lufthansa Group continues to expand its portfolio of sustainable travel offerings. It became the first airline group in the world to offer its own “green fares” throughout Europe in February 2023. They enable passengers to fly more sustainably in the whole of Europe and North Africa, because they already include offsets for the carbon emissions of the flight.

The use of sustainable aviation fuels accounts for 20% of the offsets, with 80% coming from high-quality climate protection projects implemented by the non-profit organisation myclimate in Germany and other countries.

The green fares will also be extended to long-haul routes. From November 2023, they have been available on a trial basis on twelve selected routes.

Details of additional Passenger Airlines sustainability activities can be found in the following chapters about the individual airlines and in the ↗ Combined non-financial declaration.

Operating performance

Operating performance shaped by ongoing recovery in demand

In the 2023 financial year, the operating performance of the Lufthansa Group’s Passenger Airlines segment significantly improved year-on-year due to the continued increase in demand for air travel and higher average yields.

The Passenger Airlines’ available capacity was continuously expanded over the course of the reporting year in line with the recovery in demand. In the first quarter, it was 75% of the pre-crisis level in 2019. It then increased to 83% in the second quarter, 88% in the third quarter and 89% of the pre-crisis level in the fourth quarter.

Overall, available capacity in the 2023 financial year was at 84% of the pre-crisis level and 16% higher than in the previous year. The number of flights increased by 15% year-on-year. Sales rose by 20%. The Passenger Airlines transported 122.5 million passengers in the 2023 financial year, 20% more than in the previous year (previous year: 101.8 million). The passenger load factor was 3.1 percentage points higher year-on-year, at 82.9% (previous year: 79.8%).

Average yields improved by 5.7%. Traffic revenue at the Passenger Airlines increased by 29% to EUR 26,701m year-on-year, chiefly due to higher traffic (previous year: EUR 20,705m)

| T028 | TRAFFIC FIGURES PASSENGER AIRLINES | ||||

|---|---|---|---|---|---|

| 2023 | 2022 1) | Change in % | |||

| Number of flights | Number | 936,079 | 817,127 | 15 | |

| Passengers | thousands | 122,535 | 101,775 | 20 | |

| Available seat-kilometres | million | 300,582 | 259,428 | 16 | |

| Revenue seat kilometres | million | 249,269 | 207,030 | 20 | |

| Passenger load factor | % | 82.9 | 79.8 | 3.1 pts | |

| 1) Previous year’s figures adjusted. | |||||

| T029 | OPERATING FIGURES PASSENGER AIRLINES | ||||

|---|---|---|---|---|---|

| 2023 in € cent |

2022 in € cent |

Change in % | Exchange rate adjusted change in % | ||

| Yields | 9.6 | 9.1 | 5.7 | 6.8 | |

| Unit revenue (RASK) | 9.7 | 9.0 | 7.8 | 8.8 | |

| Unit cost (CASK) without fuel and emissions trading expenses |

6.4 | 6.3 | 2.2 | 2.3 | |

| T030 | TRENDS IN TRAFFIC REGIONS | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Airlines | |||||||||||

| Net traffic revenue external revenue | Passengers | Available seat-kilometres |

Revenue seat kilometres |

Passenger load factor | |||||||

| 2023 | Change | 2023 | Change | 2023 | Change | 2023 | Change | 2023 | Change | ||

| in €m | in % | in thousands | in % | in millions | in % | in millions | in % | in % | in pts | ||

| Europe | 10,951 | 24 | 99,365 | 20 | 118,174 | 13 | 96,309 | 17 | 81.5 | +2.9 | |

| Americas | 7,190 | 20 | 11,251 | 14 | 100,021 | 9 | 84,434 | 13 | 84.4 | +3.1 | |

| Asia / Pacific | 3,351 | 81 | 4,806 | 68 | 45,476 | 63 | 38,405 | 72 | 84.5 | +4.3 | |

| Middle East/Africa | 2,407 | 15 | 7,113 | 11 | 36,911 | 7 | 30,121 | 11 | 81.6 | +2.4 | |

| Not assignable | 2,802 | 45 | – | – | – | – | – | – | – | – | |

| Total | 26,701 | 29 | 122,535 | 20 | 300,582 | 16 | 249,269 | 20 | 82.9 | +3.1 | |

Financial performance

Revenue up on previous year by 25%

Revenue in the Passenger Airlines business segment was up by 25% in the reporting year to EUR 28,337m due to higher traffic revenue compared with the previous year (previous year: EUR 22,760m). Operating income of EUR 29,643m was 25% up on the previous year (previous year: EUR 23,785m).

Unit revenues (RASK) went up by 7.8% year-on-year thanks to higher average yields and load factors. They were thus 23.6% higher than the pre-crisis level in 2019.

Expenses up by 15%

Operating expenses of EUR 27,730m were 15% higher than in the previous year (previous year: EUR 24,100m).

Unit costs (CASK) without fuel and emissions trading expenses rose by 2.2% compared with the previous year. They were 15.7% higher than the pre-crisis level. Cost increases due to inflation, additional expenses to ensure operational stability and negative economies of scale resulting from capacities that were still lower than before the crisis were largely offset by structural cost reductions.

The cost of materials and services of EUR 16,687m was 15% higher than in the previous year (previous year: EUR 14,492m). Expenses for fees and charges increased due to volume and price factors by 21% to EUR 4,193m (previous year: EUR 3,467m). Expenses for MRO services increased by 30% to EUR 2,134m (previous year: EUR 1,636m). Fuel expenses of EUR 7,552m were 6% higher than in the previous year (previous year: EUR 7,106m) due to increased flight operations.

Salary increases, a higher profit-share payment to staff and a 6% increase in the average number of employees drove up staff costs by 18% to EUR 5,426m (previous year: 4,584m).

Other operating expenses increased by 19% to EUR 3,892m (previous year: EUR 3,258m) due to the expansion of flight operations.

| T031 | OPERATING EXPENSES PASSENGER AIRLINES | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Cost of materials and services | 16,687 | 14,492 | 15 | |

| of which fuel | 7,552 | 7,106 | 6 | |

| of which fees and charges | 4,193 | 3,467 | 21 | |

| of which charter expenses | 420 | 385 | 9 | |

| - of which MRO services | 2,134 | 1,636 | 30 | |

| Staff costs1) | 5,426 | 4,584 | 18 | |

| Depreciation and amortisation2) | 1,725 | 1,766 | -2 | |

| Other operating expenses3) | 3,892 | 3,258 | 19 | |

| Total operating expenses |

27,730 | 24,100 | 15 | |

| 1) Without past service expenses/plan settlement 2) Without impairment loss 3) Without book losses |

||||

Adjusted EBIT at EUR 2.0bn

Passenger Airlines reported a positive result again in financial year 2023. Adjusted EBIT improved to EUR 2,033m (previous year: EUR -300m), largely thanks to a strong summer season. The Adjusted EBIT margin was 7.2% (previous year: -1.3%).

EBIT in the reporting year was EUR 2,064m (previous year: EUR -279m). The difference relative to Adjusted EBIT in the reporting period is mainly attributable to impairment losses recognised on aircraft held for sale as well as book losses on aircraft and reserve engines. ↗ Earnings position

Segment capital expenditure up 52% on the previous year

Segment capital expenditure increased by 52% to EUR 3,095m in the reporting year (previous year: EUR 2,032m) and primarily related to advance payments for aircraft orders, major maintenance events and final payments for new aircraft received.

Number of employees up by 7% year-on-year

The number of employees came to 60,924 on 31 December 2023 (previous year: 56,762). This is a 7% year-on-year increase on year-end 2022, above all due to new employee hires in the operational areas as a result of expanding business operations.