Logistics business segment

| T037 | KEY FIGURES LOGISTICS | ||||

|---|---|---|---|---|---|

| 2023 | 2022 | Change in % | |||

| Revenue | €m | 2,977 | 4,627 | -36 | |

| of which traffic revenue | €m | 2,775 | 4,430 | -37 | |

| Total operating income | €m | 3,090 | 4,733 | -35 | |

| Operating expenses | €m | 2,933 | 3,171 | -8 | |

| Adjusted EBITDA | €m | 401 | 1,770 | -77 | |

| Adjusted EBIT | €m | 219 | 1,600 | -86 | |

| EBIT | €m | 214 | 1,575 | -86 | |

| Adjusted EBIT margin | % | 7.4 | 34.6 | -27.2 pts | |

| Adjusted ROCE | % | 7.3 | 54.2 | -46.9 pts | |

| Segment capital expenditure | €m | 191 | 254 | -25 | |

| Employees as of 31 Dec | Number | 4,152 | 4,085 | 2 | |

| Average number of employees | Number | 4,122 | 4,088 | 1 | |

Business activities

Lufthansa Cargo is one of Europe’s leading freight airlines

In addition to Lufthansa Cargo AG, the Lufthansa Group’s logistics specialist, the Logistics segment includes the airfreight container management specialist Jettainer group, the time:matters Group, which specialises in particularly urgent shipments, the subsidiary Heyworld, which specialises in tailored solutions for the e-commerce sector, CB Customs Broker, the customs and customs clearance specialist, and the Lufthansa Group’s 50% stake in the cargo airline AeroLogic. Lufthansa Cargo also has equity investments in various handling companies and smaller companies involved in aspects of digitalising the sector.

The focus of Lufthansa Cargo’s operations lies in the airport-to-airport airfreight business. Its product portfolio encompasses standard and express freight as well as highly specialised products. Cross-border eCommerce shipments are the fastest-growing airfreight segment. Among the special products offered, such as the transport of live animals, valuable cargo, post and dangerous goods, it is primarily the demand for carriage of temperature-controlled goods that is continuously increasing. The company has specialised infrastructure at Frankfurt Airport to handle these goods, including the Animal Lounge and the Lufthansa Cargo Pharma Hub.

In addition to its own eleven Boeing 777F cargo aircraft and four Airbus A321Fs, Lufthansa Cargo uses the belly capacities of Lufthansa Airlines, Austrian Airlines, Brussels Airlines, Discover Airlines and SunExpress to transport freight.

In addition, the AeroLogic joint venture in Leipzig operates 22 777F cargo aircraft on behalf of the two shareholders, Lufthansa Cargo and DHL Express. Lufthansa Cargo is responsible for marketing the capacities of six of these aircraft.

Lufthansa Cargo also has successful international partnerships with the cargo divisions of Cathay Pacific and United Airlines. Cooperation with All Nippon Airways was suspended in October 2023.

Course of business

Lufthansa Cargo expands freighter fleet to open up new growth potential

Lufthansa Cargo is investing in future growth potential in the fast-growing eCommerce segment. Two more A321 passenger aircraft were converted to freighters in the 2023 financial year in response to the growing demand for airfreight connections within Europe, in order to ensure short delivery times. The four aircraft are operated by Lufthansa CityLine. According to the current plans, this means the short- and medium-haul freighter fleet is complete.

As a further investment to expand the capacity of its freighter fleet, Lufthansa Cargo ordered three current-generation 777Fs and seven next-generation 777-8F freighters from Boeing in the 2022 financial year. The second 777F was delivered in December 2023 and is in service with AeroLogic, as is the first 777F. The third 777F is expected in the first half of 2024 and will enter service at Lufthansa Cargo.

Product portfolio for express shipments further expanded

Lufthansa Cargo introduced td.Zoom in November 2023, a third express option in addition to td.Pro and td.Flash. With td.Zoom, airfreight customers can choose the fastest service for their most urgent consignments. It includes the shortest handling times in export, transit and import, as well as dedicated processes with no weight or size restrictions.

Lufthansa Cargo is a pioneer in the digitalisation of the airfreight industry

The leading position of Lufthansa Cargo in the airfreight industry is to be expanded by building up digital services. The ongoing development of its digital sales channels was driven by connecting global customers directly to the Lufthansa Cargo booking system via an application programming interface, and expanding the strategic partnership with the booking platform cargo.one. The number of services that can be booked online was also increased.

Another milestone for digitalisation was the announcement that the ONE record standard for data exchange co-developed by IATA would be progressed and implemented in the IT infrastructure. More pioneering work was carried out with Kühne+Nagel for paperless freight transport with a fully digital transport chain. The two companies jointly introduced the first fully paperless route between Germany and Hong Kong. These initiatives optimise the airfreight processes, boost operating efficiency and make an important contribution to sustainability efforts in the airfreight industry.

Modernisation of Frankfurt hub is progressing

Implementation of the comprehensive infrastructure programme that includes the development and renovation of the logistics centre at the home Frankfurt hub continued in the 2023 financial year. The programme was designed so that the company can finally respond flexibly to market developments and the changing needs of customers.

Construction of the new high-bay warehouse, including an automated transport system and the first building modules started in the reporting year. In addition to the new building, the existing buildings and warehouses at the Lufthansa Cargo Center are also to be technically upgraded and modernised. Lufthansa Cargo is investing a total of some EUR 500m in this major project, which is expected to be completed by 2030 and covers a building site of seven hectares.

Lufthansa Cargo leads the industry in terms of sustainability

As in previous years, Lufthansa Cargo again offered a weekly cargo flight in the 2023 summer flight timetable covered by sustainable fuels, making it more sustainable.

Moreover, all Lufthansa Cargo customers are able to transport their freight more sustainably by selecting the “Sustainable Choice” option, which has been available to book as an additional service on the website since 2023.

In order to further improve the fleet’s carbon footprint, all 777Fs will be equipped with an innovative surface technology. The “AeroSHARK” film, which imitates sharkskin, reduces aircraft air resistance and thus reduces fuel consumption. The first four 777Fs were equipped with the new technology in the reporting year.

Changes in the management of Lufthansa Cargo

Lufthansa Cargo reorganised its management. Ashwin Bhat has been the new Chief Executive Officer (CEO) of the cargo airline since 15 April 2023. He was previously Chief Commercial Officer (CCO) of Lufthansa Cargo and replaced Dorothea von Boxberg, who is the new CEO of Brussels Airlines.

In addition, Frank Bauer has been the new Chief Financial Officer and Labour Director of Lufthansa Cargo since 1 August 2023. He was previously Head of Controlling and Risk Management for the Lufthansa Group.

Long-term wage agreement reached with the Vereinigung Cockpit pilots’ union

The Lufthansa Group and the Vereinigung Cockpit pilots’ union agreed to a long-term wage agreement for the pilots of Lufthansa Cargo in August 2023. ↗ Employees

Operating performance

Lufthansa Cargo’s operating performance returns to normal after record years

The operating performance in the Logistics segment went back to normal in financial year 2023 after the records set in previous years. In 2021 and 2022, the airfreight market benefited from the shortage of belly capacities caused by the pandemic and a sharp rise in demand due to disruptions in global supply chains. Capacity in 2023 was 7% higher than the previous year, mainly due to the recovery in passenger flight operations and the related increase in belly capacities. Capacity compared with the pre-crisis level in 2019 came to 87%. Sales rose by 3% compared with the same period of the previous year. The cargo load factor decreased by 1.9 percentage points to 59.2% (previous year: 61.1%). Yields declined in all Lufthansa Cargo’s traffic regions and were 39.3% down on the year. They were nonetheless still significantly higher than the pre-crisis level in 2019.

| T038 | Traffic figures and operating figures Logistics |

||||

|---|---|---|---|---|---|

| 2023 | 2022 | Change in % | |||

| Available cargo tonne-kilometres | million | 12,620 | 11,827 | 7 | |

| Revenue cargo tonne-kilometres | million | 7,471 | 7,231 | 3 | |

| Cargo load factor | % | 59.2 | 61.1 | -1.9 pts | |

| Yields | € cent | 37.2 | 61.3 | -39.31) | |

| 1) Exchange rate-adjusted change: -37.1%. | |||||

Traffic revenues decreased by 37% to EUR 2,775m due to the lower yields (previous year: EUR 4,430m). In all traffic regions, traffic revenue decreased year on year.

The Americas and Asia/Pacific remain Lufthansa Cargo’s main traffic regions. The two regions account for nearly 90% of capacity and sales.

| T039 | TRENDS IN TRAFFIC REGIONS | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Lufthansa Cargo | |||||||||

| Net traffic revenue external revenue | Available cargo tonne-kilometres | Revenue cargo tonne-kilometres | Cargo load factor | ||||||

| 2023 | Change | 2023 | Change | 2023 | Change | 2023 | Change | ||

| €m | in % | in m | in % | In m | in % | in % | in pts | ||

| Europe | 219 | -26 | 779 | 28 | 289 | 7 | 37.1 | -7.6 | |

| Americas | 1,185 | -42 | 6,196 | -1 | 3,426 | -3 | 55.3 | -0.7 | |

| Asia / Pacific | 1,137 | -37 | 4,604 | 17 | 3,214 | 10 | 69.8 | -4.3 | |

| Middle East/Africa | 234 | -21 | 1,041 | 4 | 542 | 3 | 52.0 | -0.8 | |

| Total | 2,775 | -37 | 12,620 | 7 | 7,471 | 3 | 59.2 | -1.9 | |

Capacity was expanded in all traffic regions, and sales were increased in all traffic regions except the Americas. However, the cargo load factor declined in all traffic regions year-on-year.

Financial performance

Revenue down year-on-year by 36%

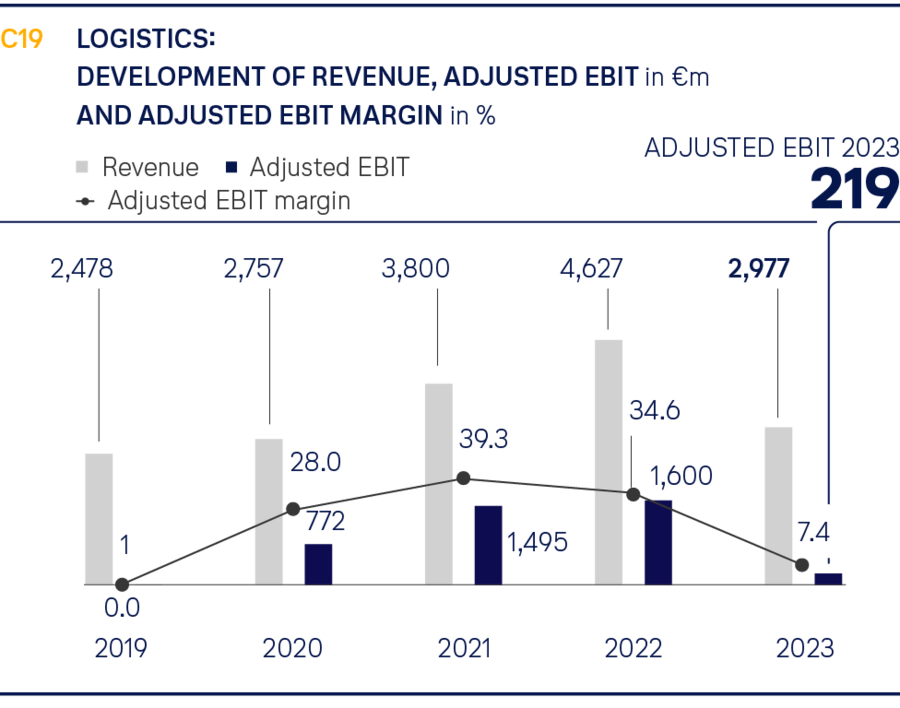

Revenue in the Logistics segment sank by 36% to EUR 2,977m in financial year 2023 (previous year: EUR 4,627m). The main reason for the decline was lower yields as capacities and demand in the airfreight market returned to normal. Operating income decreased by a total of 35% to EUR 3,090m (previous year: EUR 4,733m).

Expenses down by 8%

Operating expenses came to EUR 2,933m in the reporting year, a year-on-year decline of 8% (previous year: EUR 3,171m). Lower charter expenses and fuel costs, as well as measures to increase efficiency and cut costs were partly offset by price increases due to inflation.

| T040 | OPERATING EXPENSES LOGISTICS | |||

|---|---|---|---|---|

| 2023 | 2022 | Change | ||

| in €m | in €m | in % | ||

| Cost of materials and services | 2,063 | 2,295 | -10 | |

| of which fuel | 389 | 486 | -20 | |

| of which fees and charges | 302 | 274 | 10 | |

| of which charter expenses | 1,100 | 1,287 | -15 | |

| - of which MRO services | 116 | 111 | 5 | |

| Staff costs1) | 419 | 425 | -1 | |

| Depreciation and amortisation2) | 182 | 170 | 7 | |

| Other operating expenses3) | 269 | 281 | -4 | |

| Total operating expenses |

2,933 | 3,171 | -8 | |

| 1) Without past service expenses/plan settlement 2) Without impairment loss 3) Without book losses |

||||

Staff costs went down by 1% to EUR 419m in financial year 2023 (previous year: EUR 425m), primarily due to lower performance-related remuneration components. This was offset by a 1% increase in the average number of employees and salary increases as a result of collective bargaining agreements and pay rounds.

Depreciation and amortisation rose year-on-year by 7% to EUR 182m (previous year: EUR 170m) due to the expansion of the freighter fleet.

Other operating expenses went down by 4% to EUR 269m, mainly due to lower maintenance expenses and currency effects (previous year: EUR 281m).

Adjusted EBIT of EUR 219m

Adjusted EBIT decreased by 86% in financial year 2023 to EUR 219m (previous year: EUR 1,600m). The Adjusted EBIT margin declined by 27.2 percentage points to 7.4% (previous year: 34.6%).

EBIT decreased year-on-year by 86% to EUR 214m (previous year: EUR 1,575m).

Segment capital expenditure down 25% on the previous year

Capital expenditure in the Logistics segment decreased in the reporting year by 25% to EUR 191m (previous year: EUR 254m). This mainly related to advance payments for two 777F cargo aircraft.

Number of employees up by 2%

The number of employees at year-end increased by 2% to 4,152 (previous year: 4,085).