Remuneration of Executive Board members

The system for remunerating Executive Board members takes account of the Company’s size, complexity and economic situation, as well as its prospects. It is also aligned with the Company strategy, thereby creating an incentive for successful and sustainable governance. At the same time, it takes into account the responsibilities and performance of the Executive Board as a whole and of its individual members, as well as the Company’s current position. For this reason, the remuneration system is based on transparent, performance-related parameters relevant to Company performance and sustainability.

The Supervisory Board is responsible for the structure of the remuneration system for Executive Board members, and for defining the individual benefits. The Steering Committee assists the Supervisory Board, monitors the appropriateness of the remuneration system and prepares the Supervisory Board’s resolutions. In the event of material changes to the remuneration system, and at least every four years, the remuneration system is presented for approval to the Annual General Meeting.

Overview of the remuneration system for the 2024 financial year

Executive Board remuneration in financial year 2024 is based on the remuneration system approved by the Annual General Meeting on 9 May 2023, which has been applied to all active Executive Board members since 2023; it was again applied to all Executive Board members in the 2024 financial year. The following table provides an overview of the components of the remuneration system for Executive Board members, the underlying targets and specific application in the 2024 financial year.

| T208 | Executive Board remuneration system 2024 | |

|---|---|---|

| Component | Objective | Structure |

| Performance-unrelated remuneration | ||

| Basic salary | Shall reflect the role and responsibilities in the Executive Board. Should ensure a reasonable basic income and prevent unreasonable risk-taking | • Annual basic salary • Paid in twelve monthly instalments - CEO: EUR 1,892,000 - Outstanding Executive Board member: EUR 1,118,000 - Ordinary Executive Board member: EUR 860,000 |

| Ancillary benefits | Company car with driver, industry-standard concessionary flights for private travel, insurance premiums | |

| Retirement benefits | Shall ensure adequate retirement benefits | Annual allocation of a fixed amount within the scope of a defined-contribution system - CEO: EUR 990,000 - Outstanding Executive Board member: EUR 585,000 - Ordinary Executive Board member: EUR 450,000 |

| Performance-related remuneration | ||

| One-year variable remuneration (STI) |

Intended to support profitable growth while taking into consideration liquidity management as well as the collective responsibility of the Executive Board and the individual performance of its members | • Adjusted EBIT versus target (40%) • Adjusted Free Cashflow versus target (40%) • Overall and individual commercial and sustainability targets (20%) • Individual performance factor (bonus/malus, 0.8 – 1.2) • Cap: 200% of target amount • Settlement in cash or shares |

| Long-term variable remuneration (LTI) |

Intended to promote a sustainable increase in enterprise value, while aligning the interests of the Executive Board members with those of shareholders | • Conditional award of virtual Lufthansa shares with four-year duration; • Final number of virtual shares depends on: - Adjusted ROCE during the performance period versus annual target (50%) - Relative TSR of the Lufthansa share versus sector index (NYSE Arca Global Airlines Index) (30%) - Strategic and sustainability targets (20%) • Value depends on the absolute performance of the Lufthansa share (including dividends) over the course of the programme • Cap: 200% of target amount • Settlement in cash or shares |

| End-of-service benefits | ||

| Mutually agreed termination | Shall avoid unreasonably high severance payments | Severance payment limited to remainder of service contract or two times annual remuneration (cap) |

| Post-contractual non-compete clause | Protects the Company’s interests | • One-year non-compete clause after departure from the Executive Board, with compensation of 50% of basic salary payable • Waiver of non-compete clause by Company possible (with six-month notice period) |

| Change-of-control clause Not used in the 2024 financial year. |

Shall ensure independence in takeover situations | • Severance payment corresponding to the remuneration owed for the remainder of the service contract, up to 100% of the cap on severance pay |

| Other compensation rules | ||

| Share Ownership Guidelines | Intended to strengthen the equity culture and align the interests of Executive Board members and shareholders | • Obligation to invest in Lufthansa shares within a period of four years - CEO: 200% of basic salary - Ordinary Executive Board member: 100% of basic salary • Holding obligation for the duration of work on the Executive Board: graduated annual reduction of 25% of shareholding after departure from the Executive Board |

| Compliance and performance clawback Not used in the 2024 financial year. |

Shall ensure sustainable Company development | Supervisory Board has the right to withhold STI and LTI or recover remuneration already paid |

| Maximum remuneration in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG |

Shall prevent uncontrolled high payments | Reduction in variable remuneration where the maximum for a financial year is exceeded: - CEO: EUR 11.0m - Outstanding Executive Board member: EUR 6.5m - Ordinary Executive Board member: EUR 5.0m |

Review of the appropriateness of Executive Board remuneration

In the 2024 financial year, the Supervisory Board once again considered in detail the appropriateness of the Executive Board’s remuneration and reviewed its amount and structure. It reached the conclusion that the remuneration is appropriate.

When reviewing the appropriateness of Executive Board remuneration, the Supervisory Board considers whether it is standard for the market by examining the amount and structure of Executive Board remuneration at comparable companies (horizontal comparison). The comparable market consists of all the companies listed on the DAX40 and MDAX, since they are of a similar size as of the assessment date. This means that the largest listed companies in Germany are included, and reflects the fact that Deutsche Lufthansa AG is listed in the MDAX.

To factor in the relative size of Deutsche Lufthansa AG in this peer group, the companies are classified by size using the equally weighted criteria of revenue, headcount and market capitalisation. To determine whether it is appropriate and standard for the market, the target and maximum remuneration are assessed on the basis of Deutsche Lufthansa AG’s size in this comparable market.

In addition, the Supervisory Board carries out a vertical comparison, assessing the ratio of Executive Board remuneration against the remuneration of senior executives and the workforce as a whole and including the development of this ratio over time (see T221). The workforce as a whole is made up of the upper management tier as well as non-pay scale and pay scale workers in the German Group companies in the Lufthansa collective bargaining group.

Target remuneration

The following table shows the remuneration granted to members of the Executive Board for the 2024 and 2023 financial years, and includes a breakdown for the Chairman of the Executive Board, the Executive Board member for the finance function (determined by the Supervisory Board to be of particular importance) and the other members of the Executive Board who have worked on the Executive Board for the full year. There were no changes to remuneration in the 2024 financial year.

| T209 | Target remuneration and relative proportion in 2024 and 2023 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CEO | Outstanding Executive Board member responsible for Finance | Ordinary Executive Board members | ||||||||||

| 2024 | 2024 | 2023 | 2023 | 2024 | 2024 | 2023 | 2023 | 2024 | 2024 | 2023 | 2023 | |

| in € thousands | Proportion | in € thousands | Proportion | in € thousands | Proportion | in € thousands | Proportion | in € thousands | Proportion | in € thousands | Proportion | |

| Fixed remuneration | ||||||||||||

| Basic salary | 1,892 | 33.6% | 1,892 | 33.6% | 1,118 | 33.6% | 1,118 | 33.6% | 860 | 33.6% | 860 | 33.6% |

| Variable remuneration | ||||||||||||

| One-year variable remuneration 2024 (2023) | 1,320 | 23.4% | 1,320 | 23.4% | 780 | 23.4% | 780 | 23.4% | 600 | 23.4% | 600 | 23.4% |

| Long-term variable remuneration 2024 (2023) | 2,420 | 43.0% | 2,420 | 43.0% | 1,430 | 43.0% | 1,430 | 43.0% | 1,100 | 43.0% | 1,100 | 43.0% |

| Target direct remuneration | 5,632 | 100% | 5,632 | 100% | 3,328 | 100% | 3,328 | 100% | 2,560 | 100% | 2,560 | 100% |

Maximum remuneration

In addition to the caps on one-year and long-term variable remuneration, the Supervisory Board has capped the total amount of remuneration received by each Executive Board member in a given financial year in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG. Since 2023, this maximum remuneration has been EUR 11m for the Chairman of the Executive Board, EUR 6.5m for the Executive Board member for the finance function and EUR 5m for the other ordinary Executive Board members. It relates to actual expenses or the actual payment of remuneration agreed for the financial year (including retirement benefit commitments). If remuneration for a financial year exceeds this cap, the variable remuneration is reduced accordingly.

Compliance with the maximum remuneration limit for the 2024 financial year

Since the amount paid out for the long-term variable remuneration in 2024 will only be known on 31 December 2027 due to the four-year performance period, definitive information on compliance with the remuneration cap in relation to remuneration granted in the 2024 financial year will only be provided in the remuneration report for the 2027 financial year.

Compliance with the maximum remuneration limit for the 2021 financial year

For the 2021 financial year, the Supervisory Board specified a maximum amount for the overall remuneration granted to the Executive Board members for the 2021 financial year. Following the end of the performance period for long-term variable remuneration 2021 (LTI 2021) on 31 December 2024, it is clear that none of the Executive Board members active in the 2021 financial year exceeded this maximum amount. The following table provides a detailed overview of the amounts of remuneration granted for the individual Executive Board members for the 2021 financial year, including the respective maximum amounts.

| T210 | MAXIMUM REMUNERATION FOR 2021 FINANCIAL YEAR | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carsten Spohr, Chairman of the Executive Board, Chairman since 1.5.2014; Executive Board member since 1.1.2011 |

Christina Foerster Executive Board member from 1.1.2020 to 30.06.2024 |

Harry Hohmeister Executive Board member from 1.1.2013 to 30.06.2024 |

Detlef Kayser Executive Board member from 1.1.2019 to 30.06.2024 |

Michael Niggemann Executive Board member since 1.1.2020 |

Remco Steenbergen Executive Board member from 1.1.2020 to 7.5.20242) |

|||||||

| in € thousands | 2021 | 2021 (max.) |

2021 | 2021 (max.) |

2021 | 2021 (max.) |

2021 | 2021 (max.) |

2021 | 2021 (max.) |

2021 | 2021 (max.) |

| Fixed remuneration | ||||||||||||

| Basic salary | 1,634 | 1,634 | 860 | 860 | 860 | 860 | 860 | 860 | 860 | 860 | 860 | 860 |

| Ancillary benefits | 42 | 42 | 44 | 44 | 41 | 41 | 33 | 33 | 42 | 42 | 63 | 63 |

| Total | 1,676 | 1,676 | 904 | 904 | 901 | 901 | 893 | 893 | 902 | 902 | 923 | 923 |

| Variable remuneration | ||||||||||||

| One-year variable remuneration 20211) | – | – | – | – | – | – | – | – | – | – | – | – |

| Long-term variable remuneration (LTI 2021) | 3,140 | 4,180 | 1,652 | 2,200 | 1,652 | 2,200 | 1,652 | 2,200 | 1,652 | 2,200 | – | – |

| Total | 3,140 | 4,180 | 1,652 | 2,200 | 1,652 | 2,200 | 1,652 | 2,200 | 1,652 | 2,200 | 0 | 0 |

| Service cost | 871 | 871 | 461 | 461 | 453 | 453 | 457 | 457 | 467 | 467 | 450 | 450 |

| Total remuneration | 5,687 | 6,727 | 3,017 | 3,565 | 3,006 | 3,554 | 3,002 | 3,550 | 3,021 | 3,569 | 1,373 | 1,373 |

| Maximum remuneration in accordance with Section 87a Paragraph 1 Sentence 2 No. 1 AktG | 9,500 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | ||||||

| 1) The Supervisory Board did not award any one-year variable remuneration to Executive Board members for financial year 2021 due to the ongoing coronavirus pandemic. 2) Remco Steenbergen was not entitled to long-term variable remuneration for financial year 2021 under the terms of his severance agreement. |

||||||||||||

Variable remuneration in the 2024 financial year

The performance criteria for one-year and long-term variable remuneration are based on the Company’s strategic goals and operational management. They aim to boost profitability while setting incentives for growth, thereby taking the importance of liquidity management (including investing activities) and the optimal use of capital into account. For this reason, Adjusted EBIT, Adjusted Free Cash Flow and Adjusted ROCE are the relevant performance indicators for the Lufthansa Group and the main performance criteria for variable remuneration. Taking the interests of shareholders and other stakeholders into account, this is intended to ensure the sustainability of the business and reflect the Lufthansa Group’s social and ecological responsibilities.

On the basis of the remuneration system, the Supervisory Board determined the targets and the minimum and maximum amounts for the financial performance indicators and for the focus topics selected as part of the sustainability targets for variable remuneration for the 2024 financial year. The Supervisory Board ensured that the targets were demanding and ambitious.

For both the one-year and long-term variable remuneration, the possible range of performance against both individual financial targets as well as sustainability targets is between 0% and 200%.

One-year variable remuneration (STI 2024)

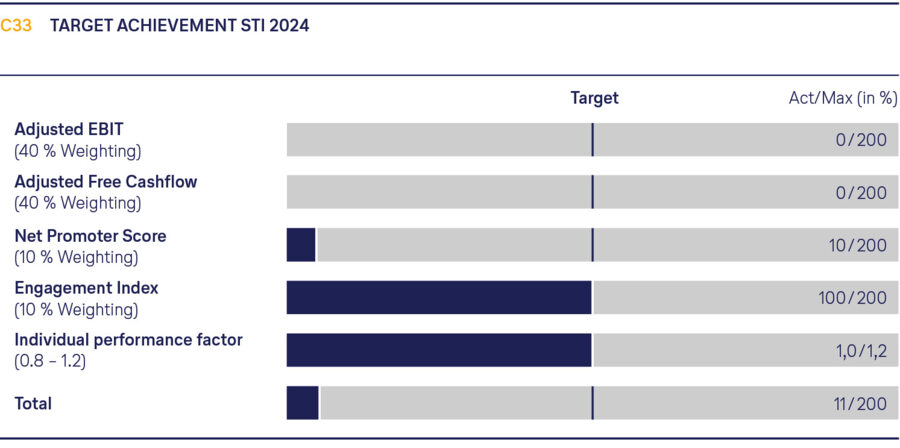

80% of the one-year variable remuneration for the 2024 financial year is based on financial targets, with 20% based on overall and individual business and sustainability targets.

In the interests of value-based management, the Group’s key performance indicators are based on the Group's key performance indicators; Adjusted EBIT and Adjusted Free Cash Flow each account for 40% of the target achievement. For the 2024 financial year, as in prior years, the Supervisory Board defined “Customers” and “Employees” as focal points for the business and sustainability targets in the one-year variable remuneration, and thus took the interests of key stakeholders into consideration.

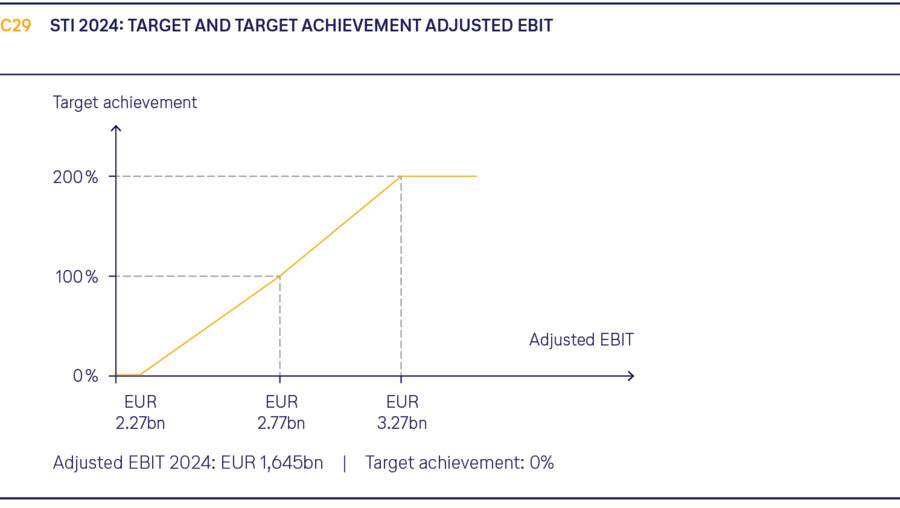

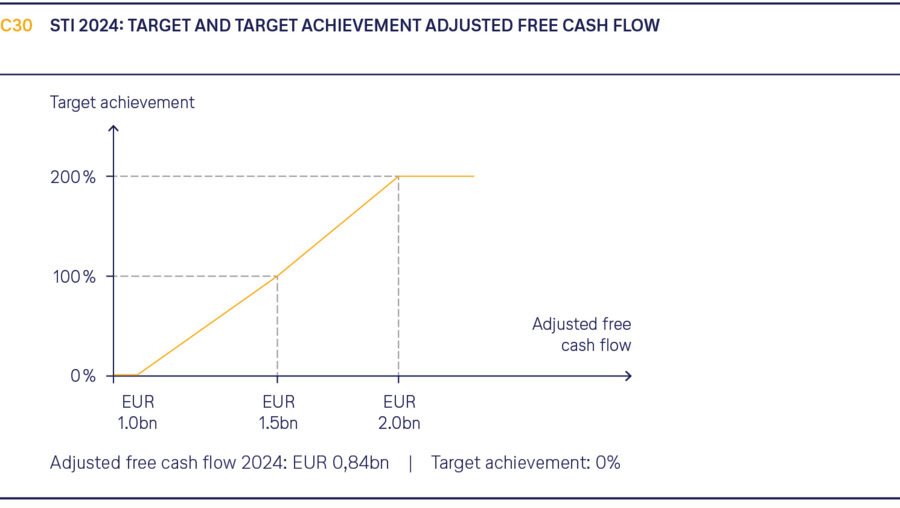

Financial targets are set by the Supervisory Board on the basis of the budget and the Group’s medium-term financial planning for the upcoming financial year. The target for Adjusted EBIT in the 2024 financial year was EUR 2.77bn. For the performance criterion of Adjusted Free Cash Flow, the target was EUR 1.5bn. Interim figures are interpolated on a straight-line basis. The targets and performance against the financial targets in financial year 2024 are shown in the diagrams.

Overall, the level of target achievement for the financial targets for the one-year variable remuneration for the 2024 financial year is therefore 0%.

For the “Customers” sustainability parameter, the Net Promoter Score1) (Combined non-financial declaration), i.e. the proportion of customers recommending the Company, is applied to all LH Group airlines (Lufthansa Airlines, SWISS, Austrian Airlines, Brussels Airlines and Eurowings). Interim figures are interpolated on a straight-line basis.

1) The Net Promoter Score is a registered trademark of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

The Engagement Index is used for the parameter “Employees” (Combined non-financial declaration). It measures the extent to which employees identify with the Company, as well as their commitment and willingness to recommend the Company to others. Each index score corresponds to a performance level. The 100% target is based on the average external benchmark.

The “Customers” and “Employees” targets each account for 10% of the 2024 STI.

Overall, the level of target achievement for the 2024 STI based on the weighted target achievement of the financial and sustainability targets is thus 11%.

In addition, the Supervisory Board can apply an individual performance factor (bonus/malus factor) of 0.8 to 1.2 when assessing the performance of each individual Executive Board member for the STI. This is based on the individual performance targets set annually by the Supervisory Board and the individual Executive Board members. In addition to the targets for individual Executive Board members, these comprise overarching targets for the entire Executive Board in order to reflect the collective responsibility of its members as a decision-making body.

The Steering Committee and Supervisory Board assessed performance against individual targets at the end of the 2024 financial year. The following table provides an overview of the predefined individual and collective targets for the 2024 financial year and their assessment for the definition of the individual performance factor for the 2024 STI.

| T211 | 2024 STI: individual performance factor | |

|---|---|---|

| 2024 targets: implementation of the LH Group strategy, particularly | Assessment of implementation in 2024 | |

|

Takeover of ITA nearly complete in 2024; successful operating start for Lufthansa City Airlines; successful expansion of Discover Airlines; LH Group brand clearly defined |

|

|

Flight operations in 2024 not yet sufficiently stabilised compared with 2023. Allegris introduction started and in flight operations | |

|

Group-wide cultural programme rolled out to the major business units | |

|

Lufthansa Group wins prize for Best Airline App 2024; Miles & More integrated into airline apps; digital check-in harmonised for hub airlines | |

|

Introduction of new low-emission aircraft delayed; good results in ESG rankings that set LH Group apart positively from the competition | |

|

Group profitability is good, but not at Lufthansa Airlines; LTH earnings for 2024 at previous year’s record level; sale of AirPlus completed |

|

|

Reorganisation in line with the new division of responsibilities; Engagement Index back at record pre-crisis level; programme launch for Target Operating Model 2026 | |

Including the collective performance and individual contributions of the Executive Board members, the Supervisory Board defined an individual performance factor of 1.0 for all Executive Board members for the 2024 financial year. For each Executive Board member, the performance factor was then multiplied by the overall target achievement in relation to financial, business and sustainability targets.

The following table shows the overall level of target achievement and the resulting amount paid for the 2024 STI for each individual member of the Executive Board.

| T212 | OVERALL LEVEL OF TARGET ACHIEVEMENT AND AMOUNTS PAID FOR THE 2024 STI | |||

|---|---|---|---|---|

| Executive Board | Target amount in € thousands | Overall target achievement in % | Individual performance factor | Payment amount in € thousands |

| Carsten Spohr | 1,320 | 11.00 | 1.00 | 145 |

| Christina Foerster (until 30 June 2024) | 300 | 11.00 | 1.00 | 33 |

| Harry Hohmeister (until 30 June 2024) | 300 | 11.00 | 1.00 | 33 |

| Detlef Kayser (until 30 June 2024) | 300 | 11.00 | 1.00 | 33 |

| Michael Niggemann | 600 | 11.00 | 1.00 | 66 |

| Remco Steenbergen (until 30 June 2024)1) | – | – | – | – |

| Till Streichert (since 15 September 2024) | 230 | 11.00 | 1.00 | 25 |

| Grazia Vittadini (since 1 July 2024) | 300 | 11.00 | 1.00 | 33 |

| Dieter Vranckx (since 1 July 2024) | 300 | 11.00 | 1.00 | 33 |

1) Under the severance agreement, Remco Steenbergen is not entitled to the 2024 STI.

Long-term variable remuneration (LTI)

To promote the long-term, sustainable development of the Company, long-term variable remuneration (the greater part of variable remuneration) depends on the achievement of long-term targets. Taking absolute and relative share performance into account closely aligns the interests of Executive Board members with those of shareholders.

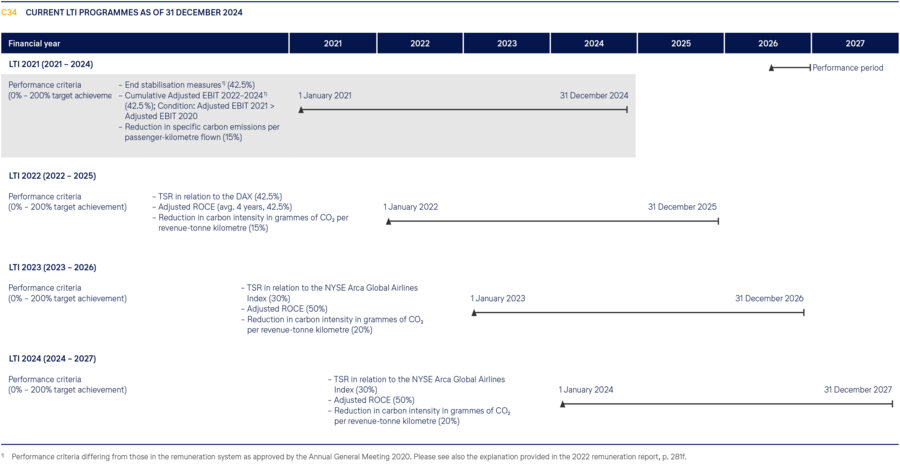

Current long-term variable remuneration includes ongoing programmes from several financial years, which are partly based on remuneration systems in effect before 1 January 2024. In particular, this includes long-term variable remuneration granted in the 2021 financial year (LTI 2021), for which the four-year programme ended on 31 December 2024. The following tables provide an overview of current LTI programmes for the members of the Executive Board, including the performance criteria set by the Supervisory Board.

Long-term variable remuneration commitment 2024 (LTI 2024)

Since financial year 2020, the long-term variable remuneration commitment for Executive Board members has been share-based. At the beginning of the performance period, the Executive Board members receive a number of virtual shares corresponding to the value of each contractually granted target amount. The number of virtual shares is determined with reference to the average price of the Lufthansa share in the first 60 trading days after the four-year performance period begins. The average price for the LTI 2024 is EUR 7.36. The following table shows the number of virtual shares allotted on a contingent basis to the individual Executive Board members as LTI 2024 in the reporting year.

| T213 | CONDITIONALLY ALLOTTED SHARES FOR 2024 LTI - ALLOCATION PRICE: EUR 7.36 | |

|---|---|---|

| Executive Board | Target amount in € thousands | Number of conditionally committed shares |

| Carsten Spohr | 2,420 | 328,804 |

| Christina Foerster (until 30 June 2024) | 550 | 74,728 |

| Harry Hohmeister (until 30 June 2024) | 550 | 74,728 |

| Detlef Kayser (until 30 June 2024) | 550 | 74,728 |

| Michael Niggemann | 1,100 | 149,457 |

| Remco Steenbergen (until 30 June 2024)1) | – | – |

| Till Streichert (since 15 September 2024) | 421 | 57,209 |

| Grazia Vittadini (since 1 July 2024) | 550 | 74,728 |

| Dieter Vranckx (since 1 July 2024) | 550 | 74,728 |

1) Under the severance agreement, Remco Steenbergen is not entitled to the LTI 2024.

The final number of virtual shares at the end of the four-year performance period depends on the achievement of the financial performance targets Adjusted ROCE (50%) and relative total shareholder return (30%), as well as the strategic and sustainability targets (20%). The Supervisory Board has specified the “Environment” parameter as a core area of focus for the strategic and sustainability targets in the LTI 2024. This provides a long-term incentive for the environmental policy goal of reducing carbon emissions.

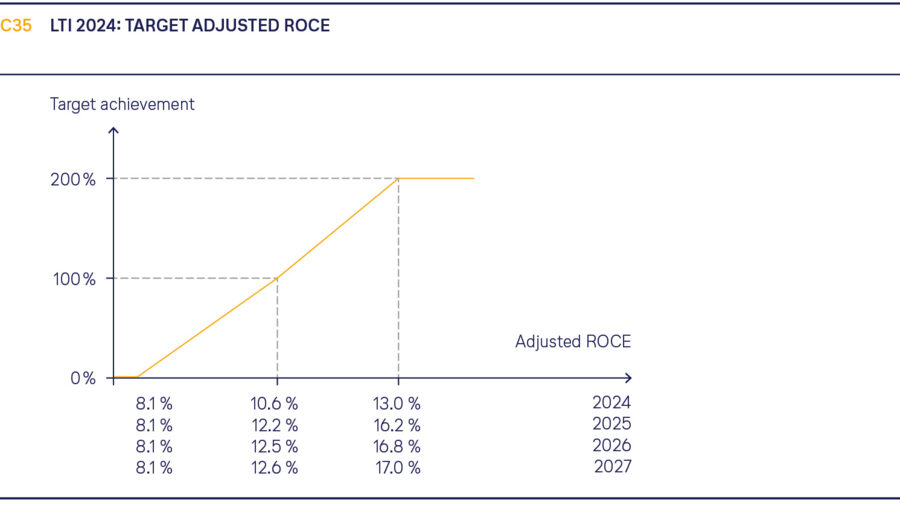

Performance against the target of Adjusted ROCE is measured by comparing the average Adjusted ROCE over the four-year performance period with a target set by the Supervisory Board at the beginning of the performance period for each year of the programme. The Supervisory Board aligns this target with the Group’s four-year operational plans, with the lower limit set to cover the weighted average cost of capital (WACC). This is in line with the strategic objective of earning a return on capital employed that exceeds the long-term cost of capital.

The Supervisory Board determines the target performance for each year based on the actual figures and the defined performance curve. Interim figures are interpolated on a straight-line basis. Overall target achievement is measured at the end of the four-year performance period as the average of the target achievements for the individual years. The following chart shows the targets for the LTI 2024.

The actual average Adjusted ROCE reached in the financial years making up the four-year performance period and the resulting levels of target achievement are published in the remuneration report for the financial year at the end of the respective performance period.

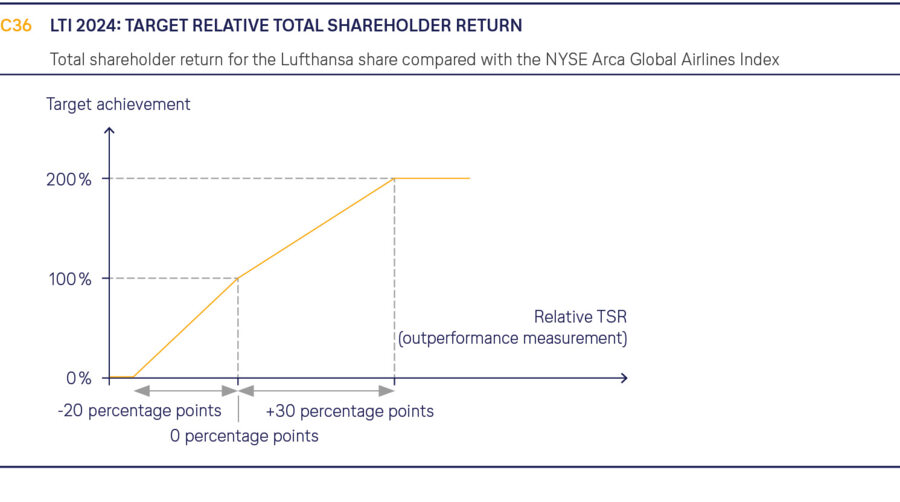

TSR performance for the LTI 2024 is calculated at the end of the four-year performance period by comparing the share return for Deutsche Lufthansa AG with the share return for the NYSE Arca Global Airlines Index. To calculate the TSR performance, the average price for the Deutsche Lufthansa AG share for the last 60 exchange trading days before the start of the performance period is compared with the average share price for the last 60 exchange trading days before the end of the performance period. Fictitiously reinvested dividends are taken into consideration. TSR performance is measured in the same way for the NYSE Arca Global Airlines Index. The relative TSR is then measured as the difference between the TSR performance of Deutsche Lufthansa AG and the TSR performance of the NYSE Arca Global Airlines Index in percentage points (outperformance).

On this basis, the target achievement is calculated at the end of the four-year performance period using the defined performance curve. The design of the performance curve includes the standard market elements of share-based remuneration components on the European market. Target achievement is 100% if the TSR of Deutsche Lufthansa AG corresponds to the TSR for the peer group index. If the relative TSR is 20 percentage points or less, the target achievement is zero. If the relative TSR is 30 percentage points or more, the target achievement is 200%. Interim figures are interpolated on a straight-line basis.

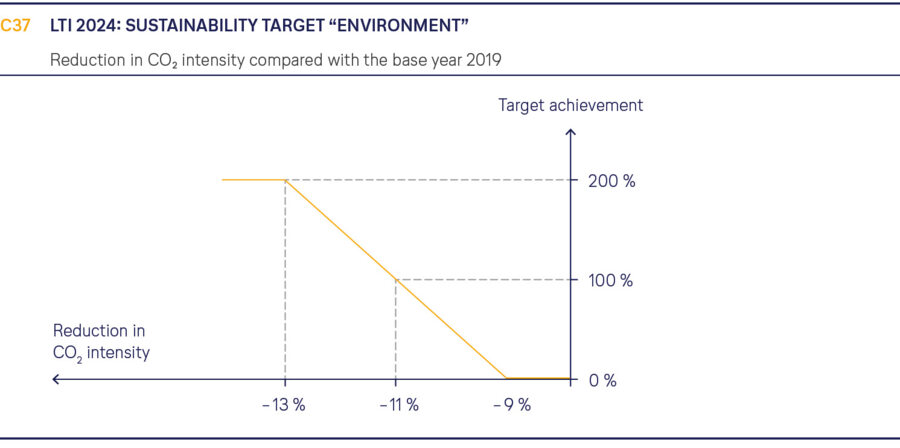

The “Environment” sustainability target is based on the Lufthansa Group’s long-term strategy. Since 2022, the Lufthansa Group’s carbon reduction targets have been based on the industry-wide and internationally acknowledged Science Based Targets initiative (SBTi), which are in line with the targets set by the Paris Climate Agreement. The Lufthansa Group thus undertakes to achieve a scientifically based intensity target relating to its specific carbon emissions, measured in terms of grammes per revenue tonne-kilometre. The reduction target for the 2024 LTI is based on the long-term target of a 30.6% reduction in specific carbon emissions by 2030 compared with the 2019 base year (Combined non-financial declaration). The target for the LTI 2024 is an 11 percentage point reduction in carbon intensity by the end of the performance period on 31 December 2027. The end points of the range are defined by a deviation of +/– 2 percentage points from the target. Interim figures are interpolated on a straight-line basis.

To calculate performance, the level of target achievement in terms of the reduction of specific carbon emissions is determined at the end of the four-year performance period. This is then counted towards the overall level of target achievement for the LTI 2024 at the end of the performance period with a weighting of 20%.

To obtain the final number of virtual shares, the number of virtual shares granted conditionally is multiplied by the total target achievement, which comprises the weighted financial and sustainability performance targets, at the end of the performance period. To calculate the payment amount, the final number of virtual shares is multiplied by the average Lufthansa share price over the last 60 trading days of the performance period, plus dividends paid during the performance period for the final number of shares. Payment is generally in cash.

Long-term variable remuneration 2021 (LTI 2021)

The long-term variable remuneration commitment for the financial year 2021 (LTI 2021) is also share-based. At the beginning of the performance period, Executive Board members received a number of virtual shares corresponding to the contractually agreed target amount. As with the LTI 2024, the number of virtual shares is determined with reference to the average price of the Lufthansa share in the first 60 trading days after the four-year performance period begins. The average price for the LTI 2021 is EUR 7.93 after adjustment for the effects of the capital increase in financial year 2021.

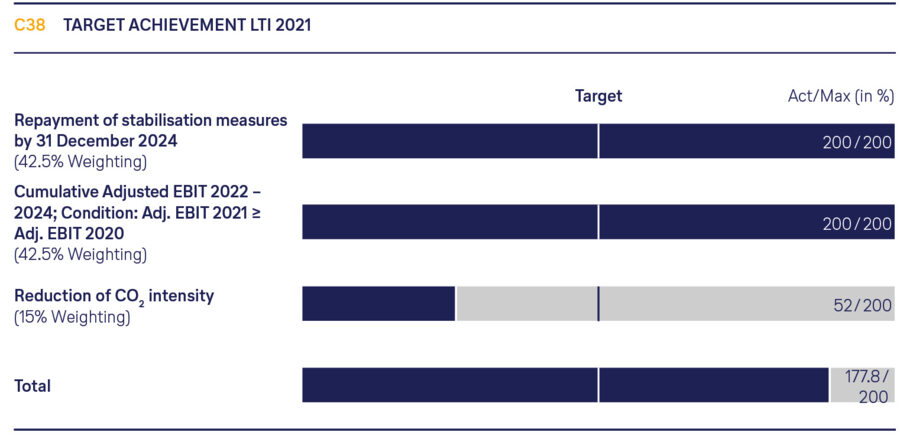

The final number of virtual shares in the LTI 2021 depends on the achievement of the financial performance targets set by the Supervisory Board for the LTI 2021 (85%), as well as the strategic and sustainability targets (15%).

Against the backdrop of the changing demands imposed by the coronavirus pandemic, the Supervisory Board temporarily chose different performance criteria for the LTI 2021 from those in the remuneration system that applied at the time. The aim was to set the focus squarely on long-term crisis management, company restructuring, repayment of the stabilisation measures and a return to profitability. Accordingly, the Supervisory Board stated its intention to deviate from the remuneration system in financial year 2022 and defined the performance criteria for the LTI 2021 as the repayment of the stabilisation measures and a return to profitability, as measured by cumulative Adjusted EBIT for the period from 2022 to 2024 (instead of relative TSR versus the DAX and Adjusted ROCE over four years). These deviations were consistent with the changes in focus as a result of the coronavirus crisis in terms of the corporate and financial strategy and were thus in the interests of the Company’s long-term prosperity. The two financial performance criteria set by the Supervisory Board each have a weighting of 42.5% in the assessment of target achievement for the LTI 2021.

The Supervisory Board defined the “Environment” parameter as a focus topic for the sustainability target for the LTI 2021. This was because sustainability remained a key objective of the long-term corporate strategy, notwithstanding the coronavirus crisis. For the environmental objective, the IATA targets for fuel efficiency were applied, i.e. the average kerosene consumption to carry a passenger 100 kilometres, which provide for an improvement of 1.5% p.a. in specific fuel consumption and thus an improvement in specific carbon emissions.

The Supervisory Board defined the 100% target as a 7.5% improvement in specific fuel consumption by the end of the four-year performance period, compared with the base year 2019. The end points of the range are defined by a deviation of +/– 5 percentage points from the target. Interim figures are interpolated on a straight-line basis.

The measurement of environmental target achievement is based on a comparison of the improvement in specific fuel consumption between 2019 and the end of the programme on 31 December 2024, with the strategic target defined by the Supervisory Board before the commitment.

The Lufthansa Group reduced its specific fuel consumption by 5.1% compared with 2019. The overall level of target achievement for the “Environment” parameter is therefore 52%.

The following table shows the target, lower and upper limits for the financial performance criteria and the sustainability target “Environment” set by the Supervisory Board for the LTI 2021, along with the target achievement for each.

| T214 | 2021 LTI: FINANCIAL TARGETS – TARGET AND TARGET ACHIEVEMENT | ||||

|---|---|---|---|---|---|

| Objective | Target achievement | ||||

| 0% | 100% | 200% | in % | ||

| Repayment of the stabilisation measures by 31 December 2024 | Repayment of 25% of the silent participations | Repayment of 75% of the silent participations | Repayment of 100% of the silent participations and full repayment of the equity investment | Stabilisation measures fully concluded in September 2022 | 200 |

| Cumulative Adjusted EBIT 2022–2024 (condition: Adj. EBIT 2021 ≥ Adj. EBIT 2020) | EUR 1bn | EUR 2bn | EUR 4bn | EUR 5.84bn (condition satisfied) |

200 |

| Reduction in carbon emissions compared with 2019 | -2.5% | -7.5% | -12.5% | -5.1% | 52 |

Overall, the level of target achievement for the long-term variable remuneration for the 2021 financial year is thus 177.8%.

To calculate the payment amount from the LTI 2021 at the end of the performance period, the number of virtual shares granted conditionally is first multiplied by the total target achievement, which is made up of the weighted financial and sustainability performance targets, in order to obtain the final number of virtual shares. The final number of virtual shares is then multiplied by the average Lufthansa share price over the last 60 trading days of the performance period, plus the dividends paid over the course of the programme. The average share price at the end of the programme is EUR 6.40 for the LTI 2021. Adding the dividend of EUR 0.30 per share paid to shareholders for the financial year 2023 means the payment amount for the LTI 2021 is obtained by multiplying the final number of virtual shares by EUR 6.70. No dividend payment requiring inclusion here was made in the financial years 2021 and 2022. The following table shows the calculation of the individual payments for eligible Executive Board members.

| T215 | Payment amounts under LTI 2021 - overall level of target achievement 177.8% | |||

|---|---|---|---|---|

| Executive Board | Target amount in € thousands |

Number of conditionally committed shares (start price: € 7.931)) |

Final number of virtual shares |

Payment amount in € thousands (final price: €6.40, plus €0.30 dividend) |

| Carsten Spohr | 2,090 | 263,556 | 468,603 | 3,140 |

| Christina Foerster (until 30 June 2024) | 1,100 | 138,714 | 246,633 | 1,652 |

| Harry Hohmeister (until 30 June 2024) | 1,100 | 138,714 | 246,633 | 1,652 |

| Detlef Kayser (until 30 June 2024) | 1,100 | 138,714 | 246,633 | 1,652 |

| Michael Niggemann | 1,100 | 138,714 | 246,633 | 1,652 |

| Remco Steenbergen (until 30 June 2024)2) | 1,100 | 138,714 | – | – |

1) After adjustment for the effects of the capital increase in the 2021 financial year.

2) Under the severance agreement, Remco Steenbergen is not entitled to the LTI 2024.

Malus and clawback rule

In the event of an intentional or grossly negligent breach of statutory obligations or internal policies (compliance penalty or clawback), or if variable remuneration components dependent on achieving certain targets are paid on the basis of false data (performance clawback), the Supervisory Board has the right to withhold or demand repayment of the one-year and long-term variable remuneration. Enforcement of the withholding or repayment claim is at the professional discretion of the Supervisory Board.

The Supervisory Board did exercise the right to withhold or demand repayment of variable remuneration components in financial year 2024.

Share Ownership Guidelines

The Share Ownership Guidelines (SOG) have been an integral part of the remuneration system for the Executive Board since 2019. They oblige the CEO to acquire Lufthansa shares worth twice his basic salary and ordinary Executive Board members to acquire shares worth one year’s gross basic salary and to hold them for their term of office and beyond. Executive Board members must demonstrate annually that they meet this obligation.

For the Executive Board members active before 1 January 2023, i.e. Carsten Spohr and Michael Niggemann, the minimum number of Lufthansa shares to be purchased was determined at the beginning of the term of office based on the average share price over the 125 trading days before the service contract begins. Till Streichert, Grazia Vittadini and Dieter Vranckx, the new Executive Board members appointed in the 2024 financial year, are obliged to purchase a number Lufthansa shares corresponding to the values of their respective annual salaries.

To build up a share portfolio, shares are to be acquired by all Executive Board members over a four-year period. Shareholdings acquired beforehand can be included in the calculation. To determine whether the SOG are met, these shares are included at the average price of the Lufthansa share in the 60 trading days prior to the start of Executive Board mandates.

| T216 | SHAREHOLDINGS OF EXECUTIVE BOARD MEMBERS ACTIVE IN FINANCIAL YEAR 2024 | |

|---|---|---|

| Number of Lufthansa shares which must be held according to SOG |

Shareholdings as of 31.12.2024 | |

| Carsten Spohr | 180,596 shares | 340,450 shares |

| Michael Niggemann | 56,126 shares | 100,000 shares |

| Till Streichert (since 15.9.2024) | €1,118,000 | €1,159,488 |

| Grazia Vittadini (since 1.7.2024) | €860,000 | – |

| Dieter Vranckx (since 1.7.2024) | €860,000 | €259,466 |

The shares acquired in accordance with the SOG are to be held until the end of the service contract with the Executive Board member. After stepping down, Executive Board members may sell 25% of their SOG shares per year.

Retirement benefits

The members of the Executive Board receive retirement benefit commitments based on a defined contribution plan. For the duration of their employment, every Executive Board member receives a fixed annual amount credited to their personal pension account. For the 2024 financial year, this amounts to EUR 990k for Carsten Spohr, the Chief Executive Officer, EUR 585k for Remco Steenbergen or Till Streichert, as applicable, nominated by the Supervisory Board as an outstanding Executive Board member - pro rata for their period of office on the Executive Board - and to EUR 450k for the other ordinary Executive Board members.

The investment guidelines are based on the investment model for the Lufthansa Pension Trust, which also applies to staff members of Deutsche Lufthansa AG.

Retirement benefits are paid when the beneficiary reaches the retirement age of 60 years (if they are no longer an Executive Board member) or in the event of disability or death. Where an employment relationship ends before retirement age is reached, the beneficiaries or their surviving dependants acquire a retirement benefit credit as defined in the investment concept. Deutsche Lufthansa AG guarantees the amounts paid into the retirement benefit account.

A supplementary risk capital sum will be added to the pension credit in the event of a claim for a disability pension or a pension for surviving dependants. This sum consists of the average contributions paid into the pension account over the past three years multiplied by the number of full years by which the claimant is short of the age of 60 from the time pension entitlement arises.

The pension credit is paid out in ten instalments. On application by the Executive Board member or their surviving dependants, a payment as a lump sum or in fewer than ten instalments may also be made, subject to approval by the Company. The pension credits received until 31 December 2018 by Carsten Spohr and Harry Hohmeister may also be paid as an annuity, on application and with the approval of the Company.

Under his contract as a pilot, which is currently not active, Carsten Spohr is entitled to a transitional pension in accordance with the wage agreement on “Transitional pensions for cockpit staff”. In the event that Carsten Spohr steps down from the Executive Board before reaching the age of 60 and resumes his employment as a pilot, he is entitled to draw a “Transitional pension for cockpit staff at Lufthansa” once he turns 60 or on request once he turns 55, in accordance with the provisions of the wage agreement. This additional benefit is paid if certain conditions of eligibility are met and provides for a monthly pension of up to 60% of the last modified salary until the beneficiary reaches the age of 63.

Pension entitlements in financial year 2024

The total amount of pension entitlements earned by active Executive Board members in the 2024 financial year was EUR 4.1m (previous year: EUR 3.3m) according to HGB and EUR 4.3m (previous year: EUR 3.4m) according to IFRS. This was recognised in staff costs (current service cost). The individual service costs and present values of pension entitlements are as follows:

| T217 | PENSION ENTITLEMENTS ACCORDING TO HGB AND IFRS | |||||||

|---|---|---|---|---|---|---|---|---|

| HGB | HGB | IFRS | IFRS | |||||

| Current service costs | Settlement amount of pension obligations | Current service costs | Defined-benefit obligations (DBO) | |||||

| in € thousands | 2024 | 2023 | 31.12.2024 | 31.12.2023 | 2024 | 2023 | 31.12.2024 | 31 Dec 2023 |

| Carsten Spohr | 942 | 958 | 12,150 | 10,493 | 993 | 996 | 12,147 | 10,490 |

| Christina Foerster (until 30 June 2024)1) | 1,072 | 426 | 3,312 | 2,060 | 1,130 | 457 | 3,302 | 2,053 |

| Harry Hohmeister (until 30 June 2024) | 225 | 442 | 2,648 | 4,887 | 225 | 450 | 2,648 | 4,887 |

| Detlef Kayser (until 30 June 2024)2) | 442 | 436 | 3,286 | 2,680 | 450 | 451 | 3,286 | 2,680 |

| Michael Niggemann | 414 | 430 | 2,684 | 2,111 | 460 | 461 | 2,664 | 2,100 |

| Remco Steenbergen (until 30 June 2024) | 244 | 589 | 1,997 | 1,635 | 304 | 601 | 1,995 | 1,634 |

| Till Streichert (since 15 September 2024) | 234 | – | 234 | – | 228 | – | 228 | – |

| Grazia Vittadini (since 1 July 2024) | 262 | – | 263 | – | 259 | – | 260 | – |

| Dieter Vranckx (since 1 July 2024) | 280 | – | 281 | – | 275 | – | 276 | – |

| Total | 4,115 | 3,281 | 26,855 | 23,866 | 4,324 | 3,416 | 26,806 | 23,844 |

1) Including the contributions to company retirement benefits for Christina Foerster until 30 June 2026.

2) Including the contributions to company retirement benefits for Detlef Kayser until 31 December 2024.

End-of-service benefits

Cap on severance pay

If a contract is terminated early for reasons other than good cause or a change of control, the Company will not remunerate more than the value of outstanding entitlements for the remainder of the contract, as recommended by the German Corporate Governance Code, whereby these payments may not exceed annual remuneration for two years (severance cap). The cap on severance pay is determined by the annual remuneration, which is made up of the basic salary and the target amounts of one-year and long-term variable remuneration; in-kind benefits and ancillary benefits are not considered. This means the maximum severance pay for an ordinary Executive Board member is currently EUR 5,120,000 per annum. An outstanding Executive Board member can receive a maximum of EUR 6,656,000 and the CEO a maximum of EUR 11,264,000.

Remuneration of Executive Board members who stepped down in the reporting year

Severance agreement with Christina Foerster

The employment contract with Christina Foerster was terminated prematurely with effect from 30 June 2024 in accordance with a Supervisory Board resolution of 22 February 2024 and the corresponding severance agreement. In line with the severance payment agreement, Christina Foerster will receive a severance payment of EUR 5.12m. The severance payment corresponds to the contractually agreed cap of two times annual remuneration, and so does not exceed the amount she would have earned over the remaining 3.5 years of her service contract. The Company waives the post-contractual non-compete clause. There is no entitlement to payment of interim compensation.

Christina Foerster retains her entitlement to one-year and long-term variable remuneration for the 2024 financial year pro rata temporis to 30 June 2024. Christina Foerster retains her full entitlement to long-term variable remuneration for the financial years 2021 to 2023. Payments will be made in line with the programme terms at the end of each performance period on the basis of target achievement as determined by the Supervisory Board.

The Company has made an annual contribution of EUR 450k – pro rata for 2026, i.e. EUR 225k to 30 June 2026 – for retirement benefits to Christina Foerster’s pension account. Existing internal rules for active Executive Board members apply to Christina Foerster’s use of concessionary private travel arrangements until 30 June 2026. The existing internal rules for former Executive Board members will apply to her concessionary private travel arrangements when she reaches the age of 60, subject to the rules on subsequent professional activities.

Termination of the employment contract with Harry Hohmeister.

Harry Hohmeister stepped down from the Executive Board on 30 June 2024 when his employment contract came to an end. Harry Hohmeister receives one-year and long-term variable remuneration for the financial year 2024 pro rata for the period 1 January 2024 to 30 June 2024. Harry Hohmeister retains his full entitlement to long-term variable remuneration for the financial years 2021 to 2023. Payments will be made in line with the programme terms at the end of each performance period on the basis of target achievement as determined by the Supervisory Board. Harry Hohmeister is not entitled to a severance payment. Since a one-year non-compete clause applies, Harry Hohmeister is entitled to an interim compensation payment of EUR 430k. The interim compensation is paid in twelve monthly instalments for the duration of the non-compete clause, i.e. until June 2026.

Existing internal rules for former Executive Board members apply to Mr Hohmeister’s use of concessionary private travel arrangements from 1 July 2024.

Harry Hohmeister’s departure from the Executive Board also means he is entitled to retirement benefits in accordance with the pension commitments for Executive Board members in effect since 1 January 2019. At Harry Hohmeister’s request, and with the Company’s approval, these will be paid as a lump sum (see disclosure in Table ↗ T219). The pension commitment in effect before 1 January 2019 will continue without further contributions.

Severance agreement with Detlef Kayser

The employment contract with Detlef Kayser was terminated prematurely with effect from 30 June 2024 in accordance with a Supervisory Board resolution of 22 February 2024 and the corresponding severance agreement. This provides for a severance payment to Detlef Kayser of EUR 1.28m. This is within the contractually agreed severance cap and does not exceed the remaining duration of the employment contract (0.5 years). The Company waives the post-contractual non-compete clause. There is no entitlement to payment of interim compensation.

Detlef Kayser retains his entitlement to one-year and long-term variable remuneration for the 2024 financial year pro rata temporis until 30 June 2024. Detlef Kayser retains his full entitlement to long-term variable remuneration for the financial years 2021 to 2023. Payments will be made in line with the programme terms at the end of each performance period on the basis of target achievement as determined by the Supervisory Board.

The Company has made the full annual contribution of EUR 450k to 31 December 2024 for retirement benefits to Detlef Kayser’s pension account. Existing internal rules continue to apply to Detlef Kayser’s use of concessionary private travel arrangements and other contractually agreed ancillary benefits until 31 December 2024. The existing internal rules for former Executive Board members will apply to his concessionary private travel arrangements when he reaches the age of 60, subject to the rules on subsequent professional activities.

Severance agreement with Remco Steenbergen

The employment contract with Remco Steenbergen was terminated prematurely with effect from 30 June 2024 in accordance with a Supervisory Board resolution of 22 February 2024 and the corresponding severance agreement. Remco Steenbergen is not entitled to a severance payment. The Company waives the post-contractual non-compete clause. This means he is entitled to payment of half the contractually agreed interim compensation, i.e. EUR 279.5k.

Remco Steenbergen is not entitled to pro rata one-year variable remuneration for financial year 2024 or to long-term variable remuneration for the financial years 2021 to 2024.

The Company has made an annual contribution of EUR 585k – pro rata for 2024, i.e. EUR 292.5k to 30 June 2024 – for retirement benefits to Remco Steenbergen’s pension account. When his employment contract ended, he lost the right to concessionary private travel.

Remuneration awarded and owed in financial year 2024 pursuant to Section 162 AktG

Pursuant to Section 162 AktG, the remuneration report must disclose the remuneration awarded and owed to each current or former member of the Executive Board or Supervisory Board in the past financial year.

Remuneration will be deemed to have been awarded if it fell due in the reporting period and the individual Executive Board member has actually received it (“payment-based perspective”). According to the prevailing legal opinion regarding the interpretation of the term “award” in Section 162 AktG, remuneration components may, as an alternative, already be presented in the remuneration report for the reporting year in which the one-year or long-term activity constituting the basis for this remuneration has been performed in full (“accumulation-based perspective”). This perspective enables transparent reporting that is easy to understand, with the level of performance in the respective reporting year matching the level of remuneration. As in the previous year, the accumulation-based perspective is therefore applied to the term “award” in the present report within the meaning of Section 162 AktG.

Accordingly, the amounts paid out for the STI are shown in the following tables for the reporting year, even though they will be paid out only after the end of the reporting year in question. Similarly, the amounts paid out for the long-term variable remuneration components are indicated in the reporting year in which the performance period ends, even though here too the payment will only be made in the following year.

The following section shows the remuneration awarded and owed to each individual active and former Executive Board member in financial year 2024, in accordance with Section 162 Paragraph 1 Sentence 1 AktG.

As well as the STI for the 2024 financial year, the variable remuneration components awarded in this sense in the financial year include the payment under the 2021 LTI.

Executive Board members active in the financial year

Table T218 shows the remuneration awarded and due to Executive Board members active in financial year 2024 as defined by Section 162 Paragraph 1 Sentence 1 AktG, and the relative proportions of individual fixed and variable remuneration components. Although the expenses for retirement benefit commitments are not classified as awarded or owed remuneration within the meaning of Section 162 Paragraph 1 Sentence 1 AktG, they are also shown in the following tables for the sake of transparency and correspond to the service cost for pensions and other contractually agreed retirement benefits in accordance with IAS 19.

| T218 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG – EXECUTIVE BOARD MEMBERS ACTIVE IN 2024 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carsten Spohr, Chairman of the Executive Board since 1.5.2014; Member of the Executive Board since 1.1.2011 |

Christina Foerster Member of the Executive Board from 1.1.2020 to 30.6.20242) |

Harry Hohmeister Member of the Executive Board from 1.1.2013 to 30.6.20243) |

||||||||||

| in € thousands | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) |

| Fixed remuneration | ||||||||||||

| Basic salary | 1,892 | 36.2% | 1,892 | 41.3% | 430 | 5.9% | 860 | 40.6% | 430 | 18.3% | 860 | 40.4% |

| Ancillary benefits | 55 | 1.1% | 51 | 1.1% | 71 | 1.0% | 39 | 1.8% | 24 | 1.0% | 47 | 2.2% |

| Total | 1,947 | 37.2% | 1,943 | 42.5% | 501 | 6.9% | 899 | 42.4% | 454 | 19.3% | 907 | 42.6% |

| Variable remuneration | ||||||||||||

| One-year variable remuneration | 145 | 2.8% | 2,313 | 50.5% | 33 | 0.5% | 1,051 | 49.6% | 33 | 1.4% | 1,051 | 49.4% |

| Long-term variable remuneration LTI 2021 (LTI 2020) | 3,140 | 60.0% | 321 | 7.0% | 1,652 | 22.6% | 169 | 8.0% | 1,652 | 70.2% | 169 | 7.9% |

| Total | 3,285 | 62.8% | 2,634 | 57.5% | 1,685 | 23.1% | 1,220 | 57.6% | 1,685 | 71.6% | 1,220 | 57.4% |

| Other | 0 | 0.0% | 0 | – | 5,120 | 70.1% | 0 | – | 215 | 9.1% | 0 | – |

| Total remuneration as defined in Section 162 AktG | 5,232 | 100.0% | 4,577 | 100.0% | 7,306 | 100.0% | 2,119 | 100.0% | 2,354 | 100.0% | 2,127 | 100.0% |

| Service cost | 993 | – | 996 | – | 1,130 | – | 457 | – | 225 | – | 450 | – |

| Total remuneration | 6,225 | – | 5,573 | – | 8,436 | – | 2,576 | – | 2,579 | – | 2,577 | – |

| 1) The relative proportions indicated here relate to the total remuneration shown in the table as defined in Section 162 AktG excluding retirement benefit expenses. 2) The severance payment of two annual salaries made to Christina Foerster under the severance agreement is shown under “Other”. 3) The monthly payment of interim compensation made to Harry Hohmeister in the 2024 financial year under the severance agreement is shown under “Other”. |

||||||||||||

| T218 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG – EXECUTIVE BOARD MEMBERS ACTIVE IN 2024 (continued) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Detlef Kayser Member of the Executive Board from 1.1.2019 to 30.6.20242) |

Michael Niggemann Member of the Executive Board since 1.1.2020 |

Remco Steenbergen Member of the Executive Board from 1.1.2021 to 7.5.20243) |

||||||||||

| in € thousands | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) |

| Fixed remuneration | ||||||||||||

| Basic salary | 430 | 12.5% | 860 | 40.6% | 860 | 32.9% | 860 | 40.6% | 559 | 62.0% | 1,118 | 31.7% |

| Ancillary benefits | 23 | 0.7% | 37 | 1.7% | 37 | 1.4% | 38 | 1.8% | 63 | 7.0% | 63 | 1.8% |

| Total | 453 | 13.2% | 897 | 42.4% | 897 | 34.3% | 898 | 42.4% | 622 | 69.0% | 1,181 | 33.5% |

| Variable remuneration | ||||||||||||

| One-year variable remuneration | 33 | 1.0% | 1,051 | 49.6% | 66 | 2.5% | 1,051 | 49.6% | – | – | 1,367 | 38.8% |

| Long-term variable remuneration LTI 2021 (LTI 2020) | 1,652 | 48.0% | 169 | 8.0% | 1,652 | 63.2% | 169 | 8.0% | – | – | – | – |

| Total | 1,685 | 49.0% | 1,220 | 57.6% | 1,718 | 65.7% | 1,220 | 57.6% | – | – | 1,367 | 38.8% |

| Other | 1,302 | 37.8% | – | – | – | – | – | – | 279 | 31.0% | 975 | 27.7% |

| Total remuneration as defined in Section 162 AktG | 3,440 | 100.0% | 2,117 | 100.0% | 2,615 | 100.0% | 2,118 | 100.0% | 901 | 100.0% | 3,523 | 100.0% |

| Service cost | 450 | – | 451 | – | 460 | – | 461 | – | 304 | – | 601 | – |

| Total remuneration | 3,890 | – | 2,568 | – | 3,075 | – | 2,579 | – | 1,205 | – | 4,124 | – |

| 1) The relative proportions indicated here relate to the total remuneration shown in the table as defined in Section 162 AktG excluding retirement benefit expenses. 2) The severance payment of EUR 1,280k, plus ancillary benefits of EUR 22k for the period 1 July to 31 December 2024 made to Detlef Kayser under the severance agreement, are shown under “Other”. 3) The employment contract with Remco Steenbergen was terminated prematurely with effect from 30 June 2024 in accordance with the corresponding severance agreement. He received his basic salary and contractual ancillary benefits until this time. The payment of interim compensation made to Remco Steenbergen under the severance agreement is shown under “Other”. The disclosures for Remco Steenbergen for 2023 include the portion of the one-off payment made in 2023 for the loss of benefits from his previous employer. The Supervisory Board agreed to pay these disclosures to Remco Steenbergen when he was first appointed. The compensation was paid in three instalments of EUR 975k in the financial years 2021, 2022 and 2023, and is not offset against the maximum remuneration for those years as defined in Section 87a Paragraph 1 Sentence 2 No. 1 AktG. |

||||||||||||

| T218 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG – EXECUTIVE BOARD MEMBERS ACTIVE IN 2024 (continued) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Till Streichert Member of the Executive Board since 15.9.2024 |

Grazia Vittadini Member of the Executive Board since 1.7.2024 |

Dieter Vranckx Member of the Executive Board since 1.7.2024 |

||||||||||

| in € thousands | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) | 2024 | 20241) | 2023 | 20231) |

| Fixed remuneration | ||||||||||||

| Basic salary | 329 | 34.5% | – | – | 430 | 85.1% | – | – | 430 | 83.3% | – | – |

| Ancillary benefits | 37 | 3.9% | – | – | 42 | 8.3% | – | – | 53 | 10.3% | – | – |

| Total | 366 | 38.4% | – | – | 472 | 93.5% | – | – | 483 | 93.6% | – | – |

| Variable remuneration | ||||||||||||

| One-year variable remuneration | 25 | 2.6% | – | – | 33 | 6.5% | – | – | 33 | 6.4% | – | – |

| Long-term variable remuneration LTI 2021 (LTI 2020) | – | – | – | – | – | – | – | – | – | – | – | – |

| Total | 25 | 2.6% | – | – | 33 | 6.5% | – | – | 33 | 6.4% | – | – |

| Other | 563 | 59.0% | – | – | – | – | – | – | – | – | ||

| Total remuneration as defined in Section 162 AktG | 954 | 100.0% | – | – | 505 | 100.0% | – | – | 516 | 100.0% | – | – |

| Service cost | 228 | – | – | – | 259 | – | – | – | 275 | – | – | – |

| Total remuneration | 1,182 | – | – | – | 764 | – | – | – | 791 | – | – | – |

| 1) The relative proportions indicated here relate to the total remuneration shown in the table as defined in Section 162 AktG, excluding retirement benefit expenses. 2) The Supervisory Board agreed to pay Till Streichert gross compensation of €1,690,000 for the loss of benefits from his previous employer. The compensation is paid in three instalments of EUR 563k each in 2024, 2025 and 2026, and is not offset against the maximum remuneration for those financial years as defined in Section 87a Paragraph 1 Sentence 2 No. 1 AktG. |

||||||||||||

In financial year 2024, the members of the Executive Board received no benefits or promises of benefits from third parties relating to their work on the Executive Board.

Former Executive Board members

Table T219 shows the remuneration awarded and due to former Executive Board members in financial year 2024 in accordance with Section 162 Paragraph 1 sentence 1 AktG. In accordance with Section 162 Paragraph 5 AktG, no personal data was disclosed for former Executive Board members who left the Executive Board before 31 December 2014.

| T219 | REMUNERATION AWARDED AND DUE IN ACCORDANCE WITH SECTION 162 PARAGRAPH 1 SENTENCE 1 AKTG - FORMER EXECUTIVE BOARD MEMBERS | ||

|---|---|---|---|

| in € thousands | Ancillary benefits |

Lump-sum pension payment |

Total |

| Karl Ulrich Garnadt Member of the Executive Board until 30 Apr 2017 |

3 | 128 | 131 |

| Harry Hohmeister Member of the Executive Board until 30 Jun 2024 |

– | 2,658 | 2,658 |

| Ulrik Svensson Member of the Executive Board until 30 Apr 2020 |

1 | – | 1 |

| Bettina Volkens Member of the Executive Board until 31 Dec 2019 |

3 | – | 3 |

Total current payments and other benefits to former Executive Board members (including the individual payments shown in Table T219) and their surviving dependants came to EUR 4.1m in the reporting year (previous year: EUR 9.2m). This includes non-cash benefits and concessionary travel. Pension obligations toward former Executive Board members and their surviving dependants amount to EUR 48.8m (previous year: EUR 49.7m).

Ongoing development of the remuneration system for Executive Board members for financial years from 2025 onwards

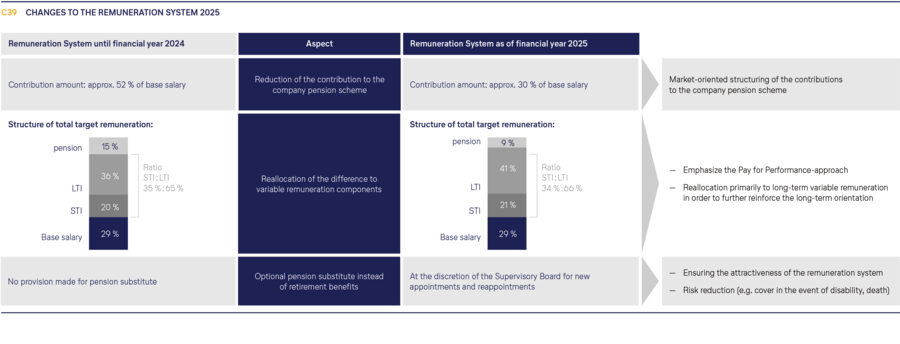

The Supervisory Board, based on a recommendation from the Steering Committee, has adopted changes to the remuneration system approved by the Annual General Meeting on 7 May 2023 which take effect from the 2025 financial year. The changes are based on a comprehensive review by the Supervisory Board of the existing remuneration system to ensure it is appropriate and reflects proposals from investors.

The new remuneration system is to enter into force from 1 January 2025 for all new appointments and contract renewals.

The revised remuneration system adopted by the Supervisory Board will be presented for approval to the Annual General Meeting on 6 May 2025 in accordance with Section 120a Paragraph 1 AktG. The key changes to the remuneration system for the members of the Executive Board are clarified below. Shareholders are referred to the invitation to the Annual General Meeting for a complete description of the system being put to the vote.

Reduction of the contribution to company retirement benefits and reallocation of the difference to variable remuneration components.

The amount of the contribution to retirement benefits is to be reduced to 30% of the basic salary for new appointments to the Executive Board and contract renewals from 1 January 2025. The difference to the previous contribution is to be reallocated to the one-year and long-term variable remuneration components. The amount of total target remuneration is therefore unchanged. At the same time, the pay-for-performance approach is strengthened. To further strengthen the long-term focus, most of the amount will be reallocated to long-term variable remuneration (LTI).

Introduction of an option for the Supervisory Board to award cash allowances

As a rule, Executive Board members will continue to receive retirement benefit commitments on the basis of a defined-contribution system. However, the Supervisory Board is to have the option of awarding Executive Board members a cash allowance instead of contributions to retirement benefits when they are first appointed or their contracts are renewed.