Report of the Supervisory Board

Karl-Ludwig Kley

Chairman of the Supervisory Board

Ladies and gentlemen, dear shareholders,

The Lufthansa Group can look back on another very challenging financial year. The tail-end effects of the coronavirus crisis are still making themselves felt throughout the airline industry. These include delays in aircraft deliveries and the need for newly hired staff to build up experience. The start of the 2024 financial year was shaped by strikes and thus placed great demands on passengers and employees. We revised our annual forecast twice: at the start of the second quarter due to the impacts of the strikes, and at the start of the third quarter on account of the market-related decline in yields in all our traffic regions, especially in Asia. We thus fell significantly short of our goal of an Adjusted EBIT margin of not less than 8% in the 2024 financial year. At the same time, however, the European Commission’s approval of our acquisition of a stake in ITA Airways and the closing of our sale of the payment provider Lufthansa AirPlus Servicekarten GmbH to Sweden’s SEB Kort were strategically important steps enabling the Lufthansa Group to more strongly focus on its core airline business segment.

In the 2024 financial year, the Supervisory Board oversaw the work of the Executive Board members and provided advice. It carried out the duties conferred on it by statute, the Company’s Articles of Association and its internal regulations. The Executive Board regularly provided the Supervisory Board with full and timely information on the course of business, the competitive environment, planned Company policy and significant strategic and operational decisions. Specifically, the Executive Board notified it of the Company’s economic situation and the challenging competitive environment in the current geopolitical context. Throughout the year, the Executive Board provided the Supervisory Board with regular reports, covering the current course of business in particular, including between meetings. As Chairman of the Supervisory Board, I read the minutes of the Executive Board meetings and discussed the current situation and the course of business with the Chairman of the Executive Board and other members of the Executive Board on an ongoing basis.

The Supervisory Board held a total of five meetings in the 2024 financial year; four ordinary meetings and one extraordinary meeting covering the Executive Board’s restructuring. At its plenary sessions and committee meetings, the Supervisory Board had sufficient opportunity to discuss the reports and proposals for resolutions from the Executive Board. When doing so, the Supervisory Board and its committees also met without the members of the Executive Board. Where significant events occurred, the Executive Board offered information sessions providing a broader picture of current developments. A large number of Supervisory Board members attended these information sessions.

Key topics discussed by the Supervisory Board

Our meetings focused on the economic development of Deutsche Lufthansa AG and its equity investments. In particular, these meetings covered the improvement in flight operational procedures, the challenging competitive environment, with exceptionally demanding conditions in Germany and Europe, and the progress made in the acquisition of shares in ITA Airways. At the same time, regular information was provided on the measures implemented under the turnaround programme established in order to achieve an operational and financial improvement in our Lufthansa Airlines core brand: unlike in many previous years, our Lufthansa Airlines core brand is currently not contributing to the Lufthansa Group’s financial success. The Supervisory Board also dealt with Lufthansa Technik AG’s “Ambition 2030” growth programme.

At its meeting held on 6 May 2024, the Supervisory Board approved an increase in the volume of capital expenditure in order to refit the cabin equipment of 19 Boeing 747-8s and 17 Airbus A350-900s of Lufthansa Airlines as well as twelve SWISS Boeing 777-3s for the Lufthansa Group’s new long-haul product. This increase was necessitated by significant price rises.

The meeting on 18 September 2024, which took place in Brussels, was dedicated to the Group’s ongoing strategic development. The Supervisory Board discussed this in detail with the Executive Board. The corporate strategy was updated on this basis and approved at the Supervisory Board meeting on 5 December 2024. At its September meeting, the Supervisory Board also agreed to an adjustment of the internal regulations for the Executive Board as well as capital expenditure for the construction of a new Lufthansa Technik AG production facility in Portugal.

At its meeting of 5 December 2024, the Supervisory Board approved the core elements of the budget for the 2025 financial year as well as the medium-term financial planning for the period from 2026 to 2028. This meeting also adopted a political resolution “For a sovereign Europe – rethinking air traffic” which was sent to key European and German political decision-makers. At this meeting, the Supervisory Board also discussed reports on environmental, social and governance issues (ESG), risk management including internal control systems, cybersecurity and compliance. It also examined the progress review for (equity) investment transactions previously approved by the Supervisory Board.

Finally, at the end of the year, on 20 December 2024, the Supervisory Board approved by circular resolution the purchase of five additional Airbus A350-1000 long-haul aircraft.

Changes to the Executive Board

At an extraordinary meeting on 22 February 2024, the Supervisory Board followed a recommendation of its Steering Committee and voted to carry out a wide-ranging reorganisation of the Executive Board. In particular, this entails a reduction in the size of the Executive Board from six to five members and a reorganisation of the various members’ areas of responsibility. The changes to the Executive Board’s division of responsibilities which were approved at this meeting came into effect as of 1 July 2024.

As part of this reorganisation, Christina Foerster, Harry Hohmeister and Detlef Kayser left the Executive Board on 30 June 2024, while Remco Steenbergen did so at the close of 7 May 2024, the date of the 2024 Annual General Meeting. The Supervisory Board would like to thank the former Executive Board members for their commitment, their achievements and their outstanding loyalty, above all in leading the Company out of the coronavirus crisis.

At this meeting, on the recommendation of the Steering Committee, the Supervisory Board appointed Grazia Vittadini and Dieter Vranckx to the Executive Board with effect from 1 July 2024 for a three-year term ending 30 June 2027. As of 1 July 2024, Grazia Vittadini took charge of the MRO & IT function and Dieter Vranckx did so for Global Markets & Commercial Management Hubs.

On 5 May 2024, at the recommendation of the Steering Committee, the Supervisory Board appointed Till Streichert to the Executive Board with effect from 15 September 2024 for a three-year term ending 14 September 2027. He is responsible for Finance. Following the departure of Remco Steenbergen and up to the appointment of Till Streichert, Michael Niggemann took charge of Finance in addition to his other responsibilities.

Adjustment of Executive Board remuneration

At its meeting held on 5 December, on the recommendation of the Steering Committee the Supervisory Board resolved adjustments to the remuneration system for the members of the Executive Board which had been approved by the 2023 Annual General Meeting. These changes are based on a comprehensive review by the Supervisory Board of the existing remuneration system. They reflect proposals from investors regarding the Executive Board members’ retirement benefits. Remuneration report.

In this context, the Supervisory Board also considered the appropriateness of the Executive Board’s remuneration and confirmed this. The new system will be presented to the 2025 Annual General Meeting for approval.

Changes in the Supervisory Board

The Supervisory Board mandates of Britta Seeger and Michael Kerkloh expired at the close of the Annual General Meeting on 7 May 2024. To ensure that the members of the Supervisory Board continue to have terms of office of uniform duration and thus to maintain a “staggered board" system, Thomas Enders and Harald Krüger resigned their seats on the Supervisory Board with effect as of the close of the Annual General Meeting on 7 May 2024. Sara Hennicken was elected for the first time, while Thomas Enders, Harald Krüger and Britta Seeger were re-elected to the Supervisory Board, in each case for a period of three years. The Supervisory Board would like to thank Michael Kerkloh for assuming his responsibilities and for his constructive and dedicated service on the Board.

The membership of the Audit Committee remained unchanged in the period up to the close of the Annual General Meeting on 7 May 2024. Karl Gernandt was elected to serve on the Audit Committee following Michael Kerkloh’s resignation from the Supervisory Board.

Attendance at meetings

Overall, the Supervisory Board members had an attendance rate of 99% for all of the meetings of the Supervisory Board and its committees in 2024. With the exception of Sara Hennicken, all Supervisory Board members were consistently present, either in person or virtually, at all Supervisory Board meetings and those of its committees on which the respective member serves. Following her election to the Supervisory Board in May 2024, Sara Hennicken was unable to attend December’s meeting since Fresenius SE’s supervisory board meeting took place at the same time.

The meetings of the Supervisory Board and its committees generally take place in-person, but in justified individual cases, video conferences may also be held. With the exception of the extraordinary Supervisory Board meeting of 22 February 2024, all the Supervisory Board meetings of Deutsche Lufthansa AG and its committees were held in-person.

| T005 | INDIVIDUAL ATTENDANCE RATES 2024 | |||||

|---|---|---|---|---|---|---|

| Supervisory Board | Steering Committee | Audit Committee |

Nomination Committee |

ESG Committee |

Attendance rate in % (all meetings) | |

| Karl-Ludwig Kley, Chairman | 5/5 | 4/4 | 2/2 | 100% | ||

| Christine Behle, Deputy Chairwoman | 5/5 | 4/4 | 100% | |||

| Tim Busse | 5/5 | 100% | ||||

| Erich Clementi | 5/5 | 2/2 | 100% | |||

| Thomas Enders | 5/5 | 4/4 | 2/2 | 100% | ||

| Karl Gernandt | 5/5 | 3/3 | 100% | |||

| Sara Grubisic | 5/5 | 2/2 | 100% | |||

| Sara Hennicken (since 7 May 2024) | 1/2 | 50% | ||||

| Christian Hirsch | 5/5 | 4/4 | 100% | |||

| Jamila Jadran | 5/5 | 100% | ||||

| Arne Christian Karstens | 5/5 | 5/5 | 100% | |||

| Michael Kerkloh (until 7 May 2024) | 3/3 | 2/2 | 100% | |||

| Carsten Knobel | 5/5 | 5/5 | 100% | |||

| Holger Benjamin Koch | 5/5 | 5/5 | 100% | |||

| Harald Krüger | 5/5 | 5/5 | 2/2 | 100% | ||

| Marvin Reschinsky | 5/5 | 2/2 | 100% | |||

| Birgit Rohleder | 5/5 | 100% | ||||

| Britta Seeger | 5/5 | 100% | ||||

| Astrid Stange | 5/5 | 100% | ||||

| Angela Titzrath | 5/5 | 2/2 | 100% | |||

| Klaus Winkler | 5/5 | 5/5 | 100% | |||

Corporate governance

We once again carried out a self-assessment of our working practices on the Supervisory Board in the 2024 financial year, on the basis of a detailed questionnaire, and discussed this subject at our meeting on 5 March 2025. In addition, the members of the Supervisory Board – in particular, the members of the ESG and Audit Committees – attended several training events offered by the Company over the course of the 2024 financial year. The topics covered included, in particular, training on the European Corporate Sustainability Reporting Directive (CSRD Directive) and the Lufthansa Group’s network and partner management. The Supervisory Board moreover received training in the fields of IT security, international aviation policy and the Lufthansa Group’s HR planning. In addition, it visited Eurocontrol in Brussels. The Supervisory Board was also offered the opportunity to attend information events relating to current issues such as the level of progress made in the Company’s acquisition of ITA Airways and its earnings performance in the second quarter of 2024.

In September 2024, the Supervisory Board and the Executive Board issued an updated declaration of compliance with the German Corporate Governance Code. The Supervisory Board also adopted an updated qualification matrix for its members at this meeting. At its March 2025 meeting, it then made further changes to this qualification matrix in line with the requirements of the CSRD Directive. www.lufthansagroup.com/corporate_governance_declaration. No conflicts of interest were disclosed in the 2024 financial year.

Work of the committees

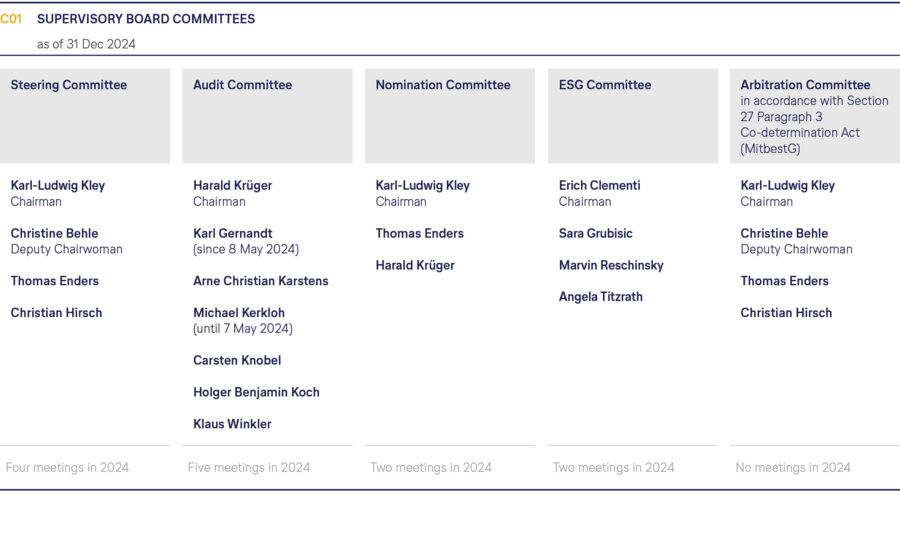

In the 2024 financial year, the Supervisory Board established five committees. Reports were provided on each of these committees’ activities at the start of the following Supervisory Board meeting. Further details on the composition of these committees can be found in the chart G01 Supervisory Board Committees.

The Steering Committee met four times in 2024. As in previous financial years, the Steering Committee prepared the Supervisory Board meetings and considered the course of business in detail. The Steering Committee also considered all of the issues relating to the remuneration received by the Executive Board. Moreover, the Steering Committee made recommendations to the Supervisory Board on all personnel and remuneration decisions concerning the Executive Board.

The Nomination Committee met twice in 2024.

The Audit Committee met five times in 2024, always in the presence of the auditors. As an independent financial expert in line with the requirements of the German Stock Corporation Act and the German Corporate Governance Code, the Chair of the Audit Committee has particular knowledge and experience in the field of accounting, including international control procedures, and in relation to sustainability reporting. The Audit Committee discussed the annual financial statements for 2023 and the interim reports for 2024 with the CFO prior to their publication. This committee also dealt with the supervision of accounting processes and the effectiveness of the internal control, risk management and internal auditing systems. Furthermore, the members received regular reports on the compliance management system and capital market communications.

They discussed in detail the 2025 budget, the Group operational planning and the medium-term financial planning for the period from 2026 to 2028. They also regularly discussed the progress made in complying with the requirements of the CSRD Directive for the preparation of a sustainability report, including with the auditor. Even though the German parliament did not pass the bill for the implementation of the CSRD Directive by the end of 2024, the Lufthansa Group nonetheless voluntarily opted to prepare a combined non-financial declaration in compliance with the CSRD Directive, and to have EY conduct a limited assurance engagement for this. Combined non-financial declaration.

The ESG Committee advises the Supervisory Board, its committees and the Executive Board on issues relating to sustainable corporate governance and the Company’s business activities in the ESG areas. It met twice in 2024. Its key areas of focus were the carbon emissions targets specified in the Lufthansa Group’s ESG strategy as well as the key reduction and offsetting tools available in order to achieve these targets.

The Arbitration Committee was not convened in the reporting year.

Audit and adoption of the annual financial statements, approval of the consolidated financial statements as of 31 December 2024

The Supervisory Board appointed EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft, Stuttgart, who were elected as auditors for the parent company and the Group at the Annual General Meeting 2024, to audit the annual financial statements and the consolidated financial statements, the combined management report including the combined non-financial declaration, and the system for the early identification of risks. The Audit Committee acknowledged the declaration of independence provided by EY and discussed the main topics of the audit. No potential grounds for disqualifying the auditors or doubting their impartiality came to light during the course of the audit.

The consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), as applicable in the European Union (EU). The auditors audited the annual financial statements and consolidated financial statements of Deutsche Lufthansa AG and the combined management report, including the combined non-financial declaration as of 31 December 2024, in accordance with the legal requirements, and issued an unqualified audit opinion. They further confirmed that the system for the early identification of risks established by the Executive Board is suitable for identifying developments which might jeopardise the Company’s continued existence at an early stage. During their audit, the auditors did not come across any facts that would run contrary to the declaration of compliance with the German Corporate Governance Code.

On 27 February 2025, the Audit Committee discussed the audit reports in detail with the CFO in the presence of the two auditors who had signed the auditors’ report. At the Supervisory Board accounts meeting on 5 March 2025, the auditors reported on their audit findings and answered questions. We examined the annual financial statements and the consolidated financial statements of Deutsche Lufthansa AG, as well as the combined management report, including the combined non-financial declaration and the remuneration report pursuant to Section 162 AktG, and did not raise any objections. The annual financial statements and the consolidated financial statements were approved. The 2024 annual financial statements of Deutsche Lufthansa AG, prepared by the Executive Board, have thereby been adopted. We agree with the Executive Board’s proposal for profit distribution. We are pleased to report we are once again able to distribute a dividend to our shareholders for the 2024 financial year.

Frankfurt am Main, 5 March 2025

For the Supervisory Board

Karl-Ludwig Kley, Chairman