Sector outlook

Passenger traffic expected to see further growth in financial year 2025

The International Air Transport Association (IATA) predicts that global passenger traffic – measured by global revenue passenger-kilometres – will grow year-on-year by 8% in 2025 (previous year: 11%) despite geopolitical crises and significant delivery bottlenecks for new aircraft. This would put passenger traffic 13% above its pre-crisis level in 2019.

In its forecast for 2025, IATA expects significant regional differences in growth. The fastest growth of 12% is expected for the Asia/Pacific region, followed by the Middle East at 10%. Growth of 8% is predicted for Africa and Latin America, respectively, and 7% for Europe. The slowest growth of 3% is expected for North America.

Financial analysts are anticipating robust demand for European airlines in 2025, driven by ongoing strong premium leisure travel and a slow but steady recovery in business travel. It seems that consumers’ willingness to spend on travel will also remain remarkably high. Demand for travel should therefore perform better than the general state of the European economy would currently suggest.

In addition to solid developments in demand, the assumption is that supply will remain limited – for example, due to a lack of staff at airports, in air traffic control and at airlines, as well as delays in the delivery of new aircraft. Capacity growth will therefore again be limited by external factors, and is expected to be lower this year than in prior years. If the failures in the Pratt & Whitney GTF engine family are overcome, traffic within Europe will be able to grow slightly faster than transatlantic traffic, where capacity will probably be largely unchanged year on year. Moderate growth prospects in these two markets suggest that yields will be stable in 2025. The strong US dollar currently also promises positive revenue potential on North Atlantic routes for European network airlines.

The picture is less positive in Asia and particularly in China. There, financial analysts are more cautious and expect the environment for European airlines to remain difficult due to macroeconomic challenges and capacity growth well above the market average.

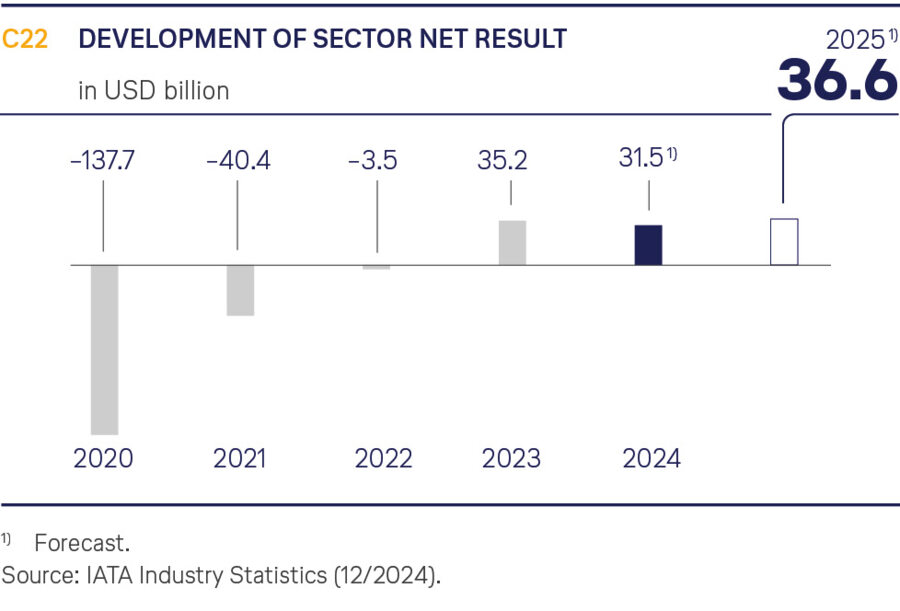

In terms of yields, IATA is expecting a year-on-year decline of 3.7% in 2025 (previous year: decline of 5.6%). The net profit for the industry is expected to come to USD 36.6bn (previous year: USD 31.5bn).

Airfreight set to increase again in 2025

For global airfreight traffic, IATA forecasts 6% growth in revenue cargo tonne-kilometres in 2025 (previous year: growth of 12%).

Yields in the cargo business are nevertheless forecast to decline slightly by 0.7% in 2025 (previous year: decline of 3.7%). However, this would still mean that yields are around 36% higher than before the crisis.

Further recovery expected in MRO market

The aviation industry is in a period of transition from conventional aircraft models to new, more efficient technologies. However, supply chain problems are preventing the leading aircraft manufacturers from reaching their original plans for production rates, which particularly applies to the new aircraft types from Boeing.

The new engine technologies (such as the Pratt & Whitney GTF engine family and the LEAP family of engines from CFM International) also have to be retrofitted with upgrades and modifications at the request of the authorities. The consequence is that these next-generation engines have to be integrated into the still emergent repair networks earlier than expected. At the same time, demand remains high for maintenance services for last-generation engine models, because the airlines are obliged to use them for longer. Demand for maintenance and repair services is also growing due to the ongoing strong demand for air travel.

The consultancy firm ICF predicts average growth for the MRO market (without countries under sanctions) of 4% in 2025 compared with the previous year. Growth rates in the individual regions are forecast to be 4% for the Americas and 5% for APAC (Asia/Pacific) and EMEA (Europe, Middle East and Africa). However, this growth can still be affected massively by external influences such as geopolitical factors, inflation or supply chain instability.