Macroeconomic situation

| T013 | GDP DEVELOPMENT | ||||

|---|---|---|---|---|---|

| in % | 2024 1) | 2023 | 2022 | 2021 | 2020 |

| World | 2.7 | 2.9 | 3.2 | 6.4 | -2.9 |

| Europe | 1.0 | 0.7 | 3.8 | 6.7 | -5.8 |

| Germany | -0.2 | -0.1 | 1.4 | 3.6 | -4.5 |

| North America | 2.6 | 2.8 | 2.6 | 6.0 | -2.4 |

| South America2) | 2.1 | 2.3 | 4.1 | 7.3 | -6.6 |

| Asia/Pacific | 4.1 | 4.5 | 3.3 | 6.7 | -0.8 |

| China | 5.0 | 5.2 | 3.0 | 8.5 | 2.2 |

| Middle East | 1.4 | 0.9 | 6.4 | 5.0 | -4.2 |

| Africa | 2.4 | 3.1 | 3.7 | 4.9 | -2.3 |

| Source: S&P Global as of 15 January 2025 1) Forecast. 2) Excluding Venezuela. | |||||

European economy weaker than the global economy once again

Global economic growth slowed in 2024 for the third year in a row. The growth rate was 2.7%, compared with 2.9% the previous year. Asia/Pacific is again the region with the fastest growth rate at 4.1% (previous year: 4.5%). In Europe, the economy grew by 1.0% (previous year: 0.7%). Economic output in Germany fell again by 0.2% (previous year: -0.1%).

Euro stable against most major currencies

The euro remained stable against the other major currencies over the course of the year. The average exchange rate against the US dollar was unchanged compared with the previous year. By contrast, the euro rose against the Chinese renminbi and the Canadian dollar, by 8% and 2% respectively. Against the pound sterling and Swiss franc the euro fell by an average of 3% and 2% respectively.

| T014 | CURRENCY DEVELOPMENT EUR 1 IN FOREIGN CURRENCY | ||||

|---|---|---|---|---|---|

| 2024 | 2023 | 2022 | 2021 | 2020 | |

| USD | 1.0819 | 1.0814 | 1.0510 | 1.1821 | 1.1402 |

| JPY | 163.77 | 151.68 | 137.86 | 129.84 | 121.77 |

| CHF | 0.9524 | 0.9714 | 1.0040 | 1.0807 | 1.0704 |

| CNY | 7.7848 | 7.6521 | 7.0754 | 7.6243 | 7.8688 |

| GBP | 0.8464 | 0.8695 | 0.8523 | 0.8595 | 0.8888 |

| CAD | 1.4818 | 1.4592 | 1.3684 | 1.4818 | 1.5288 |

| Source: Bloomberg, annual average daily price. | |||||

Continuous drop in the inflation rate

The rate of inflation declined in the reporting year. At the end of 2024, it averaged 4.5% worldwide (previous year: 5.5%). The rate of inflation was 2.4% in Europe and 2.6% in Germany. As inflation declined, central banks ended their restrictive monetary policy and lowered interest rates. The US Fed lowered interest rates in three stages to 4.5% (previous year: 5.5%). The European Central Bank cut interest rates four times to 3.15% (previous year: 4.5%).

Short and long-term interest rates fall on average over the year

Short and long-term interest rates fell on average over the course of the year. The 6-month Euribor stood at an average of 3.48% in 2024 (previous year: 3.69%). The 10-year euro swap decreased year-on-year to 2.59% (previous year: 3.05%).

| T015 | INTEREST RATE DEVELOPMENT in % | ||||

|---|---|---|---|---|---|

| Instrument | 2024 | 2023 | 2022 | 2021 | 2020 |

| 6-month Euribor average rate | 3.48 | 3.69 | 0.68 | -0.52 | -0.37 |

| 6-month Euribor year-end level | 2.57 | 3.86 | 2.69 | -0.55 | -0.53 |

| 10-month euro swap average rate | 2.59 | 3.05 | 1.93 | 0.05 | -0.14 |

| 10-month euro swap year-end rate | 2.36 | 2.49 | 3.20 | 0.30 | -0.26 |

| Source: Bloomberg | |||||

The discount rate applied for discounting the pension obligations of Deutsche Lufthansa AG, which is derived from the average return on a basket of investment-grade corporate bonds, stood at 3.6%, as in the previous year.

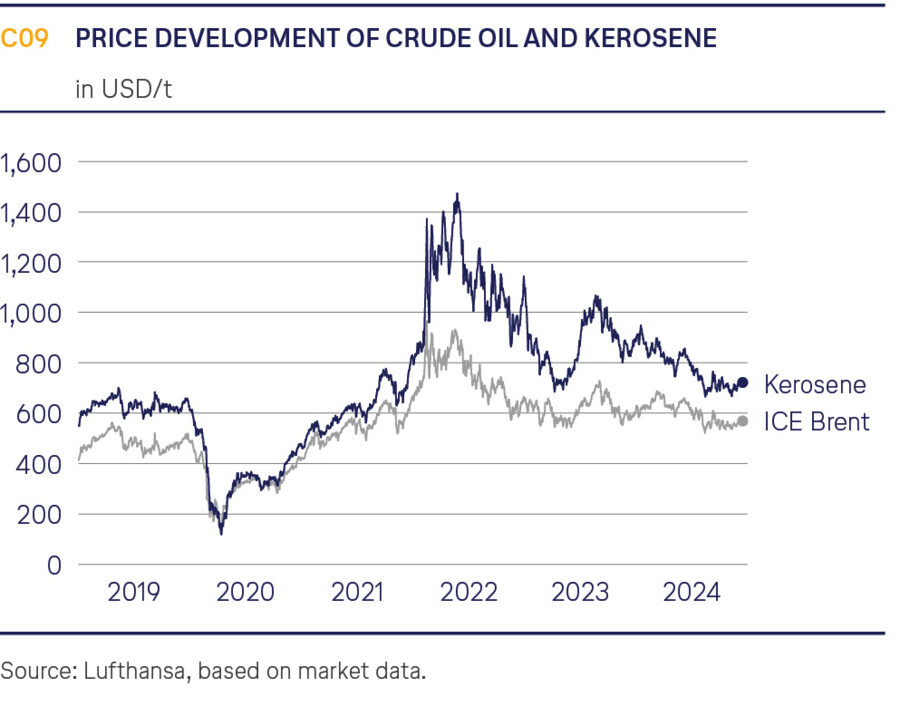

Oil price once again down on the previous year

The oil market remained calm in 2024. With prices between USD 69.19/barrel and USD 91.17/barrel, the average price for 2024 was USD 79.86/barrel, which is 3% lower than the previous year (previous year: USD 82.18/barrel). On 31 December 2024, a barrel of Brent Crude cost USD 74.64 (year-end 2023: USD 77.04/barrel).

The jet crack, the price difference between crude oil and kerosene, moved between USD 12.91/barrel and USD 38.30/barrel in 2024. On average over the year, it traded at USD 20.33/barrel and thus 31% lower than in the previous year. On 31 December 2024, the jet crack was USD 16.19/barrel (year-end 2023: USD 29.18/barrel).