Net assets

Total assets up by EUR 1.7bn

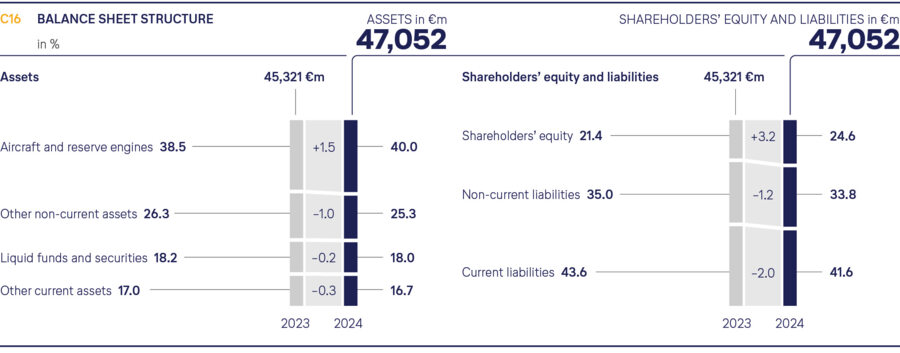

Total Group assets as of 31 December 2024 increased by EUR 1,731m over year-end 2023 to EUR 47,052m (31 December 2023: EUR 45,321m).

Non-current assets were up EUR 1,388m at EUR 30,736m (31 December 2023: EUR 29,348m). This accounts for an unchanged 65% of total assets as at year-end 2023. Current assets rose by EUR 343m to EUR 16,316m (31 December 2023: EUR 15,973m). Unchanged from year-end 2023, this accounts for 35% of total assets.

Shareholders’ equity was up EUR 1,885m at EUR 11,594m (31 December 2023: EUR 9,709m). Altogether, non-current funding accounted for 58% of total assets (31 December 2023: 56%). Non-current financing covered 89% of non-current assets (31 December 2023: 87%). Current funding came to 42% of total assets (31 December 2023: 44%).

Assets

Non-current assets up by EUR 1.4bn

At year-end 2024, non-current assets of EUR 30,736m were EUR 1,388m higher than at year-end 2023 (31 December 2023: EUR 29,348m).

In particular, the items aircraft and reserve engines (EUR +1,364m), derivative financial instruments (EUR +162m), investments accounted for using the equity method (EUR +132m) and repairable spare parts for aircraft (EUR +130m) increased. This was offset by the decline in deferred taxes (EUR -377m) and loans and receivables (EUR -116m). Due to changes in the usage patterns identified in recent years, aircraft spare parts at Lufthansa Technik AG that are primarily used for engine maintenance (“non-pool material”) were reclassified from non-current assets to inventories. The figures for the previous year were adjusted accordingly. As of 31 December 2024, this affected parts with a carrying amount of EUR 482m (31 December 2023: EUR 424m).

The value of aircraft and reserve engines came to EUR 18,828m as of year-end 2024 (31 December 2023: EUR 17,464m). Depreciation and disposals were exceeded by capital expenditure on 16 new aircraft (eight Airbus A350s, one Boeing 777F, six Airbus A320s and one Airbus A321), major maintenance events, advance payments on existing orders and additions to rights of use for aircraft. 15 short and medium-haul aircraft were sold and leased back from external lessors in the course of sale-and-leaseback transactions. As of 31 December 2024, the Lufthansa Group fleet consisted of 735 aircraft (31 December 2023: 721 aircraft). Fleet.

Current assets up by EUR 343m

Current assets as of 31 December 2024 were up EUR 343m at EUR 16,316m (31 December 2023: EUR 15,973m).

Derivative financial instruments increased (EUR +366m) due to higher market values of investment hedges, as did trade and other receivables (EUR +334m) and inventories (EUR +221m) due to increased business activity; cash and bank balances increased (EUR +200m), as did effective income tax receivables (EUR +194m) in connection with the results of tax audits in Germany.

The drop in assets held for sale (EUR -1,097m) resulted primarily from the sale of AirPlus.

Liabilities

Shareholders’ equity up by EUR 1.9bn, equity ratio grows to 24.6%

Shareholders’ equity as of 31 December 2024 increased by EUR 1,885m over year-end 2023 to EUR 11,594m (31 December 2023: EUR 9,709m). This was driven mainly by the profit earned in the 2024 financial year and positive changes in the market value of hedging transactions. It was partially offset by the dividend payment.

The equity ratio therefore increased by 3.2 percentage points compared with year-end 2023 to 24.6% (31 December 2023: 21.4%).

| T024 | DEVELOPMENT OF CONSOLIDATED EARNINGS, EQUITY, EQUITY RATIO AND RETURN ON EQUITY | |||||

|---|---|---|---|---|---|---|

| 2024 | 2023 | 2022 | 2021 | 2020 | ||

| Profit/loss after income taxes1) | in €m | 1,393 | 1,689 | 804 | -2,193 | -6,766 |

| Equity1) | in €m | 11,594 | 9,709 | 8,474 | 4,490 | 1,387 |

| Equity ratio1) | % | 24.6 | 21.4 | 19.6 | 10.6 | 3.5 |

| Return on equity1) | % | 12.0 | 17.4 | 9.5 | -48.8 | -487.8 |

| 1) Including minority interests. | ||||||

Non-current provisions and liabilities on par with previous year

Non-current provisions and liabilities of EUR 15,877m as of 31 December 2024 were roughly the same as the previous year (31 December 2023: EUR 15,862m).

At EUR 11,413m, non-current borrowing was EUR 358m higher than at year-end 2023 (31 December 2023: EUR 11,055m). The increase stems largely from new borrowing, which exceeded reclassifications due to maturities.

Net pension obligations, i.e. pension provisions less asset surpluses at some pension plans, which are presented separately in non-current assets, decreased by EUR 110m to EUR 2,566m (31 December 2023: EUR 2,676m). Pension provisions were down by EUR 203m to EUR 2,692m (31 December 2023: EUR 2,895m). The interest rate used to discount the pension obligations in Germany and Austria remained at 3.6%, the level at the end of 2023; in Switzerland, the interest rate fell by 0.4 percentage points to 1.0%. The reduction of EUR 203m includes positive valuation effects of EUR 177m due to the positive performance of plan assets.

Current provisions and liabilities decline by EUR 169m

As of 31 December 2024, current provisions and liabilities were down by EUR 169m to EUR 19,581m (31 December 2023: EUR 19,750m).

Increases were reported particularly in liabilities from unused flight documents (EUR +202m) due to higher ticket sales, other contract liabilities (EUR +184m), particularly from customer loyalty programmes and compensation payments, and other provisions (EUR +180m), mostly for obligations to return emission certificates and maintenance obligations under aircraft leasing contracts. The increases were offset by the drop in liabilities in connection with assets held for sale (EUR -670m). This related to the sale of AirPlus.

EUR 62m year-on-year increase in net indebtedness

Despite the positive free cash flow, at EUR 5,744m, net indebtedness at year-end 2024 was up by EUR 62m on year-end 2023 (31 December 2023: EUR 5,682m) due to lease financing, interest and dividend payments.

Adjusted net debt, the sum of net indebtedness and net pension obligations less 50% of the hybrid bond issued in 2015, was down by EUR 48m compared with year-end 2023 to EUR 8,063m (31 December 2023: EUR 8,111m).

The ratio of Adjusted net debt/Adjusted EBITDA was thus 2.0 (previous year: 1.7).

| T025 | CALCULATION OF NET INDEBTEDNESS | ||

|---|---|---|---|

| 2024 | 2023 | Change | |

| in €m | in €m | in % | |

| Bonds | -6,969 | -6,224 | -12 |

| Borrower’s note loans | -395 | -1,143 | 65 |

| Credit lines | -26 | -21 | -24 |

| Aircraft financing | -3,798 | -3,802 | 0 |

| Lease liabilities | -2,887 | -2,568 | -12 |

| Other financial debt | -148 | -185 | 20 |

| Financial liabilities | -14,223 | -13,943 | -2 |

| Other bank borrowing | -9 | -4 | -125 |

| Group indebtedness | -14,232 | -13,947 | -2 |

| Bank balances, cash in hand and time deposits (4–12 months) | 2,465 | 1,865 | 32 |

| Securities | 6,023 | 6,400 | -6 |

| Net indebtedness | -5,744 | -5,682 | -1 |

| Pension provisions | -2,692 | -2,895 | 7 |

| Pension surpluses | 126 | 219 | -42 |

| Net pension obligation | -2,566 | -2,676 | 4 |

| Net indebtedness and net pension obligations | -8,310 | -8,358 | 1 |