Financial position

Capital expenditure

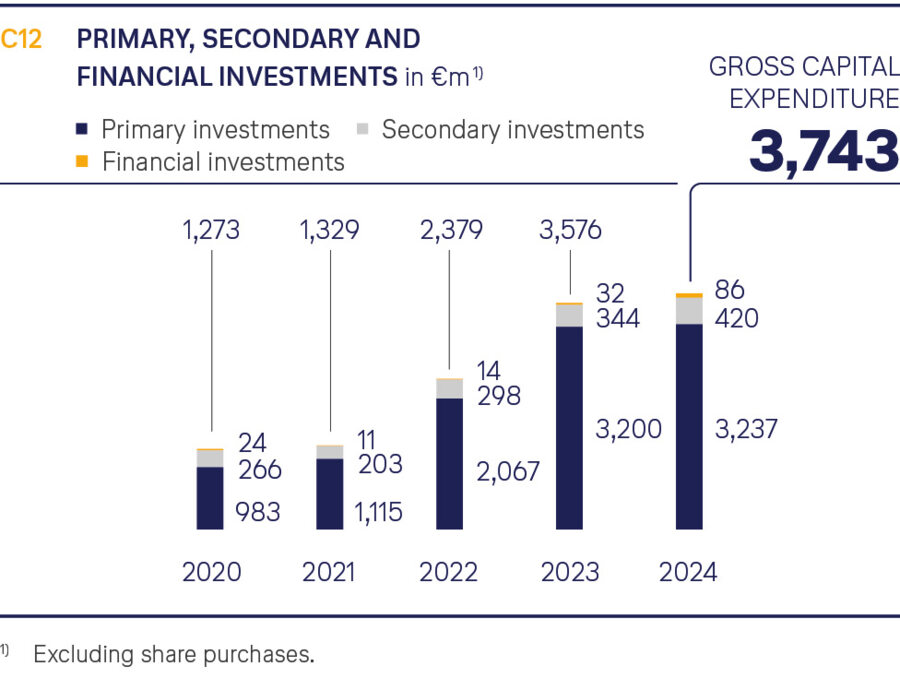

Investment volume up on previous year

Compared with the previous year, the Lufthansa Group’s gross capital expenditure (excluding the purchase of shares) increased by 5% to EUR 3,743m in the 2024 financial year (previous year: EUR 3,576m).

Primary investment in down payments and final payments for aircraft, aircraft components, and aircraft and engine overhauls were unchanged year on year at EUR 3,237m (previous year: EUR 3,200m). This accounts for 86% of gross capital expenditure. EUR 1,065m was attributable to advance payments for future deliveries, particularly for long-haul aircraft (previous year: EUR 1,536m).

Capital expenditure for other items of property, plant and equipment and for intangible assets, known as secondary investment, increased by 22% to EUR 420m (previous year: EUR 344m). Property, plant and equipment, such as technical equipment and machinery, and operating and office equipment accounted for EUR 333m of the total (previous year: EUR 238m). EUR 87m (previous year: EUR 106m) was invested in intangible assets such as licences and software.

Financial investments (excluding share purchases) with a total volume of EUR 86m (previous year: EUR 32m) comprised mainly cash outflows from loans to joint ventures.

Passenger Airlines accounted for the bulk of capital expenditure with EUR 3,275m (+6% year-on-year). Fleet.

Capital expenditure of EUR 149m (-22% compared with the previous year) in the Logistics segment consisted mainly of advance payments for cargo aircraft, plus the renewal of the Frankfurt freight centre. Capital expenditure of EUR 206m in the MRO business segment (+50%) was mainly for technical operating equipment and financing joint ventures.

There were fewer additions to repairable spare parts in the 2024 financial year as large inventories were built up the previous year. The corresponding cash outflows fell year-on-year as a result by 48% to EUR 241m (previous year: EUR 466m). In the course of sale-and-leaseback transactions for 15 passenger aircraft, aircraft delivered in the 2024 financial year and advance payments were sold to external lessors and leased back for six-year periods in the 2024 financial year. This resulted in inflows of EUR 761m (previous year: EUR 608m).

Including payments for replacement parts for aircraft, proceeds from the sale of assets, mainly the sale of AirPlus and sale-and-leaseback transactions for 15 Airbus A320/A321s, plus dividend and interest income, the Lufthansa Group’s net capital expenditure came to EUR 2,392m (previous year: EUR 2,771m).

As of 31 December 2024, there were order commitments of EUR 21.6bn (previous year: EUR 20.5bn) for capital expenditure on property, plant and equipment, including repairable spare parts, and for intangible assets. Financing, particularly of capital expenditure on aircraft, is based on a mixture of unsecured corporate finance arrangements, specific aircraft financing models and leasing.

Cash flow

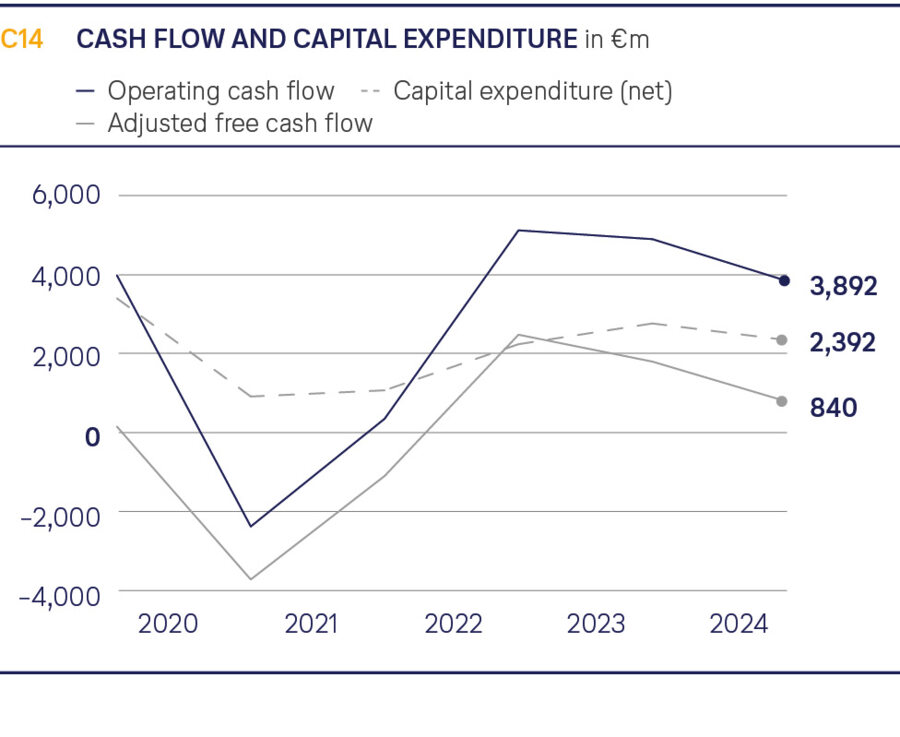

Cash flow from operating activities of EUR 3,892m

The cash flow from operating activities at the Lufthansa Group in the 2024 financial year was 21% lower than the previous year at EUR 3,892m (previous year: EUR 4,905m). The decline is primarily due to lower Adjusted EBITDA.

Inflows from the change in working capital (EUR 525m, previous year: EUR 207m) were related to higher liabilities from unused flight documents, which went up by EUR 202m in the reporting year (previous year, adjusted for reclassification effects: EUR 376m). Effects from higher receivables and contract assets came to EUR -197m (previous year, adjusted for reclassification effects: EUR -552m); higher liabilities and contract obligations came to EUR 676m (previous year: EUR 607m). Higher inventories resulted in an outflow of EUR -216m (previous year: EUR -213m). EUR 669m of the operating cash flow related to payments to former employees on the basis of pension obligations (previous year: EUR 662m). In addition, allocations were made to pension plans in the amount of EUR 417m (previous year: EUR 472m), while investment income from plan assets of EUR 549m (previous year: EUR 630m) was used in connection with pension payments. Cash flowing into or out of the plan assets was also reported in cash flow from operating activities, resulting in a net cash outflow of EUR 537m in connection with pensions (previous year: net outflow of EUR 505m).

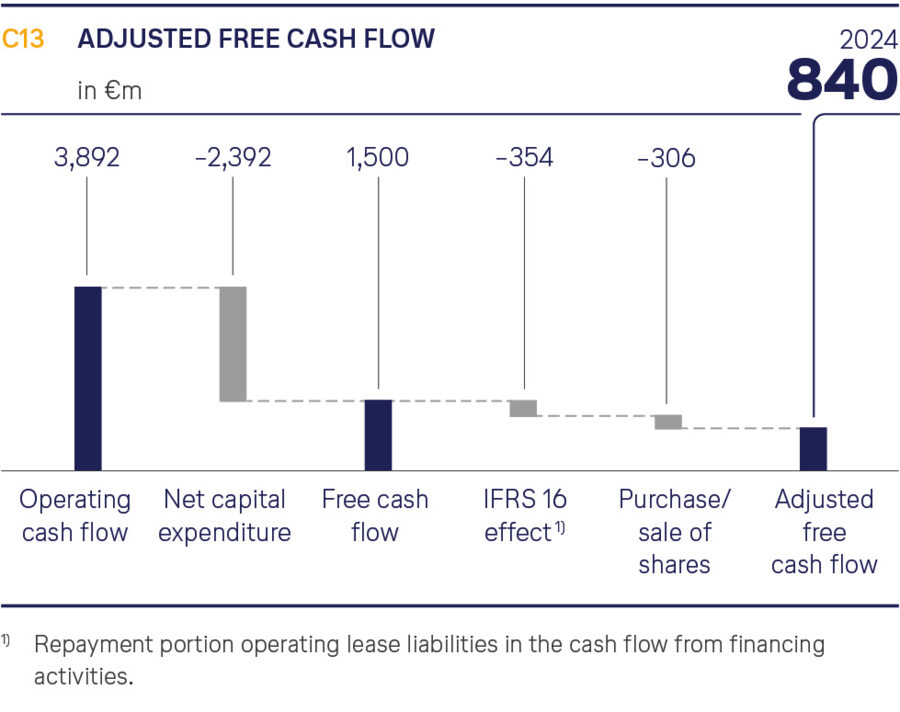

Adjusted free cash flow of EUR 840m

Gross capital expenditure (without share purchases) by the Lufthansa Group came to EUR 3,743m in the reporting year (previous year: EUR 3,576m) and includes the primary, secondary and financial investments mentioned above. This was offset by the increase in repairable spare parts for aircraft of EUR 241m (previous year: increase of EUR 466m). Share purchases accounted for expenses of EUR 76m (previous year: EUR 33m).

Income from the disposal of non-current assets and assets held for sale of EUR 1,260m (previous year: EUR 1,031m) mainly related to the sale of a total of 16 aircraft. In addition to the revenue from sale-and-leaseback transactions (EUR 761m), the sale of the AirPlus group resulted in a net inflow of EUR 376 million (after deduction of cash and cash equivalents sold). Interest and dividend income went up by 49% to EUR 408m (previous year: EUR 273m), primarily due to higher interest income as a result of higher interest rates. This brought total net cash used for investing activities to EUR 2,392m, This was 14% below the previous year’s figure (previous year: EUR 2,771m).

After deducting this net cash used for investing activities, free cash flow for the 2024 financial year was positive at EUR 1,500m (previous year: EUR 2,134m).

Adjusted free cash flow dropped by 54% to EUR 840m (previous year: EUR 1,846m). This figure includes cash outflows for leases (repayment portion) as shown in cash flow for financing activities, which came to EUR 354m in the reporting year (previous year: EUR 319m). Not included in this figure are cash flows from the purchase or sale of shares in companies, which amounted to a net figure of EUR 306m in the reporting year (previous year: EUR -31m).

Financing

Financing activities result in cash outflow of EUR 1,450m

Financing activities in the 2024 financial year led to a net cash outflow of EUR 1,450m (previous year: outflow of EUR 2,072m).

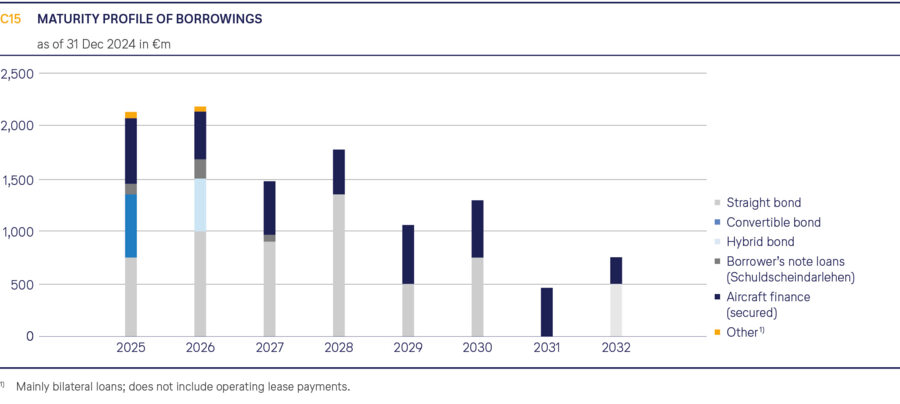

This arose from repayments in the overall amount of EUR 2,745m, mainly for two bonds (EUR 1,000m), borrower’s note loans (EUR 746m), aircraft financing (EUR 527m) and lease liabilities (EUR 407m). Interest and dividend payments came to EUR 930m.

However, the cash inflow from new financing measures on the capital market amounted to EUR 2,225m. This mainly comprised three euro bonds (EUR 1,734m) and Japanese operating leases for three Boeing 787-9s (EUR 385m).

Furthermore, the Lufthansa Group has bilateral credit lines with banks. At the end of the 2024 financial year, the revolving credit line amounting to EUR 2.5bn was unused. On 31 December 2024, unused credit lines totalled EUR 2,549m (31 December 2023: EUR 2,097m).

Liquidity

Total available liquidity of EUR 11.0bn

Balance-sheet liquidity (total of cash, current securities and fixed-term deposits) came to EUR 8,488m at year-end 2024 (31 December 2023: EUR 8,265m). EUR 7,664m was available centrally to Deutsche Lufthansa AG at year-end 2024 (31 December 2023: EUR 7,709m).

Including its freely available credit lines at year-end 2024, the Company’s available liquidity thus amounted to EUR 11.0bn (31 December 2023: EUR 10.4bn).

| T023 | ABBREVIATED CASH FLOW STATEMENT OF THE LUFTHANSA GROUP | ||

|---|---|---|---|

| 2024 | 20231) | Change | |

| in €m | in €m | in % | |

| Profit/loss before income taxes | 1,569 | 2,055 | -24 |

| Depreciation and amortisation/reversals | 2,494 | 2,424 | 3 |

| Net proceeds from disposal of non-current assets | -182 | 144 | |

| Net interest/result from equity investments | -40 | 133 | |

| Income tax payments/reimbursements | -181 | -92 | 97 |

| Significant non-cash expenses/income | -244 | -264 | -8 |

| Change in trade working capital | 525 | 207 | 154 |

| Change in other assets and liabilities | -49 | 298 | |

| Cash flow from operating activities | 3,892 | 4,905 | -21 |

| Investments and additions to repairable spare parts and cash outflows for acquisitions of equity investments | -4,060 | -4,075 | 0 |

| Proceeds from the purchase/disposal of shares/non-current assets | 1,260 | 1,031 | 22 |

| Dividends and interest received | 408 | 273 | 49 |

| Net cash from/used in investing activities | -2,392 | -2,771 | 14 |

| Free cash flow | 1,500 | 2,134 | -30 |

| Purchase/disposal of securities/fund investments | 67 | -170 | |

| Transactions through minority interests | – | -1 | -100 |

| Non-current borrowing and repayment of non-current borrowing | -520 | -1,537 | -66 |

| Dividends paid | -372 | -25 | -1,388 |

| Interest paid | -558 | -509 | -10 |

| Net cash from/used in financing activities | -1,450 | -2,072 | 30 |

| Changes due to currency translation differences | 5 | -8 | |

| Cash and cash equivalents as of 1 Jan | 1,668 | 1,784 | -7 |

| Cash and cash equivalents as of 31 Dec | 1,790 | 1,668 | 7 |

| Less cash and cash equivalents of companies held for sale as of 31 Dec. |

– | 78 | |

| Cash and cash equivalents of companies not held for sale as of 31 Dec. |

1,790 | 1,590 | 13 |

| 1) Previous year figures adjusted due to the reclassification of non-pool material from repairable spare parts to inventories. | |||