Basis for preparing this statement

BP-1 – General basis for the preparation of sustainability statements

The 2024 combined non-financial declaration for Deutsche Lufthansa AG has been prepared for all consolidated legal entities with operating activities. As such, the consolidated quantitative and qualitative data on the topics of environmental protection, social matters and corporate governance include the parent company Deutsche Lufthansa AG and the subsidiaries controlled by the Lufthansa Group. Associated companies and joint ventures are considered part of the value chain.

Generally speaking, the scope of reporting fulfils the same requirements as for financial reporting. However, there are two differences: firstly, the reporting scope of the EU’s Corporate Sustainability Reporting Directive (CSRD) is limited to all subsidiaries with operating activities because these are the relevant legal entities for reporting on material impacts, risks and opportunities. Secondly, the Lufthansa Group has reviewed whether financially non-consolidated subsidiaries contribute to the material impacts, risks and opportunities. This was not the case for the 2024 financial year.

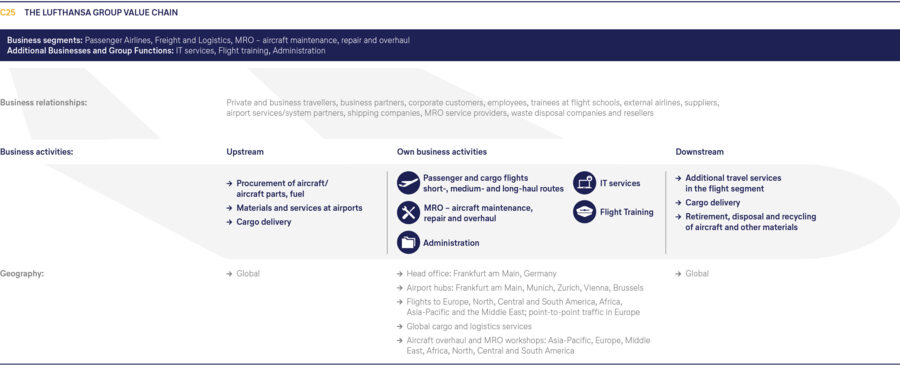

The operating segments of the Lufthansa Group conduct different business activities, which lead to differences in their value chains. The value chains for the three business segments of the Lufthansa Group are described below, as well as for additional businesses and Group Functions.

Passenger Airlines and Logistics business segments

Upstream value chain:

- Procurement and leasing of aircraft, fuel and other goods and services for ground and in-flight service, freight transport and logistics services

Downstream value chain:

Use of products and services

- Aircraft sales

- Disposal and contribution of materials, such as waste on board, to external recycling systems

- Transport, handling and delivery of products

Business segment MRO – aircraft maintenance, repair and overhaul

Upstream value chain:

- Procurement of components, engines, replacement parts, consumables and tools

- Procurement of used components, such as from the disassembly of aircraft, for obtaining replacement parts, unusable material for overhauls for reuse, procurement of MRO services (maintenance, repair and overhaul)

Downstream value chain:

- Use of other products and services, such as commercial, state and special operations, e.g. VIP aircraft

- Contribution of non-repairable aircraft components and materials, including rare-earth elements, to external recycling systems; disposal of hazardous substances, chemicals, industrial waste and wastewater

Additional Businesses and Group Functions

IT services

Upstream value chain:

- Procurement of hardware and supplies

- Purchase of computer programs and IT infrastructure services (e.g. servers, database management, data centres)

Downstream value chain:

- Use of different services

- Disposal or resale of decommissioned hardware, waste and water

Financial services

Upstream value chain:

- Procurement of hardware, utility services, computer programs and IT infrastructure services

Downstream value chain:

- Use of various payment solutions, such as corporate cards, virtual cards and debit account solutions

- Disposal or resale of decommissioned hardware, waste and water

Flight training

Upstream value chain:

- Procurement of hardware, simulators and supplies

- Purchase of computer programs and IT infrastructure services

- Procurement and leasing of aircraft, fuel and other goods and services for training purposes

Downstream value chain:

- Use of digital solutions and various devices and training

- Disposal or resale of decommissioned hardware, simulators, training aircraft, waste and water

Business relationships

Upstream value chain:

- Suppliers

- MRO service providers for aircraft maintenance, repair and overhaul; shipping companies

- Airport services / system partners

Downstream value chain:

- Private and business travellers

- Business partners and corporate customers

- External airlines

- Airport services / system partners

- Waste disposal services and resellers

The Lufthansa Group exercises the option to omit from its reports specific information that relates to intellectual property, expertise or the results of innovations. The Lufthansa Group also invokes the relevant exemption and exercises the option not to provide any information about upcoming developments or matters that are the subject of ongoing negotiations.

BP-2 – Disclosures in relation to specific circumstances

Time horizons are based on the Lufthansa Group’s risk management

The time horizons for the management of material impacts, risks and opportunities are based on the Lufthansa Group’s risk management. The short-term time horizon corresponds to the reporting period and thus one calendar year. The medium-term horizon deviates from the definition in the European Sustainability Reporting Standards (ESRS) and comprises more than one year, but less than four years. Time horizons beyond four years are defined as long-term horizons. The Lufthansa Group uses its own definitions of time horizons in order to ensure consistency across the Group in all risk assessments – regardless of the type of risk.

Estimates and sources relating to the value chain vary for some metrics

For some metrics, the Lufthansa Group uses indirect sources in order to estimate data relating to the value chain. A list of all data points where estimates are used to approximate information relating to the value chain can be found in the calculation methods. There are no data points with a high measurement or outcome uncertainty for the reporting year. The methods and corresponding degree of accuracy are described in the topic-specific chapters under the relevant calculation methods as are details about the sources of valuation and measurement uncertainty, as well as assumptions, approximations and discretionary decisions.

Changes in the preparation or presentation of sustainability information

Corporate Accounting is responsible for any changes to the financial data of the Lufthansa Group. Any changes to these figures are not described separately in the combined non-financial declaration. Whether or not figures relating to sustainability data need to be adjusted is decided on a case-by-case basis. The decisions are based on the cost/benefit analysis between low comparability with previous periods and higher accuracy with more information. If figures have been adjusted, this is stated in the report at the relevant point. Revised comparative figures and the relevant differences between earlier and current figures, or the explanation that the preparation of comparative figures is not feasible, are described in the topic-specific chapters.

Reporting errors in prior periods

Should the Lufthansa Group determine that there are measurement or calculation errors in its reporting, such cases are mentioned in the subsequent report. Corrections and/or the circumstances leading to the error are published within the relevant topic-specific chapter.