Passenger Airlines business segment

| T026 | KEY FIGURES PASSENGER AIRLINES | |||

|---|---|---|---|---|

| 2024 | 2023 | Change in % | ||

| Revenue | €m | 29,690 | 28,337 | 5 |

| of which traffic revenue | €m | 27,869 | 26,701 | 4 |

| Operating income | €m | 30,682 | 29,643 | 4 |

| Operating expenses | €m | 29,722 | 27,730 | 7 |

| Adjusted EBITDA | €m | 2,882 | 3,758 | -23 |

| Adjusted EBIT | €m | 1,046 | 2,033 | -49 |

| EBIT | €m | 1,116 | 2,064 | -46 |

| Adjusted EBIT margin | % | 3.5 | 7.2 | -3.7 pts |

| Adjusted ROCE1) | % | 8.5 | 19.0 | -10.5 pts |

| Segment capital expenditure | €m | 3,275 | 3,095 | 6 |

| Employees as of 31 Dec | number | 65,172 | 60,924 | 7 |

| Average number of employees | number | 63,952 | 59,331 | 8 |

| 1) Last year’s figure adjusted | ||||

Business activities

Passenger Airlines offers their customers a differentiated and high-quality product

The Passenger Airlines segment includes Lufthansa Airlines, SWISS, Austrian Airlines, Brussels Airlines and Eurowings, whose results are also reported individually.

The network carriers Lufthansa Airlines, SWISS, Austrian Airlines and Brussels Airlines offer their customers a premium experience, with high-quality products and services. The multi-hub strategy offers passengers a comprehensive route network along with the greatest possible flexibility for their journey.

Eurowings is positioned as a value carrier with an exclusive focus on point-to-point traffic on short- and medium-haul routes.

The Passenger Airlines segment also includes the regional airlines Lufthansa CityLine, Lufthansa City Airlines, Air Dolomiti, Edelweiss Air, Discover Airlines and the equity investment in SunExpress, the joint venture with Turkish Airlines.

Moreover, commercial joint ventures with leading international airlines extend the Passenger Airlines route network. Commercial joint ventures exist with United Airlines and Air Canada on routes between Europe and North America, and with All Nippon Airways (ANA), Singapore Airlines and Air China on routes between Europe and Japan as well as Singapore and China respectively. In addition, numerous code-share agreements are in place.

Course of business

Fleet modernisation continues

The Passenger Airlines are driving forward with modernising and unifying their fleets. Older aircraft models are being retired and new, efficient aircraft with lower fuel needs and less carbon emissions are joining the fleet. Investment in modern and particularly fuel-efficient aircraft and engine technologies is currently the most important lever for reducing carbon emissions in flight operations. Combined non-financial declaration.

Passenger Airlines added 17 new aircraft to its fleets in financial year 2024. Four older aircraft were retired from the fleets. At the end of the 2024 financial year, the Passenger Airlines fleet had a total of 713 aircraft (previous year: 700 aircraft). Fixed orders for 235 aircraft are due for delivery in the period up to 2032. In the reporting year, numerous problems at the manufacturers relating to production, supply chains and certification caused delays in the delivery of ordered aircraft.

In September 2024, the Lufthansa Group renewed its wet lease partnership with airBaltic for another three years. This partnership enables the flexible deployment of up to 21 additional fuel-efficient Airbus A220-300 aircraft during the summer and up to five aircraft in the winter at various hubs.

In December 2024, the Lufthansa Group ordered five more Airbus A350-1000 long-haul aircraft, increasing its fixed orders for aircraft of this type from ten to 15. The cutting-edge aircraft will be delivered between 2028 and 2030. The order represents another important step towards the modernisation of the fleet, product upgrade and carbon reduction. Fleet.

Further expansion of product and services

Lufthansa Group Passenger Airlines are continuing to expand their product range in line with customer expectations. Customers will thus be offered a wider choice of relevant individually selectable product components as well as an improved travel experience on board and on the ground, in the premium segment in particular. This includes fitting Lufthansa Airlines and SWISS aircraft with Allegris and SWISS Senses product generation seats which will offer a new travel experience in every class on long-haul routes. Austrian Airlines will also get a new long-haul cabin when the Boeing 787 Dreamliner is introduced.

The Lufthansa Group is also expanding and improving its digital services. The focus is on the Lufthansa Group app, which won a prize for the best airline app at the World Aviation Festival in 2024.

The culinary range will also be upgraded in the spirit of a premium service. There is also a focus on improvements to customer service, e.g. the enhanced accessibility of call centres, and expanded digital service channels.

Sustainability activities intensified

In February 2023, the Lufthansa Group became the first airline group in the world to introduce green fares for more sustainable flying on short and medium-haul routes. This offering has now been extended to the Lufthansa Group’s long-haul flights and is thus available on the global route network. Green fares can be booked on more than 850,000 flights a year and in all travel classes as of December 2024. The more sustainable fare includes the offset of individual flight-related carbon emissions.

Green fares are available on flights from Lufthansa Airlines, SWISS, Austrian Airlines, Brussels Airlines, Edelweiss, Discover Airlines and Air Dolomiti. The only exceptions are flights from other Group airlines and individual route segments in certain traffic regions of joint venture partners. Eurowings also offers a fare for more sustainable flying under the name of PlanetBlu.

Details of additional Passenger Airlines sustainability activities can be found in the following chapters providing further information about the individual airlines and in the Combined non-financial declaration.

Operating performance

Operating performance defined by high demand and falling yields

Traffic in the Lufthansa Group’s Passenger Airlines segment continued to increase in the 2024 financial year due to the continued high demand for air travel. The Passenger Airlines’ available capacity was continuously expanded over the course of the reporting year. It was 9% up on the previous year, despite flight cancellations due to strikes in the 2024 financial year. Capacity was up by 12% on the previous year in the first quarter, by 11% in the second quarter, 6% in the third quarter and 5% in the fourth quarter. Available capacity in Passenger Airlines thus reached 91% of the pre-crisis level from 2019 in financial year 2024.

The number of flights increased by 5% year-on-year. Sales rose by 9%. The Passenger Airlines transported 131.3 million passengers in the 2024 financial year, 7% more than in the previous year (previous year: 122.5 million). The passenger load factor was 0.2 percentage points higher year-on-year, at 83.1% (previous year: 82.9%). Yields fell by 2.6% on the previous year, however.

Traffic revenue at the Passenger Airlines increased by 4% to EUR 27,869m year-on-year, chiefly due to higher traffic (previous year: EUR 26,701m).

| T027 | TRAFFIC FIGURES PASSENGER AIRLINES | |||

|---|---|---|---|---|

| 2024 | 2023 | Change in % | ||

| Number of flights | number | 980,423 | 936,079 | 5 |

| Passengers | thousands | 131,300 | 122,535 | 7 |

| Available seat-kilometres | millions | 326,176 | 300,582 | 9 |

| Revenue seat-kilometres | millions | 271,038 | 249,269 | 9 |

| Passenger load factor | % | 83.1 | 82.9 | 0.2 pts |

| T028 | OPERATING FIGURES PASSENGER AIRLINES | |||

|---|---|---|---|---|

| 2024 in € cents |

2023 in € cents |

Change in % | Exchange-rate adjusted change in % | |

| Yields | 9.3 | 9.6 | -2.6 | -2.6 |

| Unit revenue (RASK) | 9.2 | 9.7 | -4.3 | -4.1 |

| Unit cost (CASK) without fuel and emissions trading expenses |

6.6 | 6.4 | 1.9 | 2.1 |

| T029 | TRENDS IN TRAFFIC REGIONS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Airlines | ||||||||||

| Net traffic revenue external revenue | Passengers | Available seat-kilometres |

Revenue seat-kilometres |

Passenger load factor | ||||||

| 2024 | Change | 2024 | Change | 2024 | Change | 2024 | Change | 2024 | Change | |

| in €m | in % | in thousands | in % | in millions | in % | in millions | in % | in % | in pts | |

| Europe | 11,784 | 8 | 106,788 | 7 | 128,406 | 9 | 105,123 | 9 | 81.9 | +0.4 |

| Americas | 7,719 | 7 | 12,269 | 9 | 108,619 | 9 | 91,992 | 9 | 84.7 | +0.3 |

| Asia/Pacific | 3,538 | 6 | 5,647 | 18 | 54,035 | 19 | 44,952 | 17 | 83.2 | -1.3 |

| Middle East/Africa | 2,273 | -6 | 6,596 | -7 | 35,116 | -5 | 28,971 | -4 | 82.5 | +0.9 |

| Not assignable | 2,555 | -9 | ||||||||

| Total | 27,869 | 4 | 131,300 | 7 | 326,176 | 9 | 271,038 | 9 | 83.1 | +0.2 |

Financial performance

Significant decline in earnings position of Passenger Airlines

The earnings position of Passenger Airlines deteriorated significantly overall in financial year 2024, despite ongoing capacity growth. This was particularly due to the poor performance at Lufthansa Airlines. This was mainly driven by the impact of strikes in the first quarter of 2024, lower yields as a result of capacity growth throughout the market in the second quarter of 2024 and high costs related to flight irregularities, especially in the second quarter of 2024, and ongoing high cost inflation throughout the 2024 financial year. Additionally, delays in the delivery of new aircraft led to considerable financial expenses due to the need to continue operating older aircraft models and lease aircraft from third parties.

Revenue up on previous year by 5%

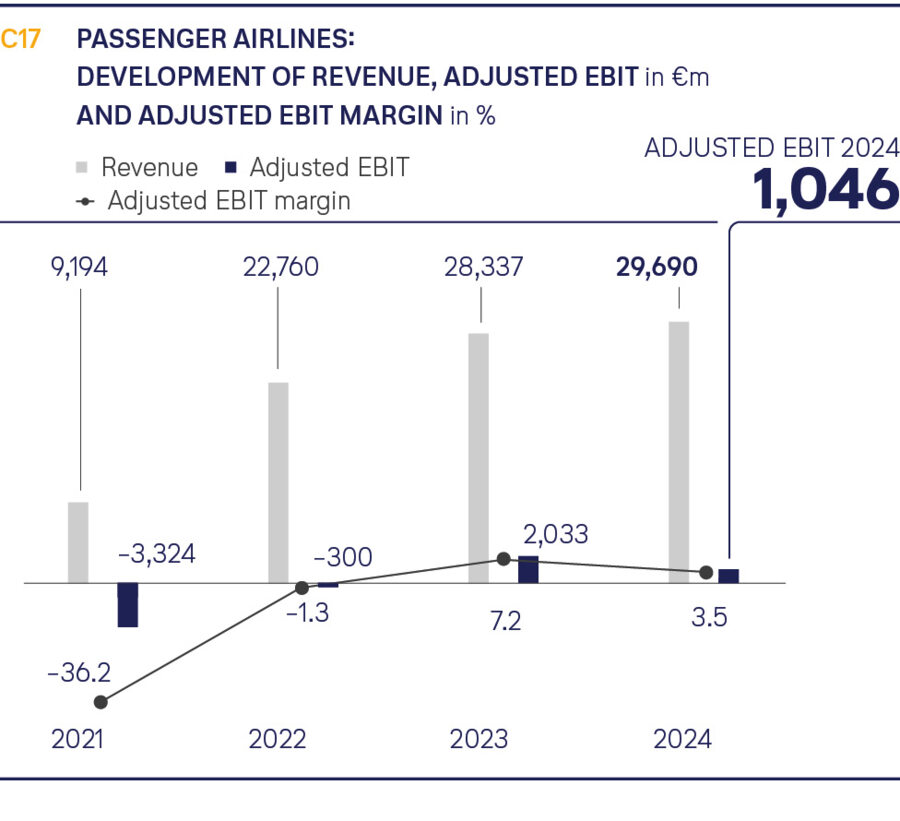

Revenue in the Passenger Airlines business segment was up by 5% in the reporting year to EUR 29,690m due to higher traffic revenue compared with the previous year (previous year: EUR 28,337m). Operating income of EUR 30,682m was 4% up on the previous year (previous year: EUR 29,643m).

Unit revenues (RASK) dropped by 4.3% year on year, due in particular to lower yields, but also on account of increased compensation payments to passengers. Direct compensation payments for flight delays and cancellations are recognised as reductions in revenue and totalled EUR 479m (previous year: EUR 228m).

Expenses up by 7%

Operating expenses of EUR 29,722m were 7% higher than in the previous year (previous year: EUR 27,730m).

Unit costs (CASK) without fuel and emissions trading expenses increased by 1.9% compared with the previous year, partly due to inflation.

The cost of materials and services of EUR 17,761m was 6% up on the previous year (previous year: EUR 16,687m). Within the cost of materials and services, expenses for fees and charges rose due to volumes and prices by 11% (+EUR 477m), expenses for in-flight services by 17% (+EUR 164m) and charter expenses by 34% (+EUR 142m). Fuel expenses of EUR 7,422m were 2% lower than in the previous year (previous year: EUR 7,552m) despite increased flight operations.

Salary increases resulting from pay agreements, one-off payments and an 8% increase in the average number of employees, partially compensated for by lower variable remuneration components, drove up staff costs by 11% to EUR 5,997m (previous year: 5,426m).

Expenses for passenger assistance in connection with flight irregularities due to strikes and operational difficulties at German airports were up 34% at EUR 362m (previous year: EUR 271m).

Depreciation and amortisation increased by 6% to EUR 1,836m (previous year: EUR 1,725m).

Other operating expenses increased by 6% to EUR 4,128m (previous year: EUR 3,892m) due to the expansion of flight operations.

| T030 | OPERATING EXPENSES PASSENGER AIRLINES | ||

|---|---|---|---|

| 2024 | 2023 | Change | |

| in €m | in €m | in % | |

| Cost of materials and services | 17,761 | 16,687 | 6 |

| of which fuel | 7,422 | 7,552 | -2 |

| of which fees | 4,670 | 4,193 | 11 |

| of which charter expenses | 562 | 420 | 34 |

| of which MRO services | 2,213 | 2,134 | 4 |

| Staff costs1) | 5,997 | 5,426 | 11 |

| Depreciation and amortisation2) | 1,836 | 1,725 | 6 |

| Other operating expenses3) | 4,128 | 3,892 | 6 |

| Total operating expenses | 29,722 | 27,730 | 7 |

| 1) Without past service expenses / plan settlement 2) Without impairment loss 3) Without book losses. |

|||

Adjusted EBIT at EUR 1.0bn

Overall, Adjusted EBIT at Passenger Airlines fell by 49% in financial year 2024 to EUR 1,046m (previous year: EUR 2,033m). This was largely due to the significant drop in earnings at Lufthansa Airlines. The Adjusted EBIT margin dropped by 3.7 percentage points to 3.5% (previous year: 7.2%).

EBIT decreased year-on-year by 46% to EUR 1,116m (previous year: EUR 2,064m). The difference relative to Adjusted EBIT in the reporting period is mainly attributable to book gains in connection with the sale-and-lease-back transactions for aircraft, book losses on aircraft and reserve engines and expenses from changes in pension plans. Earnings position.

Segment capital expenditure up 6% on the previous year

Segment capital expenditure increased by 6% to EUR 3,275m in the reporting year (previous year: EUR 3,095m) and primarily related to advance payments for aircraft orders, major maintenance events and final payments for new aircraft received.

Number of employees up by 7% year-on-year

The number of employees came to 65,172 on 31 December 2024 (previous year: 60,924). This is a 7% year-on-year increase on year-end 2023, above all due to new employee hires in the operational areas as a result of expanding business operations.