MRO business segment

| T040 | KEY FIGURES MRO | |||

|---|---|---|---|---|

| 2024 | 2023 | Change in % | ||

| Revenue | €m | 7,441 | 6,547 | 14 |

| of which with companies of the Lufthansa Group | €m | 2,405 | 2,158 | 11 |

| Operating income | €m | 7,918 | 7,028 | 13 |

| Operating expenses | €m | 7,292 | 6,383 | 14 |

| Adjusted EBITDA | €m | 790 | 785 | 1 |

| Adjusted EBIT | €m | 635 | 628 | 1 |

| EBIT | €m | 584 | 628 | -7 |

| Adjusted EBIT margin | % | 8.5 | 9.6 | -1.1 pts |

| Adjusted ROCE | % | 10.9 | 12.0 | -1.1 pts |

| Segment capital expenditure | €m | 206 | 137 | 50 |

| Employees as of 31 Dec | number | 24,499 | 22,870 | 7 |

| Average number of employees | number | 23,789 | 21,925 | 9 |

| Fully consolidated companies | number | 26 | 25 | 4 |

Business activities

Lufthansa Technik is the world’s leading MRO provider

Lufthansa Technik is the world’s leading manufacturer-independent provider of maintenance, repair and overhaul services (MRO) for civilian commercial aircraft. This company is divided up into five different areas, three of which are traditional MRO areas (Engine Services, Aircraft Component Services, Aircraft Maintenance Services) and two of which represent fields of the future (Digital Fleet Services and Original Equipment & Special Aircraft Services).

The Lufthansa Technik group comprises 33 plants (previous year: 30 plants) offering technical aviation services worldwide. The company also holds direct and indirect stakes in 64 companies. Lufthansa Technik serves more than 800 customers worldwide, including OEMs, aircraft leasing companies, VIP jet operators, governments and armed forces as well as airlines. Around one third of its business comes from entities in the Lufthansa Group and two thirds from clients outside of the Lufthansa Group.

Lufthansa Technik is certified worldwide for maintenance, design and production services. The company holds a comprehensive range of approvals as a maintenance company which it has been issued by the EU authorities as well as the authorities in over 40 other countries. Its design organisation approvals (DOA) mean that Lufthansa Technik is able, for instance, to carry out aircraft modifications or repairs even if the company lacks the relevant type certificate. By virtue of its approvals in the field of production, Lufthansa Technik is able to manufacture components for aircraft, such as spare parts for use in repairs.

The MRO market is characterised by high entry barriers. They stem from the necessary technical know-how, because air safety and quality have top priority. Both official certifications and licences from OEMs are also needed. Then there is the significant capital spending and investment required to provide MRO services.

Clear strategic roles for MRO areas

Lufthansa Technik’s five MRO areas have clear strategic roles and realise synergies.

Its Engine Services area offers a comprehensive range of engine services worldwide. Its product offering encompasses the entire range of services for modern engines, such as overhaul, repair, mobile and auxiliary power unit (APU) services for virtually all manufacturers. It contributes roughly one third of Lufthansa Technik’s revenue and will be a strong growth driver over the next few years, in particular for maintenance of the new generation of engines.

Lufthansa Technik’s Aircraft Component Services area likewise contributes around one third of its revenue and serves as an integrator which pools the repair of a wide range of components of OEMs and aircraft manufacturers at Lufthansa Technik’s workshops. Its “Total Component Support” (TCS) product combines Lufthansa Technik’s component pool (the world’s largest) with integrated in-house logistics and AI-supported materials management in real time, in order to maximise the availability of components for all of its customers.

Lufthansa Technik’s Aircraft Maintenance Services play a leading role in the standardised and efficient overhaul of civilian, commercially operated aircraft (base maintenance). Support covers the entire life cycle, and comprises complex aircraft modifications as well as mobile services that are offered worldwide.

The Digital Fleet Services unit develops the “Digital Tech Ops Ecosystem” and offers customers digital products to implement and optimise technical aircraft operations. The use of modern technologies, such as artificial intelligence, and the availability of the ever-growing data pool play a key role. The unit relies on flexible, cloud-based IT solutions that are offered primarily under software-as-a-service (SaaS) contracts.

The Original Equipment & Special Aircraft Services unit serves a broad range of customers that includes VIP customers, aircraft manufacturers and governments. Its portfolio ranges from specialised engineering services through to the mass production of products developed internally. This represents the nucleus of Lufthansa Technik’s growing Defence business.

Course of business and operating performance

Strong demand for MRO services

Lufthansa Technik once again reported a positive course of business in the reporting year. Strong demand for flights led to rising demand for maintenance and repair services as well as other Lufthansa Technik products and services, which in turn had a positive impact on revenue and earnings. The ongoing shortage of materials and staff continues to constitute a burden. While the shortage of materials is mainly attributable to delays in deliveries by the manufacturers and suppliers of aircraft, engines and aircraft components, the staff shortage is the result of the multiple-year training and skill-building programmes in the MRO field. Despite this operational burden and strike-related work stoppages in the first quarter of 2024, Lufthansa Technik was again able to surpass its very strong result for the previous year and achieved record revenue and Adjusted EBIT volumes.

Lufthansa Technik working on Ambition 2030 growth programme

Lufthansa Technik is continuing to pursue its Ambition 2030 growth programme. This programme aims to expand Lufthansa Technik’s leading global position in the technical servicing of aircraft fleets. In the engine business in particular, a permanently increased level of demand for repair and overhaul services is expected, since the number of older engines in global flight operations remains high due to delays in deliveries of the newly developed engine types, while these new engine types require a higher level of maintenance intensity. The Ambition 2030 programme therefore envisages wide-ranging capital expenditure over the next few years for the expansion of core business, additional bases and a greater international presence (potentially also by means of acquisitions) as well as the expansion of digital business models. By 2030, Lufthansa Technik therefore aims to increase its revenue to beyond EUR 10bn and its Adjusted EBIT to in excess of EUR 1bn.

Measures initiated to boost profitability and cash flow

Despite Lufthansa Technik’s leading global position, pressure on operating margins remains high due to cost inflation as well as the shortage of materials and staff. The company is pursuing clear strategic initiatives in order to achieve its Ambition 2030 target of an Adjusted EBIT margin of more than 10% by 2030. This consists of measures to optimise the cost of materials and services as well as the development of new repair procedures and the use of alternative spare parts, further optimisation of Lufthansa Technik’s site and service portfolio, its Digitize the Core digital initiatives and ramped-up growth in individual areas such as Engine Parts Repair and Mobile Engine Services.

At the same time, it is stepping up measures to boost cash flow. These consist of a further improvement in the turnaround time (TAT) in its workshops, the launch of operational excellence initiatives, the commercial improvement of net working capital, improvements to its production network (make-or-buy decisions and the use of big data) as well as an improvement in the efficiency of its component pool (introduction of a new AI-based planning tool).

Investments in the future get underway

The capital expenditure planned for Ambition 2030 exceeds EUR 1.8bn for the period up to 2030 and will be committed to all three world regions, the Americas, APAC (Asia/Pacific) and EMEA (Europe, the Middle East and Africa).

Lufthansa Technik is pursuing three new construction projects at its head office in Hamburg, including additional workshop buildings for its Aircraft Component Services and Special Aircraft Services and a hydraulics workshop for which the topping-out ceremony has already taken place. At its Alzey site, Lufthansa Technik has begun work on the construction of a new storage and logistics centre for aircraft engines and their spare parts at Lufthansa Technik AERO Alzey. It has established a new company in Portugal as part of its “NewStar” project, which will develop an additional production site for Engine Services and Aircraft Component Services. This future plant for the repair of aircraft components and engine parts is expected to be completed by the end of 2027. It will be fitted out with the latest technologies in the MRO sector, in order to achieve a lasting increase in Lufthansa Technik’s repair capacities in Europe.

In the APAC region, Lufthansa Technik intends to further expand its existing base maintenance capacity in the field of Aircraft Maintenance Services. It is also increasing its MRO capacity in the Americas region. In the reporting year, it founded the Canadian company Lufthansa Technik Canada Inc. in order to provide additional repair capacities for Engine Services in the North American MRO market for the new generation of engine types especially. Additional component repair capacity is being established at Lufthansa Technik Component Services LLC’s site in Tulsa, USA.

Growth through company transactions

Lufthansa Technik increased its capacities in the heat exchanger field in the reporting year with its purchase of a majority stake in ETP Thermal Dynamics LLC, Tulsa, USA. Following this first acquisition since 2016, it is now examining additional acquisitions in order to increase its level of MRO value creation and vertical integration in the North America region in particular. The focus here is on areas of expertise in the repair of specific components. Company transactions are also an instrument for growth in the defence and digital businesses.

Focus on recruiting new professionals

The high level of demand for qualified professionals continued in the reporting year in both the operating and the administrative areas. Lufthansa Technik is responding to this need with various national and international recruiting activities.

It is increasingly focusing on groups which it has targeted less strongly to date with Lufthansa Technik stepping up its hiring activities outside Germany. It is also deliberately targeting people of retirement age through the “Senior Experts” programme which it launched in the previous year. The Women@LHT programme is intended to strengthen diversity in the working environment and attract a greater number of women to join Lufthansa Technik. Lufthansa Technik also has strategic partnerships, for example with universities. It is continuously working on improvements to its application and onboarding process. This approach includes low-threshold application procedures. In addition, welcome events offer guidance for new employees during their first few days at the company. Lufthansa Technik is also continuing to employ many apprentices and students on combined degree programmes once they finish their training and courses. More than 300 junior staff started work at its German sites alone in the reporting year.

Future business safeguarded by a large number of new contracts as well as fleet growth

Lufthansa Technik serviced some 4,800 aircraft under long-term component contracts at the end of the 2024 financial year (4% more than in the previous year). This increase is being driven by the growth of aircraft fleets for which Lufthansa Technik already has long-term contracts and by the signing of new contracts. Seventeen new customers were acquired over the course of the reporting year and 936 new contracts were signed with a volume of EUR 7.5bn, EUR 0.8bn of which was with companies in the Lufthansa Group. The slight year-on-year decrease in the volume of new business reflects Lufthansa Technik’s currently still limited production capacities. For this reason, it is deliberately restricting its acquisition of new business to selected areas.

New long-term contracts for component supplies were signed with several airlines. For instance, Lufthansa Technik has signed an exclusive agreement to service a total of 193 aircraft in the A320 and A330 family with the emerging airline Vietjet from Vietnam. Lufthansa Technik is also set to handle the supply of components for Air India’s entire B777 fleet. With this first long-term contract, these two companies have laid the foundation for their future cooperation in what is currently one of the world’s largest growth markets for the aviation sector.

In the field of engine maintenance, Lufthansa Technik has also signed new contracts for various engine types, including with the Filipino low-cost carrier Cebu Pacific for the maintenance of a significant number of CFM56-5B engines for its A320ceo fleet and with LOT Polish Airlines for engine maintenance for its B737NG fleet’s CFM56-7B engines.

Lufthansa Technik has also expanded its partnership with Boeing. Lufthansa Technik has thus now become the first Boeing-licensed service centre for cabin modifications to B787 Dreamliner aircraft. Operators, lessors and other companies seeking to modify the cabins of their B787s are now able to cooperate with Lufthansa Technik in this area.

Digitalisation is progressing

In its MRO core business segment, Lufthansa Technik is moving forward with digitalisation and product modularisation as part of its Digitize the Core initiative, in order to achieve its Ambition 2030 goal of becoming a fully digitalised MRO provider by 2030. Lufthansa Technik is bringing together the operational and digital skills for technical aircraft operations in its Digital Tech Ops Ecosystem. This consists of AVIATAR as a platform for data-based analytics solutions, flydocs as a digital records and asset solution and AMOS, a product of Swiss Aviation Software AG, the world market leader in the field of maintenance and engineering / MRO software.

At the end of 2024, the data from around 4,400 aircraft (thus 33% more than in the previous year) was already connected to the AVIATAR platform with service contracts. Lufthansa Technik has also expanded its digital services. For instance, it has launched its Engineering Analytics Suite application as part of its AVIATAR Reliability Solutions. This enables customers to produce live data analyses for fleet performance indicators.

Defence business expanded

Alongside MRO services and digital services for civil and commercial aircraft operators, Lufthansa Technik is driving the expansion of its new Defence business. For instance, in the reporting year Lufthansa Technik signed a letter of intent on cooperation in the field of global maintenance and logistics services with Lockheed Martin, a global aviation and defence technology company.

Lufthansa Technik celebrated the Pegasus programme’s maiden flight as part of its cooperation with the German Air Force. Here, Lufthansa Technik is handling system integration and aircraft certification for Germany’s next-generation signals intelligence aircraft. Lufthansa Technik has also begun to provide skill-building courses for the technical staff of the German Navy, by way of preparation for the forthcoming addition to its fleet of the new maritime reconnaissance aircraft P-8A Poseidon. Lufthansa Technik has serviced the aircraft of the Special Air Mission Wing at the German Federal Ministry of Defence for more than 60 years. In the reporting year, it handed over the final government Airbus A350 aircraft, the “Kurt Schumacher”, to the Special Air Mission Wing.

AeroSHARK surface technology reduces carbon emissions

Lufthansa Technik aims to use technology to make flying more sustainable in future. The AeroSHARK fuel-saving surface technology which it developed together with BASF was further rolled out in the reporting year. As of the end of 2024, 21 Boeing 777 and B777F aircraft have been fitted with AeroSHARK. Demand from non-Group customers has picked up significantly. In the reporting year, LATAM therefore decided to equip four more of its aircraft with this innovative film. Further contracts were signed with All Nippon Airways and EVA Air.

Lufthansa Technik’s Cyclean Engine Wash solution is a further product which conserves resources. It is already available at over 60 locations worldwide. In the financial year, Lufthansa Technik added the key market of India here.

Financial performance

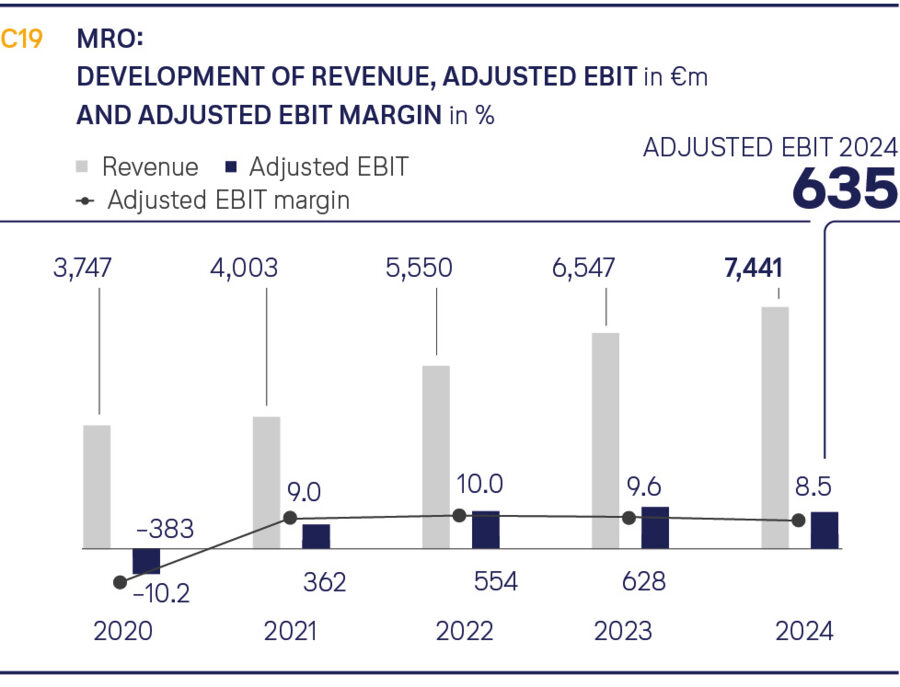

Revenue up by 14% on previous year

Revenue in the MRO business segment climbed by 14% in the 2024 financial year to EUR 7,441m (previous year: EUR 6,547m). Lufthansa Technik benefited from increased demand for maintenance and repair services due to the rising number of flights.

Performance was driven by the Engine Services and Aircraft Component Services MRO units in particular. Both external revenue and revenue with companies of the Lufthansa Group increased year-on-year. Operating income rose by 13% to EUR 7,918m (previous year: EUR 7,028m).

Expenses 14% higher than in previous year

Operating expenses increased in the reporting year proportionately to revenue, by 14% to EUR 7,292m (previous year: EUR 6,383m).

The cost of materials and services rose by 18% to EUR 4,525m due to higher volumes and prices (previous year: EUR 3,844m). This reflected the positive course of business, which led to an increase in material consumption and the volume of external services, as well as significant increases in materials prices due to the shortage of materials.

Staff costs of EUR 1,700m were 9% higher than in the previous year (previous year: EUR 1,559m), due primarily to the higher average number of employees, as well as to pay scale and salary increases.

Depreciation and amortisation were stable year-on-year at EUR 155m (previous year: EUR 157m).

| T041 | OPERATING EXPENSES MRO | ||

|---|---|---|---|

| 2024 | 2023 | Change | |

| in €m | in €m | in % | |

| Cost of materials and services | 4,525 | 3,844 | 18 |

| of which raw materials, consumables and supplies | 2,610 | 2,188 | 19 |

| of which external services | 1,915 | 1,656 | 16 |

| Staff costs1) | 1,700 | 1,559 | 9 |

| Depreciation and amortisation2) | 155 | 157 | -1 |

| Other operating expenses3) | 912 | 823 | 11 |

| Total operating expenses | 7,292 | 6,383 | 14 |

| 1) Without past service expenses/plan settlement. 2) Without impairment loss. 3) Without book losses. |

|||

Adjusted EBIT reaches new record of EUR 635m

Adjusted EBIT improved by 1% in the reporting year to EUR 635m (previous year: EUR 628m), a new record. The Adjusted EBIT margin dropped by 1.1 percentage points to 8.5% (previous year: 9.6%).

EBIT came to EUR 584m (previous year: EUR 628m). The difference in relation to Adjusted EBIT stems mainly from write-downs on joint ventures as well as expenses for restructuring.

Segment capital expenditure up by 50%

Segment capital expenditure in the MRO business segment has risen by 50% to EUR 206m (previous year: EUR 137m). Capital expenditure mainly concentrated on property, plant and equipment and financial investments. Within property, plant and equipment, it focused particularly on ongoing new building projects, technical equipment, machinery and operating materials for MRO services for various next-generation aircraft and engine models. Capital expenditure on financial investments mainly went to affiliated (not consolidated) companies and joint ventures.

Number of employees rises by 7%

The number of employees at the end of 2024 was up by 7% year-on-year to 24,499 (previous year: 22,870). This growth in the workforce reflects recruitment activities as a result of the increased volume of business and has occurred in Germany and in other countries in equal measure.