Logistics business segment

| T036 | KEY FIGURES LOGISTICS | |||

|---|---|---|---|---|

| 2024 | 2023 | Change in % | ||

| Revenue | €m | 3,263 | 2,977 | 10 |

| of which traffic revenue | €m | 3,054 | 2,775 | 10 |

| Operating income | €m | 3,356 | 3,090 | 9 |

| Operating expenses | €m | 3,147 | 2,933 | 7 |

| Adjusted EBITDA | €m | 449 | 401 | 12 |

| Adjusted EBIT | €m | 251 | 219 | 15 |

| EBIT | €m | 252 | 214 | 18 |

| Adjusted EBIT margin | % | 7.7 | 7.4 | 0.3 pts |

| Adjusted ROCE | % | 8.2 | 7.3 | 0.9 pts |

| Segment capital expenditure | €m | 149 | 191 | -22 |

| Employees as of 31 Dec | number | 4,261 | 4,152 | 3 |

| Average number of employees | number | 4,223 | 4,122 | 2 |

Business activities

Lufthansa Cargo is one of Europe’s leading cargo airlines

Lufthansa Cargo is the Lufthansa Group’s logistics specialist. The Logistics business segment also includes the airfreight container management specialist Jettainer group, the time:matters group, which specialises in particularly urgent shipments, the subsidiary Heyworld, which specialises in tailored solutions for the e-commerce sector, and CB Customs Broker, the customs and customs clearance specialist. This business segment also encompasses the Lufthansa Group’s 50% stake in the cargo airline AeroLogic. Lufthansa Cargo also has equity investments in various handling companies and smaller companies involved in various aspects of the sector’s digitalisation.

The focus of Lufthansa Cargo’s operations lies in the airport-to-airport airfreight business. Its product portfolio encompasses standard and express freight as well as highly specialised products. Cross-border e-commerce shipments are the fastest-growing airfreight segment. Among the special products offered, such as the transport of live animals, valuable cargo, post and dangerous goods, it is primarily the demand for carriage of temperature-controlled goods that is continuously increasing. The company has specialised infrastructure at Frankfurt Airport to handle these goods, including the Animal Lounge and the Lufthansa Cargo Pharma Hub.

As well as its own twelve Boeing 777F cargo aircraft and four Airbus A321Fs, Lufthansa Cargo uses the belly capacities of Lufthansa Airlines, Austrian Airlines, Brussels Airlines, Discover Airlines and SunExpress to transport freight.

In addition, the AeroLogic joint venture in Leipzig operates 22 Boeing 777F cargo aircraft on behalf of its two shareholders, Lufthansa Cargo and DHL Express. Lufthansa Cargo is responsible for marketing the capacities of six of these aircraft.

Lufthansa Cargo also has successful international partnerships with the cargo divisions of Cathay Pacific and United Airlines. Cooperation with All Nippon Airways was suspended in October 2023.

Course of business

Lufthansa Cargo adds additional freighter to its global network

In June 2024, besides Monterrey, Mexico, Lufthansa Cargo also incorporated Brussels, Belgium, in its global cargo network. This means that, for the first time, it is not just from Germany that this airline is operating an intercontinental route. Moreover, it has adjusted its network in line with global economic trends and strengthened it in particular in Asia. In the summer, it added Shenzhen and Zhengzhou to its cargo network. This move allows the company to support important supply chains to and from China and, among other things, meet the continued strong demand for e-commerce shipments.

Since October 2024 Lufthansa Cargo has also, for the first time, directly linked Asia with North America. It flies a circular freight route from Frankfurt via Ho Chi Minh City to Los Angeles and then back to Frankfurt. Customers thus benefit from an even faster link between Vietnam and the USA.

In addition, the A321F fleet network has acquired a new hub in Munich. With its Frankfurt, Munich, Vienna and Brussels hubs, Lufthansa Cargo is able to flexibly manage its freighter network in line with its customers’ needs. With its winter flight plan, including the additional cargo capacities which are marketed within the Lufthansa Group, it offers up to 7,500 flights worldwide per week to over 350 destinations.

In August 2024, Lufthansa Cargo also expanded its network by adding to its fleet its 18th Boeing 777F, including the six freighters which it markets for AeroLogic. Lufthansa Cargo is thus continuing to use the most efficient aircraft type of its class. It has ordered a further seven Boeing 777-8Fs with upcoming technology and expects to receive these by 2030.

Investing in the Frankfurt hub as a commitment to doing business there

In September 2024, Lufthansa Cargo presented the future of its central cargo hub at Frankfurt Airport to guests from the fields of politics and business as well as its employees, customers and project partners. This project has a total investment volume of almost EUR 600m. The cargo airline intends to complete a comprehensive modernisation project by 2030 which will make its Lufthansa Cargo Center (LCC) Europe’s cutting-edge airfreight hub. This clearly reflects Lufthansa Cargo’s commitment to doing business in Frankfurt.

Lufthansa Cargo supports the digitalisation of the airfreight sector

Lufthansa Cargo’s participation in the IATA ONE Record initiative represents a significant step forward in the airfreight industry’s digital transformation. Since March 2024, companies involved in the airfreight transport chain have been able to exchange shipment details with one another through the open-source ONE Record solution and benefit from shipment tracking for their shipments.

The company also initiated a series of automation projects in the reporting year, with the goals of improving its customer service and increasing its level of efficiency. These include automated booking changes for shipments and the automated creation and dispatch of written reports in case of irregularities during transport as well as AI assistants in the fields of sales and handling.

Lufthansa Cargo is actively pursuing sustainability activities

In July 2024, Lufthansa Cargo joined the Smart Freight Centre (SFC) community and is thus continuing to work actively towards reducing its greenhouse gases caused by aviation as well as by processes on the ground. The SFC is an international non-profit organisation which focuses on reducing the greenhouse gas emissions arising through freight transport.

In August 2024, Lufthansa Cargo fitted its fleet’s fifth Boeing 777F with the innovative surface technology AeroSHARK. This reduces aircraft air resistance and thus cuts kerosene consumption and carbon emissions.

Continuous fuel efficiency monitoring enables additional measures to be implemented such as a statistical method for the supply of tailored fuel volumes. This allowed the company to save up to 18,000 tonnes of CO2 in 2024.

In addition, Lufthansa Cargo participates in an industry-wide testing programme which aims to predict areas where contrails which impact the climate may form. For a total of 100 assessed scheduled flights, this newly developed forecasting tool will predict areas where long-lasting contrails may form, so that these areas can be avoided in future.

Changes to the management of Lufthansa Cargo

Dietmar Focke, Chief Operating Officer of Lufthansa Cargo, took up the role of Managing Director of Lufthansa Industry Solutions on 31 October 2024. Ashwin Bhat, Chairman of the Executive Board, and Frank Bauer, Chief Financial Officer and Executive Board Member for Human Resources, are responsible for Dietmar Focke’s responsibilities on an interim basis.

New wage agreement signed for ground staff

In March 2024, the Lufthansa Group and ver.di signed a new wage agreement for ground staff which includes the employees of Lufthansa Cargo. Employees.

Operating performance

Lufthansa Cargo registers positive course of business

Following the normalisation of its operating performance in the 2023 financial year, the revenue and earnings situation in the Logistics business segment developed positively in the 2024 financial year, in spite of the challenging airfreight market environment and the negative impact of the strikes in the first quarter. A turnaround materialised over the course of the 2024 financial year and Lufthansa Cargo performed very strongly in the fourth quarter. This positive trend was buoyed by a high level of e-commerce demand. Lufthansa Cargo responded to this by shifting capacities, in particular from North America to China.

In the 2024 financial year, capacity was 9% higher than in the previous year. This was due to Lufthansa Cargo’s additional freighter capacities as well as the expansion of passenger flight operations and the related increase in belly capacities. Capacity stood at 94% relative to its pre-crisis level in 2019. Sales rose by 14% compared with the previous year. The cargo load factor increased by 2.7 percentage points to 61.9% (previous year: 59.2%). Yields in all of Lufthansa Cargo’s traffic regions fell over the year as a whole and were down 3.2% on the previous year, mainly due to lower fuel surcharges, but nonetheless remained significantly higher than their pre-crisis level in 2019. In the previous year, the high level of demand as a result of global supply chain disruptions, combined with limited capacity, was a significant factor which supported the revenue trend, in the first quarter of the year in particular.

| T037 | TRAFFIC FIGURES AND OPERATING FIGURES LOGISTICS | |||

|---|---|---|---|---|

| 2024 | 2023 | Change in % | ||

| Available cargo tonne-kilometres | millions | 13,706 | 12,620 | 9 |

| Revenue cargo tonne-kilometres | millions | 8,482 | 7,471 | 14 |

| Cargo load factor | % | 61.9 | 59.2 | 2.7 pts |

| Yields | € cent | 36.0 | 37.2 | -3.21) |

| 1) Exchange rate-adjusted change: -2.0%. | ||||

Despite the lower yields, traffic revenue increased by 10% to EUR 3,054m (previous year: EUR 2,775m). Traffic revenue rose in all traffic regions year-on-year, with the Asia/Pacific region registering the strongest increase.

The Americas and Asia/Pacific remain Lufthansa Cargo’s main traffic regions. These two regions account for nearly 90% of capacity and sales.

Lufthansa Cargo significantly expanded its capacity in the Asia/Pacific traffic region in particular, increasing its sales and also its cargo load factor in all its traffic regions.

| T038 | TRENDS IN TRAFFIC REGIONS | |||||||

|---|---|---|---|---|---|---|---|---|

| Lufthansa Cargo | ||||||||

|

Net traffic revenue external revenue |

Available cargo tonne-kilometres | Revenue cargo tonne-kilometres | Cargo load factor | |||||

| 2024 | Change | 2024 | Change | 2024 | Change | 2024 | Change | |

| €m | in % | in millions | in % | in millions | in % | in % | in pts | |

| Europe | 231 | 5 | 727 | -7 | 328 | 13 | 45.1 | +8.0 |

| Americas | 1,227 | 4 | 6,359 | 3 | 3,637 | 6 | 57.2 | +1.9 |

| Asia/Pacific | 1,354 | 19 | 5,603 | 22 | 3,917 | 22 | 69.9 | +0.1 |

| Middle East/Africa | 242 | 3 | 1,017 | -2 | 600 | 11 | 59.0 | +7.0 |

| Total traffic | 3,054 | 10 | 13,706 | 9 | 8,482 | 14 | 61.9 | +2.7 |

Financial performance

Revenue up 10% year-on-year

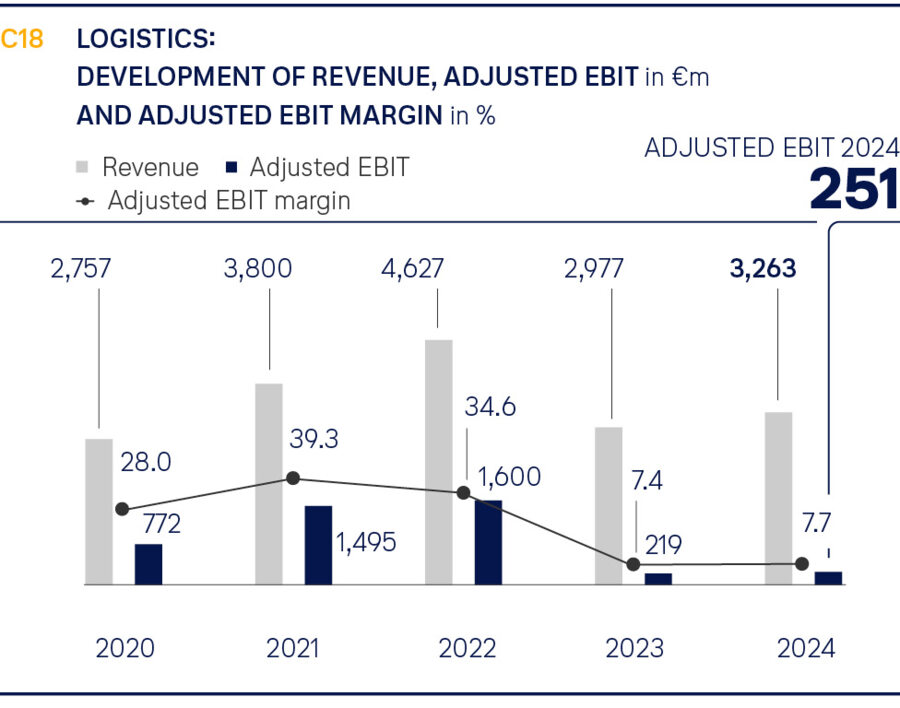

Revenue in the Logistics business segment rose by 10% to EUR 3,263m in the 2024 financial year (previous year: EUR 2,977m). This increase was due, in particular, to the development of the e-commerce business, in the Asia/Pacific region especially. Operating income increased overall by 9% to EUR 3,356m (previous year: EUR 3,090m).

Expenses up by 7%

Operating expenses of EUR 3,147m were 7% up on the previous year (previous year: EUR 2,933m) in the reporting year.

| T039 | OPERATING EXPENSES LOGISTICS | ||

|---|---|---|---|

| 2024 | 2023 | Change | |

| in €m | in €m | in % | |

| Cost of materials and services | 2,241 | 2,063 | 9 |

| of which fuel | 368 | 389 | -5 |

| of which fees and charges | 361 | 302 | 20 |

| of which charter expenses | 1,232 | 1,100 | 12 |

| of which MRO services | 131 | 116 | 13 |

| Staff costs1) | 443 | 419 | 6 |

| Depreciation and amortisation2) | 198 | 182 | 9 |

| Other operating expenses3) | 265 | 269 | -1 |

| Total operating expenses | 3,147 | 2,933 | 7 |

| 1) Without past service expenses / plan settlement. 2) Without impairment loss. 3) Without book losses. |

|||

The cost of materials and services rose by 9% year-on-year to EUR 2,241m (previous year: EUR 2,063m). Fuel expenses decreased by 5% to EUR 368m (previous year: EUR 389m). This was largely price-related. Charter expenses rose by 12% to EUR 1,232m (previous year: EUR 1,100m), mainly due to increased belly expenses paid to Group companies.

Staff costs increased by 6% to EUR 443m in the 2024 financial year (previous year: EUR 419m), primarily on account of wage and salary increases as a result of wage settlements and pay rounds as well as a 2% increase in the average number of employees.

Depreciation and amortisation rose by 9% year-on-year to EUR 198m (previous year: EUR 182m) owing to the expansion of the freighter fleet.

Other operating expenses went down by 1% to EUR 265m, mainly due to lower currency effects (previous year: EUR 269m).

Adjusted EBIT of EUR 251m

Adjusted EBIT increased by 15% in the 2024 financial year to EUR 251m (previous year: EUR 219m). Of this amount, EUR 199m was attributable to the fourth quarter of 2024 alone (previous year: EUR 30m). The fourth quarter of 2024 was the best fourth quarter in the Company’s history, with the exception of the years 2020 to 2022, which were marked by the coronavirus pandemic. The Adjusted EBIT margin improved by 0.3 percentage points to 7.7% (previous year: 7.4%).

EBIT of EUR 252m was 18% higher than in the previous year (previous year: EUR 214m).

Segment capital expenditure down 22% on the previous year

Capital expenditure in the Logistics business segment decreased by 22% in the reporting year to EUR 149m (previous year: EUR 191m). This mainly related to the addition of an 18th Boeing 777F cargo aircraft, while the previous year’s figure had included advance payments for two Boeing 777Fs.

Number of employees up by 3%

The number of employees at year-end increased by 3% to 4,261 (previous year: 4,152).